Picture supply: easyJet plc

As an easyJet shareholder, the corporate’s future issues to me. And presently, it’s not wanting nice. The share price is down 47% in 5 years, having underperformed the FTSE 100 for the previous three years.

Not that I’m contemplating promoting my shares. Quite, I’m questioning if now is an efficient time to purchase extra, due to this fact lowering my common spend per share.

First, I need to attempt to determine the place the shares are headed.

To take action, I’ve studied some key metrics which might be used to forecast development potential. Typical development price metrics embrace:

Income and earnings

Income is the whole earnings an organization generates, whereas earnings are the revenue remaining after bills, taxes and different prices.

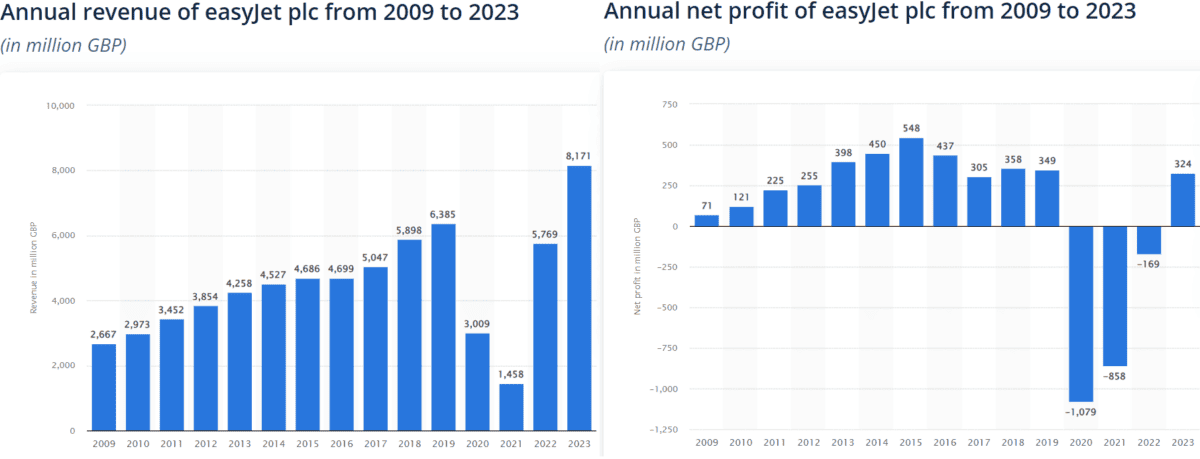

Airways have been among the many worst affected companies throughout the pandemic and like many others, easyJet is but to get well totally. It turned worthwhile once more this yr, with earnings of £324m — barely down over 5 years. However an analogous occasion might render it unprofitable once more, digging it even additional into debt.

For now, income stays excessive, at £8.17bn.

