Picture supply: Getty Photographs

Frequently feeding cash right into a Self-Invested Private Pension (SIPP) has the potential to considerably enhance a person’s retirement. That’s true even when the individual is simply simply beginning to put money into their center age.

To reveal, I need to have a look at how a lot somebody might have by retirement by investing £700 a month in one in all these DIY pensions. Let’s get began.

Tax reduction

A SIPP is a sort of tax-efficient retirement funding account out there to UK residents. The best way it really works is just like a Shares and Shares ISA, however a key distinction is that funds can’t be accessed till a minimum of age 55 (rising to 57 in 2028).

One other distinction is that there’s tax reduction on contributions. In different phrases, the UK authorities boosts pension financial savings by including 20% tax reduction for basic-rate taxpayers. Larger-rate (40%) and additional-rate (45%) taxpayers can declare much more reduction by way of their self-assessment tax return.

So, for somebody investing £700 per thirty days right into a SIPP, the tax reduction would add an additional £175, bringing the full funding to £875.

Nonetheless, it’s value mentioning that solely 25% of the pension pot can ultimately be withdrawn tax-free. The rest is then taxed as revenue upon withdrawal.

Please be aware that tax remedy will depend on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

£663k!

Placing this collectively then, a 45-year-old basic-rate taxpayer placing £700 into their SIPP each month (£10,500 per 12 months due to tax reduction) would have round £663,000 by age 68.

This assumes an 8% return (after charges) over the long term. Whereas not assured, I feel this price of return is achievable for most individuals prepared to rigorously research their investments and construct a diversified portfolio.

It’s definitely not a nasty outcome for somebody beginning at 45 and placing away £700 a month. Undoubtedly, it could be a pleasant supplementary enhance in retirement.

International index

SIPP accounts supply a variety of investing choices, together with shares, bonds, funding trusts, and exchange-traded funds (ETFs).

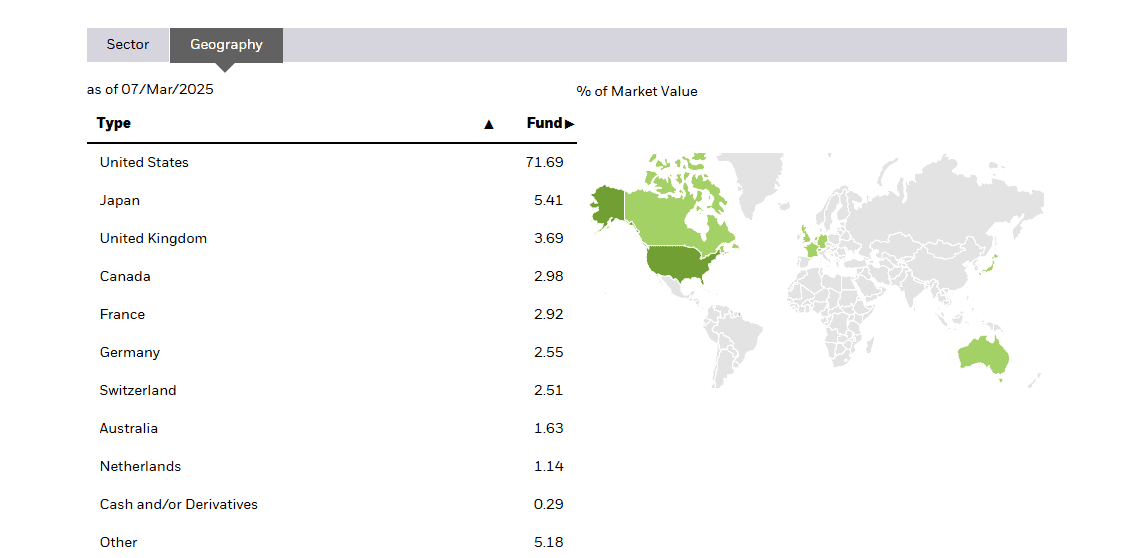

For a lot of buyers, a world index fund just like the iShares Core MSCI World UCITS ETF (LSE: SWDA) will type a core a part of their portfolio. This fund provides broad publicity to a variety of worldwide firms (1,355 holdings) inside 23 developed nations.

Over the previous decade, it has delivered an annualised whole return of 9.9%. Whereas it’s not assured to ship that in future, I’m optimistic it will probably nonetheless return a minimum of 8% over the long run.

Now, it’s value mentioning that the US market has dominated returns and now makes up round 71% of the ETF’s whole. So if the American economic system enters a recession attributable to President Trump’s tariffs, the fund’s return could possibly be decrease than anticipated over the subsequent few years. This can be a key threat right here.

Long run nonetheless, I feel it’s protected to imagine that the tech revolution will solely get stronger. Certainly, it might even speed up dramatically as rising fields like AI and (probably) quantum computing take maintain.

Such innovation ought to drive world financial enlargement. A world index fund is the only method to seize this development, for my part.

In fact, progress isn’t linear and there can be main volatility alongside the way in which. However with £875 to deploy every month, an investor can be choosing up bargains throughout downturns, seemingly setting them up for robust future returns.