Picture supply: Getty Photographs

I’ve been investing in tech shares for a while now, and because the market suggests, my returns have been fairly robust. Actually, since withdrawing some cash from my ISA a yr in the past, my portfolio of circa 25 shares has nearly doubled in worth.

Nevertheless, Monday (27 January) was nearly definitely the worst day for my portfolio ever. The £15,000 drop within the worth of my investments was not an insubstantial a part of my complete. Nevertheless, as all the time, I ought to look to be taught from these occasions. Listed below are my key takeaways.

A gray swan occasion

We will’t plan for each eventuality. And on Monday, synthetic intelligence (AI)-related shares tanked as a result of a Chinese language firm’s language mannequin, reportedly produced for simply $5.6m, turned probably the most downloaded chatbot on the App Retailer.

DeepSeek hadn’t been on buyers’ bingo checklist for 2025. However only one month into the yr, it’s acquired folks questioning the dominance of US tech and asking how a lot cash is admittedly wanted to develop AI. Nevertheless, though DeepSeek ranked increased than lots of its Western chatbot friends, some questions stay in regards to the validity of the event claims.

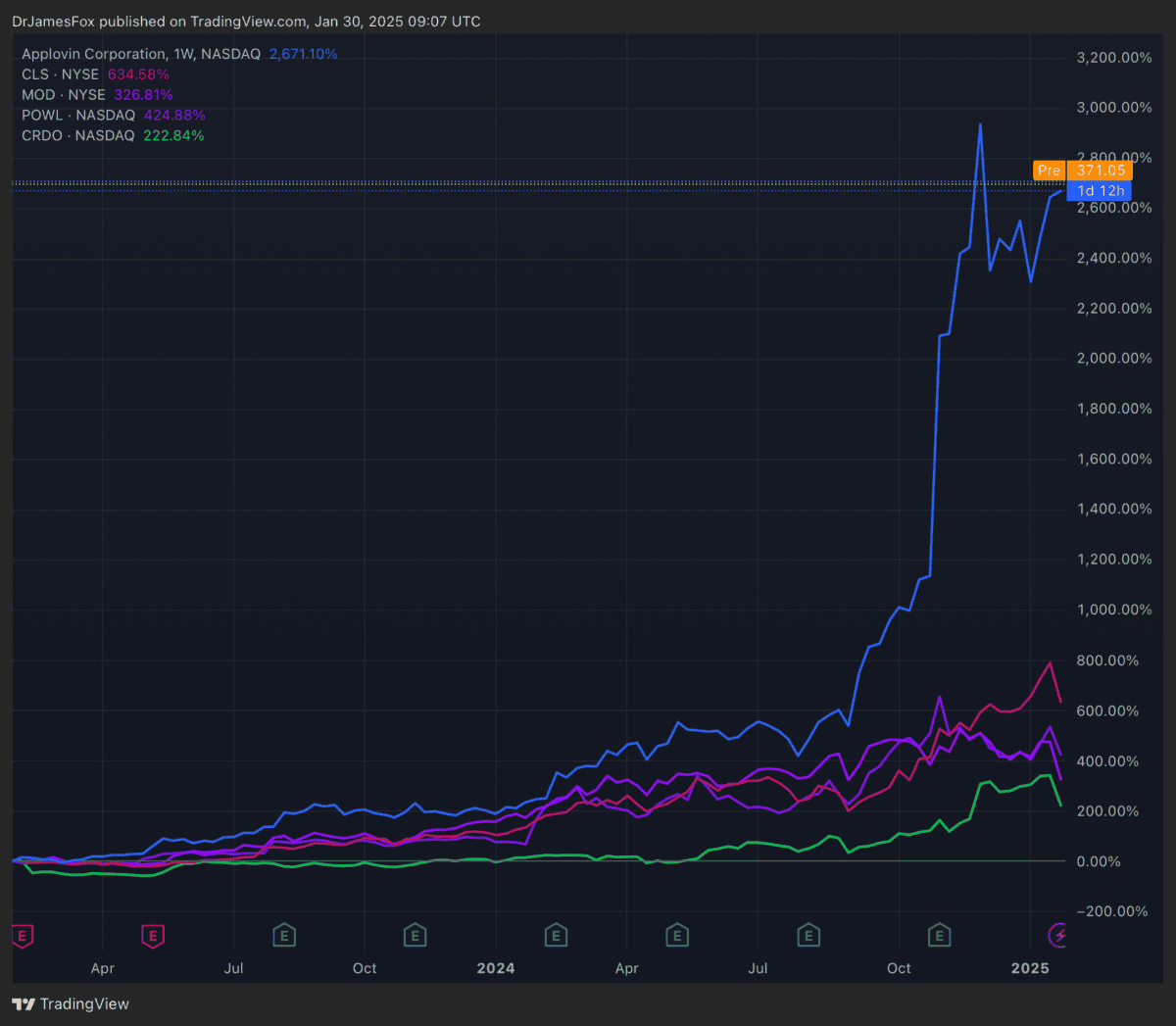

Whereas the headlines centered in on Nvidia, which fell greater than 10% in Monday’s buying and selling, a few of my AI infrastructure holdings fell additional. Celestica and Credo each fell round 30%, whereas Modine Manufacturing and Powell Industries weren’t far behind.

A lapse in diversification

I’ve 25 shares in my portfolio, however my error was that I allowed some to develop too massive, creating focus threat. I just lately offered most of my AppLovin shares, which had been up 800%, however I didn’t follow the identical warning with Celestica, Modine, or Powell. All three had been up over 200% in my portfolio, rising quicker than most of my different shares.

Consequently, nearly 20% of my portfolio centered on AI infrastructure. It’s an necessary reminder than diversification requires fixed asset adjustment to keep away from focus threat.

Reaching diversification

Celestica inventory has surged again from Monday although, and I partially count on the others to do the identical. Nevertheless, within the spirit of diversification, I may contemplate a inventory for the ‘second layer’ of AI. UiPath (NYSE:PATH) is one such firm, and it’s been on my watchlist for some time. It’s the second layer of AI as a result of it’s one of many corporations that’s utilizing technological developments to supply platforms to assist enterprise automate and optimise processes.

From a valuation perspective, it’s buying and selling with a price-to-earnings-to-growth (PEG) ratio of 0.99, which represents a 46% low cost to the knowledge know-how sector common. Nevertheless, at 32 occasions ahead earnings, there’s a sure diploma of threat right here and something lower than a shocking efficiency could possibly be a problem. For now, it’s a inventory I plan to maintain an in depth eye on. Perhaps I’d have been clever to maneuver a bit of earlier when the inventory traded with decrease multiples.

Nevertheless, for even better diversification, I could want to contemplate an ETF or a fund-based method. This may present me with publicity to a number of corporations sometimes with decrease threat than investing in a singular inventory.