Amid a market downturn, the place most tech-focused cash are stagnating or experiencing sharp declines, Hyperliquid continues to solidify its place with outstanding resilience. Let’s dive in and analyze the following potential pattern for Hyperliquid Worth Prediction.

What’s Hyperliquid?

Hyperliquid touts itself as a next-generation platform designed to fully revolutionize the way you work together with digital property. Crafted from the bottom up to supply easy, seamless one-click buying and selling, Hyperliquid combines cutting-edge expertise with a deal with real-time liquidity and precision.

Hyperliquid: The DEX Revolution Difficult Prime CEXs

Hyperliquid is quickly establishing itself as one of many main DeFi platforms, surpassing conventional decentralized exchanges (DEXs) by absolutely integrating an optimized Layer 1 blockchain ecosystem for buying and selling and good contract deployment.

With over 60% market share within the decentralized derivatives sector, Hyperliquid shouldn’t be solely competing with different DEXs but additionally instantly difficult centralized exchanges (CEXs) like Binance, OKX, and Bybit. Able to dealing with up to 100,000 transactions per second, that includes a totally on-chain order e-book for full transparency, and using the HyperBFT consensus mechanism to cut back latency to only 0.2 seconds, the platform delivers a high-speed buying and selling expertise whereas sustaining full decentralization.

Past reaching a record-breaking $15 billion in day by day buying and selling quantity, Hyperliquid has additionally change into the very best revenue-generating blockchain, surpassing Ethereum, Solana, and BNB Chain with a day by day earnings of $3 million. This proves its potential to maintain liquidity and development with out counting on Binance or different centralized listings. Moreover, with a clear tokenomics mannequin free from enterprise capital (VC) manipulation, $HYPE stays undervalued in comparison with its precise potential, making it a lovely funding alternative. Hyperliquid is greater than only a DEX—it’s laying the inspiration for a next-generation decentralized monetary ecosystem, the place customers have full management over their property, profit from optimized transaction prices, and entry groundbreaking monetary alternatives.

