Picture supply: Getty Photographs

The Self-Invested Private Pension (SIPP) is — just like the Particular person Financial savings Account (ISA) — an efficient product for constructing a pot of money for retirement.

Like a Shares and Shares ISA, any capital features or dividend earnings generated in a SIPP are shielded from the taxman. This gives traders with extra capital, and due to this fact the means for superior exponential development by way of compounding.

However that’s not all. With tax aid, SIPP traders additionally get tax aid from the federal government with which to develop their portfolio.

Right here’s how even a 40-year-old with no financial savings or investments might probably construct a big retirement fund with a £500 month-to-month contribution.

Please observe that tax remedy is determined by the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Tasty tax aid

That £500 funding won’t seem to be lots at first look. At £6,000 a yr, that is properly under the present annual allowance on SIPPs. Most often, that is both £60,000 or a sum equal to a yearly earnings, whichever’s decrease.

However due to beneficiant tax aid, the precise worth of those contributions will be significantly larger.

Reduction is about on the following charges:

- 20% for basic-rate taxpayers

- 40% for higher-rate taxpayers

- 45% for additional-rate taxpayers

So in impact, a basic-rate taxpayer is placing £625 into their SIPP every month by investing £500 of their very own money.

Larger-rate and additional-rate taxpayers get pleasure from the identical £125 month-to-month top-up straight into their pension. The rest is claimed again by way of self-assessment.

Investing properly

A boosted month-to-month contribution is a large perk for SIPP customers. However as with all different monetary product, the quantity of wealth generated in the end is determined by the way in which they use their cash.

Traders should purchase all kinds of shares, trusts and funds with a SIPP. Or they’ll merely select to carry their cash in money.

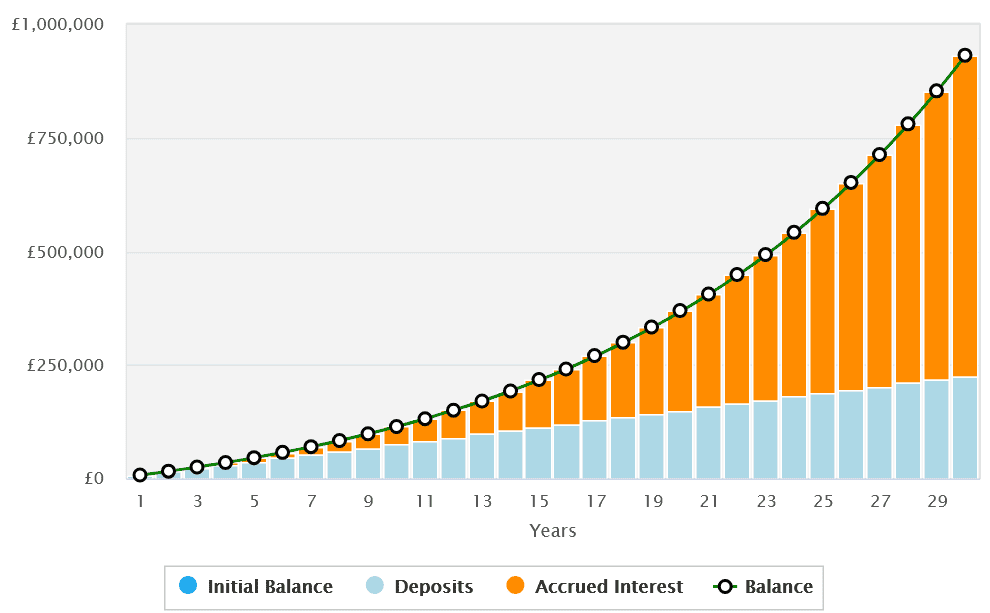

The distinction on long-term returns will be appreciable. Let’s say a basic-rate taxpayer was to get a median 3.5% financial savings fee on their money steadiness. Based mostly on a £625 month-to-month contribution they’d, after 30 years, have a pension price roughly £397,133.

Now let’s say they as a substitute bought shares that supplied a median annual return of 8%. With the identical contribution over three a long time they’d be sitting on a considerably greater sum of £931,475.

Getting began

There’s no proper and fallacious solution to method SIPP investing. The only option for every of us relies on our private funding targets and tolerance of threat.

However I imagine these looking for to supercharge their retirement fund ought to contemplate investing in shares. Investing in a fund or a belief can cut back threat too by spreading capital throughout a basket of belongings.

The F&C Funding Belief‘s (LSE:FCIT) an asset that ticks lots of containers for me and might be price additional research. Relationship again to 1868, it has an extended and distinguished report of delivering wholesome returns, together with 53 consecutive years of dividend development.

At this time, it holds shares in additional than 400 completely different international corporations unfold throughout a number of sectors. Main names embody chipmaker Nvidia , monetary companies supplier Mastercard, drugmaker Eli Lilly and retailer Costco.

This diversification doesn’t protect traders from disappointing returns throughout downturns. However over the long run it’s confirmed an efficient manner of balancing threat administration and optimising returns.

Since January 2015, the F&C Funding Belief’s supplied a median annual return of 11.4%. If this continues (and that’s an enormous ‘if’ because it’s not assured), contemplating a £625 month-to-month funding right here might assist traders construct a huge SIPP lots earlier than 30 years.