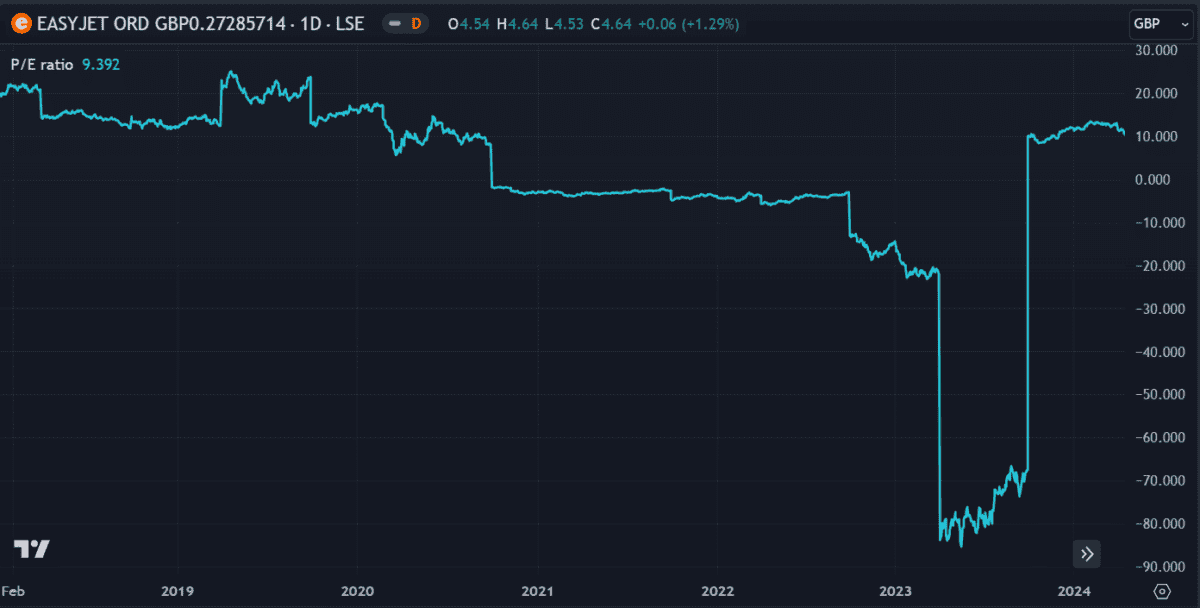

P/E ratio

easyJet’s P/E ratio seems low at 9.3, contemplating the UK market common is round 16.5. However funds journey is a fiercely aggressive business in Europe and easyJet faces stiff competitors from rivals Ryanair, Wizz Air and Jet2. Presently, its P/E ratio is increased than Jet2 and Wizz Air.

On one hand, this might point out that buyers have increased confidence within the airline. But it surely additionally reduces its comparative development potential. Nevertheless, with earnings forecast to develop by 33%, its ahead P/E ratio might drop to 7 within the coming 12 months.

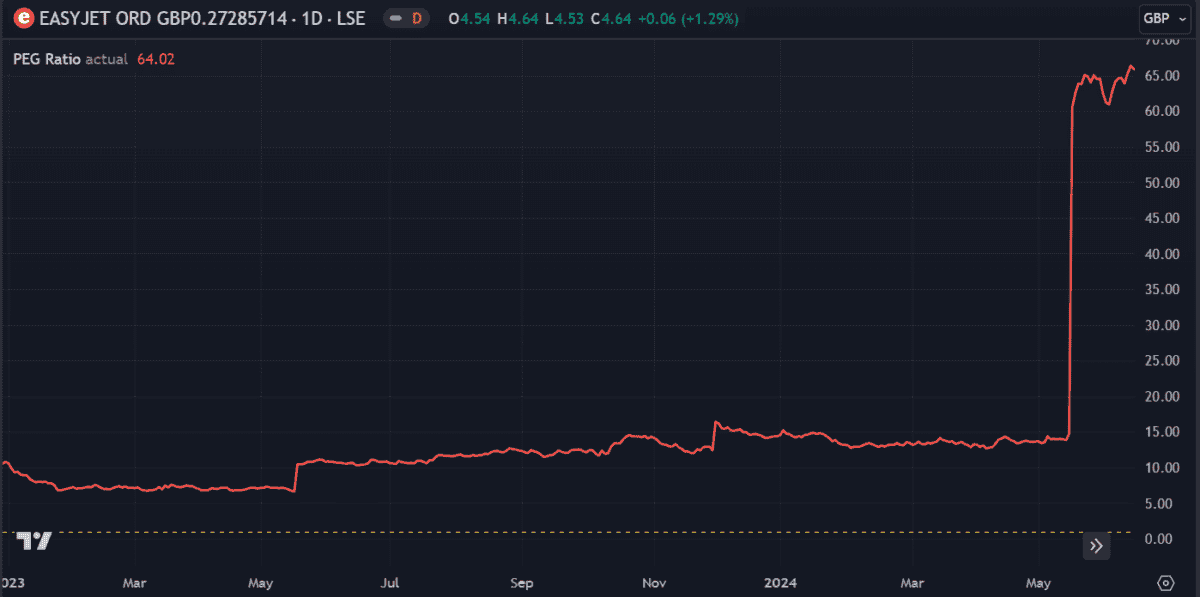

PEG ratio

The PEG ratio compares the price to anticipated earnings development to gauge what sort of returns an investor might anticipate. If this metric is 1 (or 100%), earnings and price are anticipated to extend equally. Any quantity beneath 1 is sweet, because the price is anticipated to outperform earnings.