Supply: Defillama

Hype Tokenomics

HYPE Token Distribution

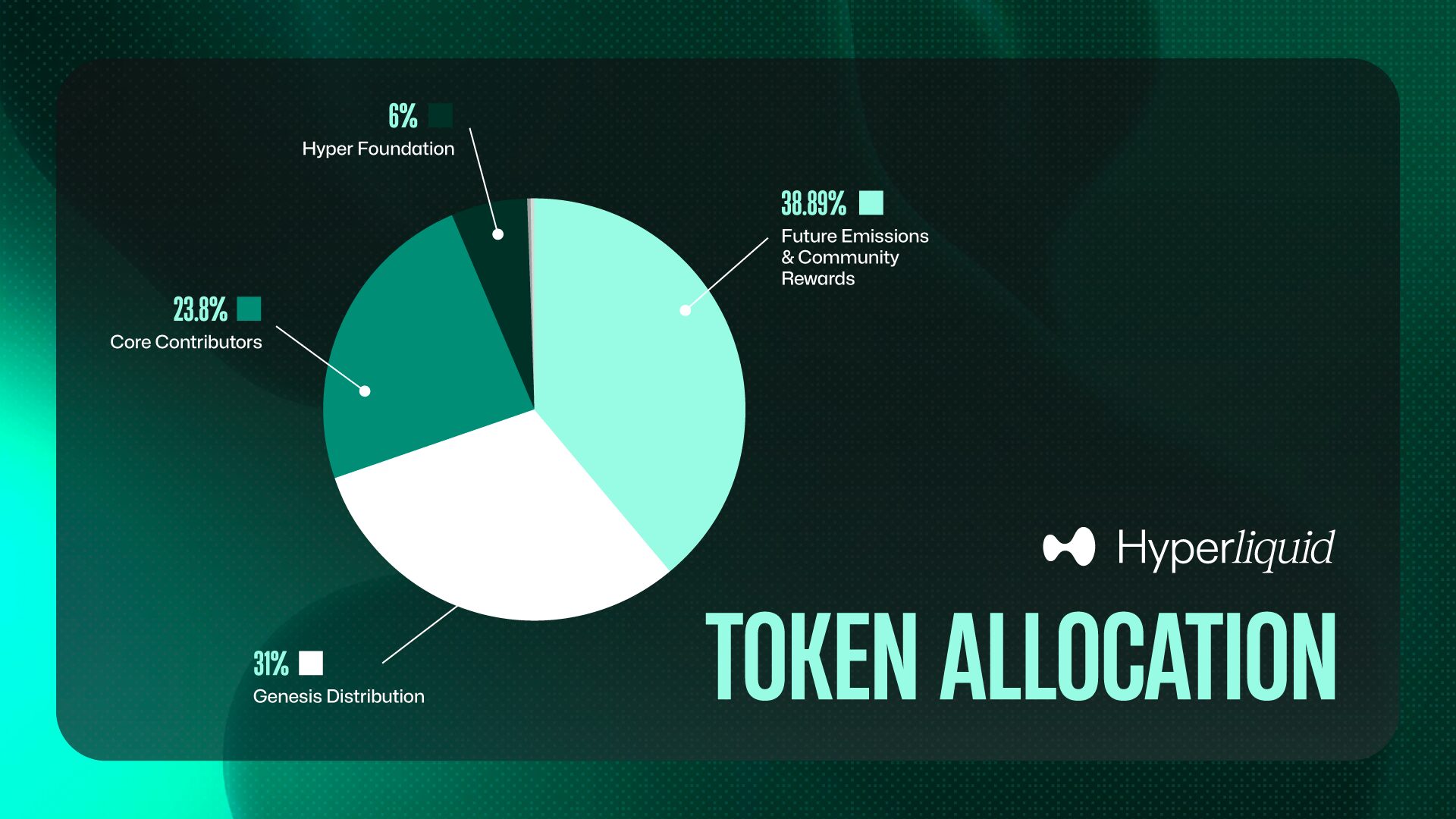

Complete Provide: 1 billion HYPE tokens

- Genesis Distribution: 31%

- Future Emissions and Group Rewards: 38.888%

- Core Contributors: 23.8%

- Hyper Basis: 6%

- Group Grants: 0.3%

Vesting Schedule

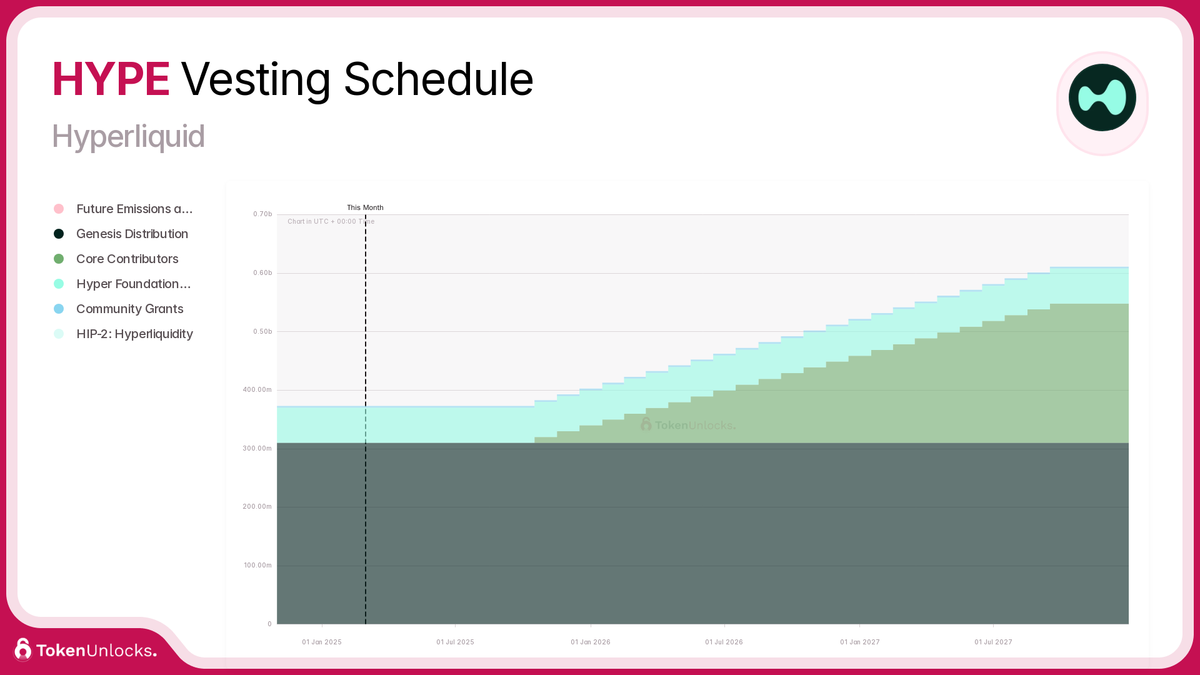

- Group Allocation: Over 30% of the full provide was distributed at launch by way of the airdrop.

- Staff Tokens: Locked for one yr, adopted by a gradual month-to-month unlock over two years, with full distribution by 2027–2028.

Supply: Tokenomist

Hyperliquid Worth Prediction

Overview of the HYPE Chart

HYPE is a comparatively new buying and selling pair with restricted historic knowledge. This makes it difficult to find out previous help and resistance ranges. Nevertheless, by using Fibonacci retracements, analyzing price construction, and evaluating current market habits, we will make a well-informed evaluation of its potential future pattern.

In response to CoinGecko, the present price of HYPE, displays a 24-hour change of -4.9% and a 7-day decline of -20.3%. Nevertheless, over the previous 30 days, the price has elevated by 42%, indicating a notable restoration pattern.

