- Solana dominated Ethereum when it comes to community exercise.

- SOL’s weekly chart remained inexperienced, however the development may change quickly.

Solana [SOL] has been gaining a lot traction within the latest previous due to a number of memecoin launches on the blockchain. However there was extra occurring with the blockchain, as a key metric has been on an rising development, which seemed fairly optimistic.

Solana is rising

AMBCrypto reported earlier how Solana’s quantity was rising, which may be attributed to a number of memecoin launches reminiscent of Dogewifhat [WIF], BONK, and so forth.

Moreover, the blockchain’s efficiency within the DeFi area was commendable. This was the case as Solana’s TVL not too long ago reached an all-time excessive.

On prime of that, Token Terminal not too long ago posted a tweet that highlighted yet one more achievement. As per the tweet, SOL’s charges have been on the rise.

In reality, if the most recent knowledge is to be thought of, SOL’s charges have been fairly near these of Ethereum [ETH]. AMBCrypto’s analysis of Artemis’ knowledge revealed {that a} comparable development was additionally famous when it comes to each blockchains’ income.

Supply: Artemis

Whereas Solana’s charges and income have been closing in on these of Ethereum, SOL has already been dominating ETH by a considerable margin when it comes to community exercise.

Each Solana’s each day energetic addresses and each day transactions have been significantly larger than Ethereum’s, reflecting SOL’s recognition and excessive adoption.

Nonetheless, Ethereum continued to guide within the DeFi area, as its TVL was a lot larger than SOL’s.

Supply: Artemis

SOL bulls should not letting go

Amidst all this, SOL bulls rejected the choice to step down because the token’s weekly price motion remained optimistic within the considerably bearish market.

Based on CoinMarketCap, on the time of writing, the token was buying and selling at $167.45 with a market capitalization of over $76.9 billion.

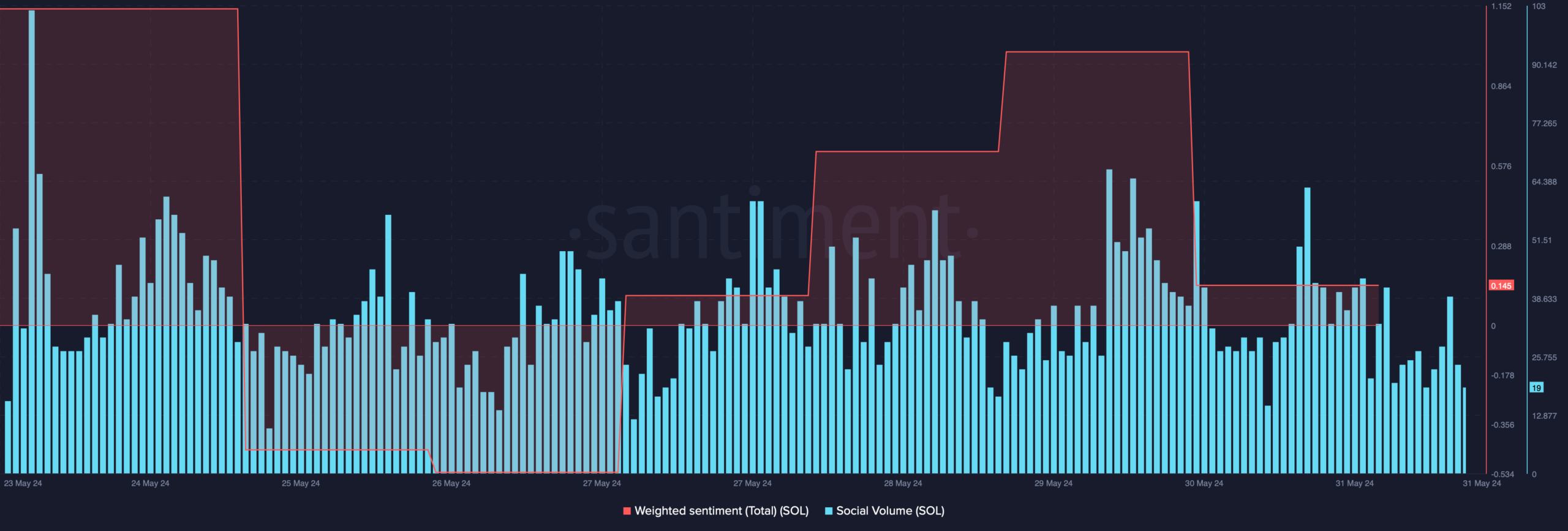

Due to the bullish price motion, Solana’s weighted sentiment remained excessive. This meant that bullish sentiment across the token was dominant out there.