easyJet presently has a superb PEG ratio of 0.64 (displayed on the chart as 64%). However its development is threatened by any hiccup within the native financial system that may trigger customers to chop down on pointless bills.

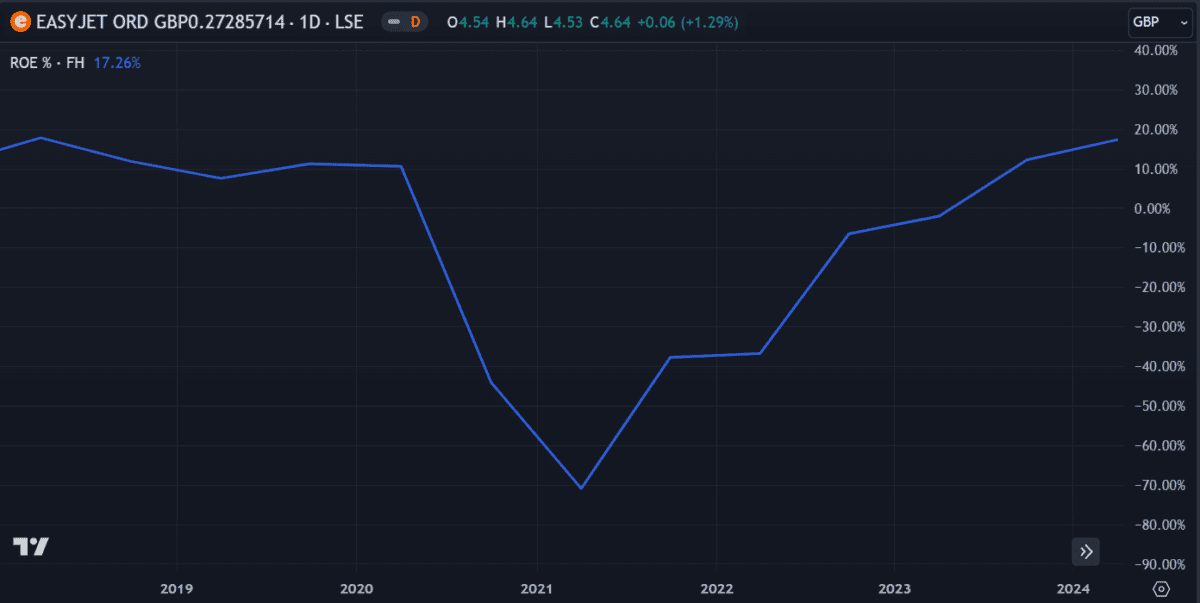

ROE

ROE is a measure of an organization’s monetary efficiency, calculated by dividing web earnings by shareholders’ fairness. easyJet’s ROE has lately climbed again up to pre-Covid ranges round 17%.

Whereas the advance is spectacular, it stays significantly decrease than the business common of 30%. Hopefully, its development will proceed, prompting the share price to comply with swimsuit.

The underside line

A number of metrics in these charts point out development potential. In the latest quarterly earnings report, passenger numbers rose 8% and income elevated 16%. This was boosted by development within the airline’s new ‘holidays’ providing, which has proved well-liked.

On the similar time, the share price continues to wrestle and the inventory carries a number of dangers. I purchased EZJ shares when air journey reopened because it appeared essentially the most promising UK airline inventory on the time.

Up to now, I’m dissatisfied within the efficiency and never impressed to purchase extra. However with no airline providing something extra promising, I’ll maintain my shares for now and see the place it goes.