Historic knowledge exhibits that the ATH was $34.96 on December 22, 2024, whereas the all-time low (ATL) was $3.81 on November 29, 2024, highlighting the token’s important price volatility. The present market capitalization stands at $4,533,147,158, with a 24-hour buying and selling quantity of $134,598,198, demonstrating a comparatively excessive degree of buying and selling exercise.

Latest Worth Development Evaluation

Primarily based on knowledge from CoinGecko, HYPE has skilled important price fluctuations over the previous month. Particularly:

- 30 days in the past, the price was round $9.51 (calculated from the 42% enhance to succeed in the present $13.51).

- 14 days in the past, the price was roughly $10.04 (based mostly on a 34.5% rise in 14 days).

- 7 days in the past, the price was round $16.95 (reflecting a 20.3% decline up to now 7 days to succeed in the present degree of $13.51).

Elementary Evaluation: Hyperliquid’s Technological Edge and Group-Centric Strategy

Technological Improvements

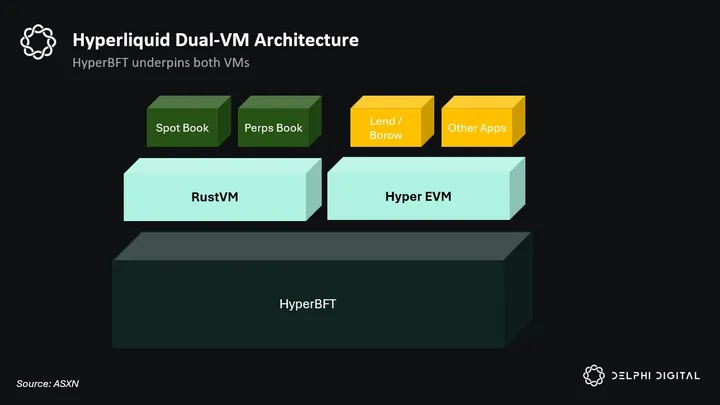

Hyperliquid’s blockchain employs the HyperBFT consensus mechanism, a variant of Byzantine Fault Tolerance (BFT), enabling fast transaction speeds with block finality underneath 1 second. This effectivity helps high-frequency buying and selling and complicated decentralized finance (DeFi) functions. The combination of HyperEVM ensures compatibility with Ethereum’s Digital Machine (EVM), facilitating seamless deployment of good contracts and decentralized functions (dApps) by builders aware of Ethereum’s ecosystem.