Moreover, its social quantity additionally remained excessive, reflecting its recognition within the crypto area.

Supply: Santiment

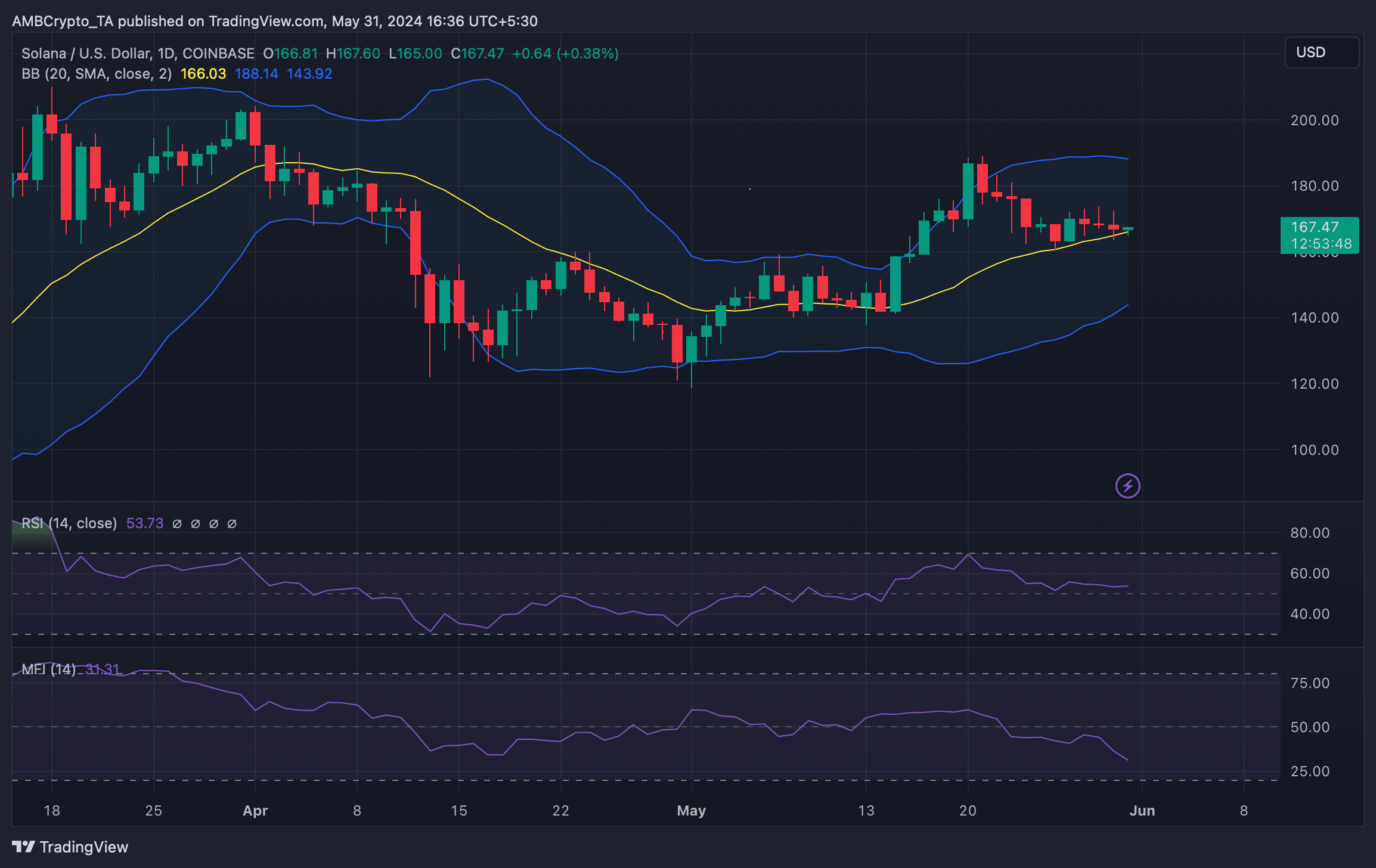

AMBCrypto then analyzed the token’s each day chart to higher perceive whether or not this bullish price motion would proceed additional. As per our analysis, the optimistic price motion may not final as its Relative Power Index (RSI) took a sideways path.

Learn Solana’s [SOL] Worth Prediction 2024-25

Furthermore, the token’s Cash Stream Index (MFI) registered a pointy downtick, additional hinting at a price drop.

Nonetheless, SOL was sitting proper above its 20-day Easy Transferring Common (SMA), which usually acts as a assist.

Supply: TradingView