Hyperliquid, an rising Layer 1 blockchain, has surged in prominence following its record-breaking airdrop in November 2024, positioning itself as a formidable contender within the DeFi area. Its fast rise invitations comparisons with Ethereum, the main Layer 1 blockchain.

Whereas Ethereum boasts a large Whole Worth Locked (TVL), Hyperliquid’s means to generate considerably larger charges regardless of a smaller TVL highlights an enchanting dynamic in blockchain economics, pushed by their distinct designs and market focuses.

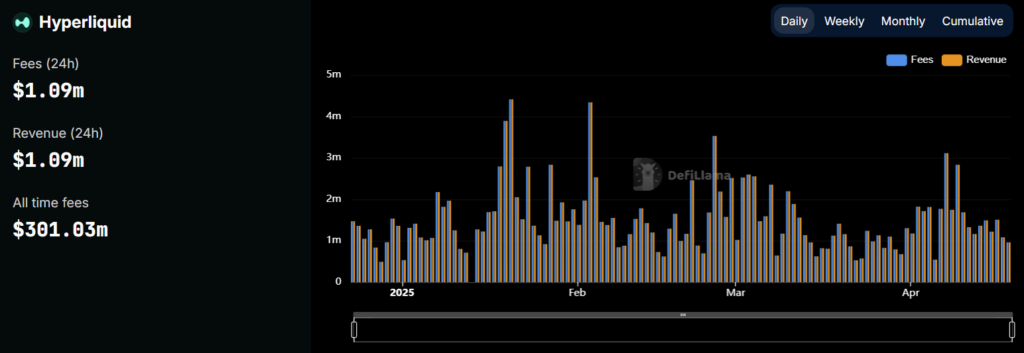

Hyperliquid is Starring: The Numbers Converse

Hyperliquid is a high-performance Layer 1 blockchain tailor-made for decentralized perpetual futures buying and selling. As of April 2025, its TVL is roughly $627.27 million, a fraction of Ethereum’s however spectacular for a specialised platform. The latest airdrop of 310 million HYPE tokens to 94,000 customers, valued at $7.6 billion, catapulted Hyperliquid into the highlight, driving person adoption and buying and selling quantity.

Be taught extra: What’s Hyperliquid?

Supply: DefilLama

Ethereum, the spine of DeFi, instructions a TVL of over $46 billion, dwarfing Hyperliquid’s. Internet hosting over 1,216 tasks, it helps a various ecosystem of dApps, NFTs, and DeFi protocols. Current updates embrace the Dencun improve (March 2024), which slashed Layer 2 charges by 95%, and rising restaking adoption by way of EigenLayer.

Nonetheless, Ethereum’s chain charges have struggled, standing at $300,000 within the final 24 hours in comparison with Hyperliquid’s $1 million. All through Q1 2025, Ethereum’s efficiency faltered, with charges hitting report lows as a result of diminished community exercise lately amid the chaos of the general market and decrease fuel costs post-Dencun. Regardless of its unmatched validator rely (1.05 million) and decentralization, Ethereum’s income has lagged, as its excessive TVL displays passive actions like staking reasonably than high-turnover buying and selling.

Supply: DefilLama

The distinction is stark: Ethereum’s TVL is almost 80 instances Hyperliquid’s, but Hyperliquid generates over 3 times the day by day charges. This hole widened in Q1 2025, as Ethereum’s charges repeatedly hit historic lows, whereas Hyperliquid’s DEX thrived regardless of whale-induced volatility. The airdrop additional amplified Hyperliquid’s attraction, boosting its person base to over 230,000 and day by day buying and selling quantity to $470 million.

Supply: Artemis

Why Hyperliquid’s Price Surge?

Hyperliquid’s payment benefit stems from its specialised design and market match. Its perpetual futures DEX, constructed on the Hyperliquid L1 with HyperBFT consensus, delivers sub-second latency and 100,000 orders per second, rivaling centralized exchanges.

The platform’s high-leverage buying and selling (up to 50x) and low-cost construction drive large buying and selling volumes, amplifying payment era. The HLP Vault, a novel function, aggregates charges from transactions, funding, and clearing, making certain environment friendly income seize.

In distinction, Ethereum’s fuel charges, distributed to validators, rely upon community congestion and are much less tied to TVL, which is usually locked in low-turnover protocols like Aave or Lido. The Dencun improve, whereas bettering scalability, slashed charges, decreasing Ethereum’s income.

Hyperliquid’s airdrop additionally performed a pivotal position, drawing merchants and sustaining TVL development post-TGE, not like typical post-airdrop declines seen in tasks like Scroll. Its community-focused tokenomics, allocating 76.2% of HYPE tokens to customers, additional fueled engagement.

Hyperliquid Ecosystem after Its Elevating Efficiency

Hyperliquid has developed from a perpetual futures DEX right into a multidimensional Web3 ecosystem since launching HyperEVM, an Ethereum-compatible blockchain, in February 2025. HyperEVM’s high-performance design, with fast block instances and parallel processing, helps over 100 dApps throughout DeFi, NFTs, GameFi, AI, and liquid staking.

Tasks like Hyperlend and Timeswap innovate in lending, whereas Cluster and Solv Protocol improve liquid staking. Native DEXs (HyperSwap, Spectra) and AI-driven instruments (Beats AI, HCR Bot) showcase its versatility.

NFT collections like Rich Hypio Infants and GameFi platforms like Hyperverse drive neighborhood engagement. Bridges (Wormhole, HyBridge) and oracles (Pyth Community) guarantee interoperability, whereas meme tokens like Autist add viral attraction. Hyperliquid’s imaginative and prescient, likened to a “Solana on EVM,” goals for ultra-fast, scalable experiences, positioning it as a basis for Web3 innovation. Its various ecosystem, constructed on a trader-centric core, indicators a shift from a distinct segment DEX to a broad, aggressive platform.

Learn extra: Hyperliquid Ecosystem: From Perp DEX to Rising Crypto Ecosystem