Supply: Delphi Digital

In contrast to many DEXs that make the most of Automated Market Maker (AMM) fashions, Hyperliquid employs an order e-book system, offering deeper liquidity and extra favorable pricing for merchants. This method mirrors conventional CEXs, providing customers a well-known and environment friendly buying and selling expertise. Moreover, Hyperliquid eliminates fuel charges for transactions, considerably decreasing prices for customers and enhancing the platform’s accessibility. That is the explanation why large-volume leveraged positions are actually being opened on this platform fairly than the extra tenured ones.

Staff and Group Engagement

The core staff behind Hyperliquid includes alumni from prestigious establishments akin to Harvard, Caltech, and MIT, with skilled backgrounds at main tech and monetary companies like Google, Hudson River Trading, and Nuro. This various experience underpins the platform’s revolutionary improvement and strategic path.

Emphasizing a community-first philosophy, Hyperliquid has eschewed enterprise capital funding, allocating a considerable portion of its native token, HYPE, on to the group. This method fosters a decentralized governance mannequin and aligns the platform’s success with its consumer base, selling lively participation and long-term dedication.

Income Mannequin and Monetary Sustainability

Hyperliquid’s income is primarily derived from transaction charges, with a good portion redistributed to the group. Notably, all charges are directed to the Hyperliquid Liquidity Suppliers (HLP) and the help fund, making certain that the group instantly advantages from the platform’s development. This mannequin contrasts with different protocols the place charges primarily profit the staff or insiders.

The platform’s tokenomics are designed to help long-term sustainability and group engagement. A portion of the tokens could also be burned throughout staking to cut back circulation, integrating a deflationary mannequin to spice up the token’s worth.

Differentiation from Different Layer 1 Platforms

Hyperliquid distinguishes itself from different Layer 1 platforms like Ethereum and Solana by way of a number of key features:

- Devoted Blockchain: Working by itself Layer 1 blockchain, Hyperliquid ensures tailor-made optimizations for buying and selling actions, leading to enhanced efficiency and consumer expertise.

- Group-Centric Tokenomics: By allocating a considerable portion of its native token to the group and avoiding enterprise capital funding, Hyperliquid fosters real decentralization and aligns incentives with its consumer base.

- Order E book Mannequin: Using an order e-book system, versus the prevalent AMM mannequin, supplies merchants with deeper liquidity and extra exact pricing, catering to each retail and institutional members.

Figuring out Key Ranges in Technical Evaluation

Key Assist Ranges

- The underside level earlier than HYPE reached its highest peak performs an important function in confirming help ranges.

- After breaking by way of this key help degree, the price retested it, confirming Fibonacci retracement ranges.

- When the price reaches a deep help zone, a minor rebound might happen.

Accumulation and Breakout Zones

- The chart exhibits price consolidating inside slim ranges—an indication of accumulation.

- When price breaks out of an accumulation zone, it’s important to substantiate whether or not it’s a real breakout or only a lure.

- If the price strikes up after a breakout, it might sign a confirmed bullish pattern.

- Conversely, if the price fails to carry above the breakout degree, it might point out a bull lure.

Supply: TradingView

HYPE Trading Methods

At the moment, there are not any clear indicators of a confirmed pattern reversal. Due to this fact, NFTevening nonetheless prioritizes the bearish state of affairs within the close to future, particularly because the price has damaged out of the buildup zone and is now displaying a restoration transfer to substantiate this breakout.

- If the price continues to remain under the newly fashioned resistance zone, the downtrend is more likely to persist.

- Alternatively, if a robust reversal sign emerges available in the market, the technique ought to be adjusted accordingly.

Key Assist Ranges if the Worth Continues to Decline

If the downtrend continues, the price might attain key Fibonacci ranges that act as potential help zones:

- 12 – 12.5 USDT: This vary is close to the earlier low, the place shopping for stress might emerge, doubtlessly triggering a slight rebound.

- 10 – 10.5 USDT: That is anticipated to be the strongest help zone. If the bearish momentum persists, NFTevening anticipates the price might drop into this vary.

Conclusion

HYPE is presently in a robust downtrend, with no clear reversal indicators. Trading at this stage requires warning and affirmation by way of technical alerts. To optimize buying and selling methods, traders ought to monitor price reactions at key help ranges and anticipate a reversal sample earlier than making any purchase selections.