When Anne obtained an pressing e mail from an obvious Federal Commerce Fee agent claiming there was a requirement for cost and a warrant out for her arrest over fraudulent purchases, she nervously shared her cellphone quantity with the sender.

The 77-year-old girl adopted directions she obtained by textual content message to pay $9,000 in money into an ATM at a gasoline station close to her house in Chicago.

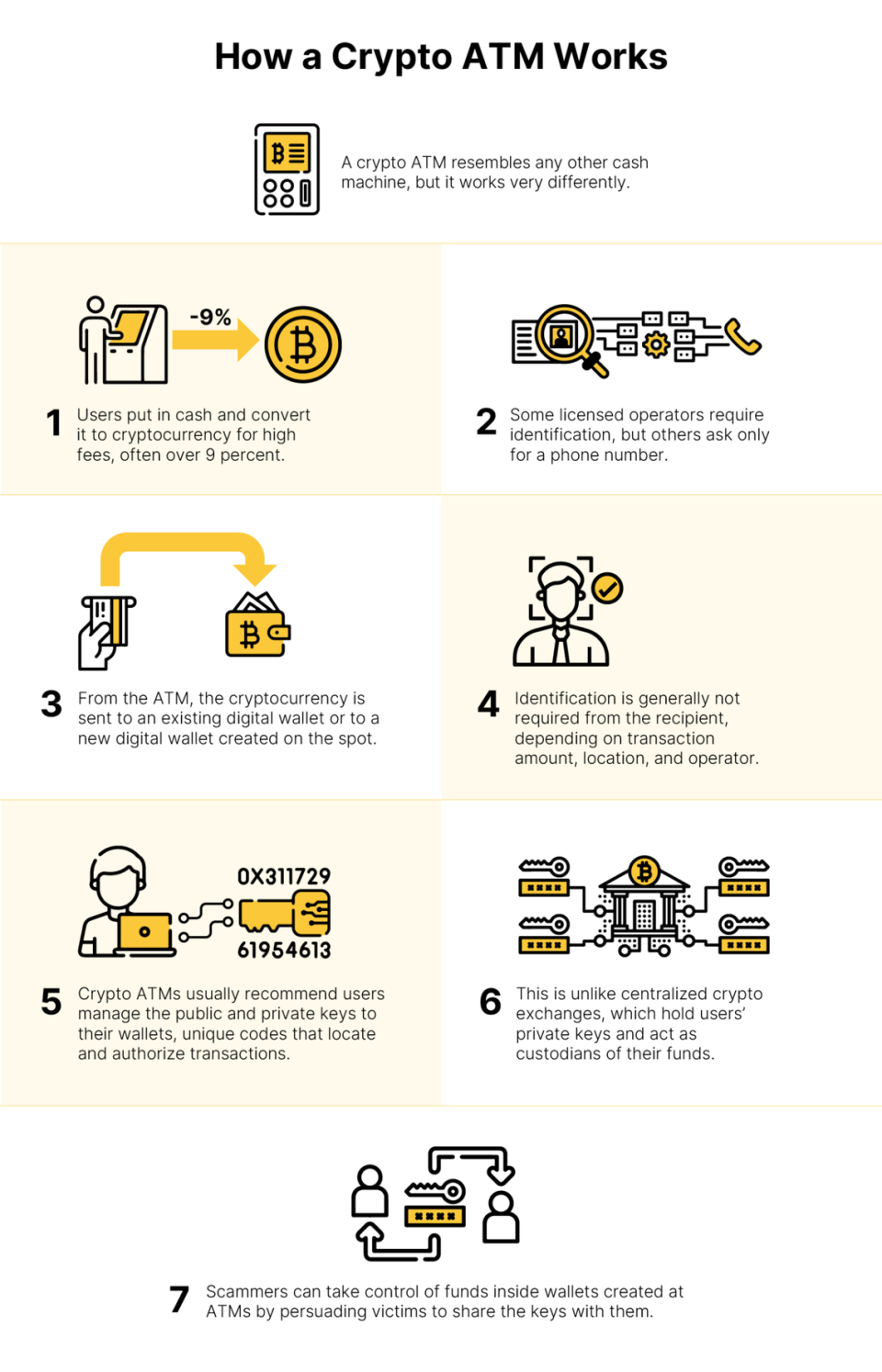

However the machine the place she positioned her cash wasn’t a traditional ATM related to a financial institution — as a substitute, it was what’s generally known as a crypto ATM, an more and more frequent kind of kiosk that converts money into cryptocurrency.

Tucked away in low-key places like gasoline stations, vape retailers, and laundromats, crypto ATMs are touted by operators as a simple option to change money to crypto. Nonetheless, consultants say crypto ATMs have develop into a automobile for worldwide felony enterprise, and that hundreds of thousands of {dollars}’ value of fraud is carried out utilizing the machines within the U.S. alone.

In Anne’s case, her cash disappeared right into a pockets related to an offshore crypto change inside minutes, in accordance with forensic consultants who examined the incident for OCCRP. She has by no means recovered her cash.

“I just can’t wrap my head around someone being so devious and so evil to do this to somebody who’s older who has worked all their life to try to provide for themselves and for their family,” Anne’s daughter stated. OCCRP is utilizing a pseudonym for Anne on the request of her household.

A small variety of crypto ATMs enable customers to promote bitcoin and take out money, however the majority solely convert money to crypto. The machines have much less stringent identification necessities than on-line crypto exchanges — and, as in Anne’s case, they permit giant quantities of money to be stolen lengthy earlier than legislation enforcement has even been notified a few rip-off. Inconsistent laws throughout U.S. states and traditionally strained sources for preventing monetary crimes exacerbate the difficulty.

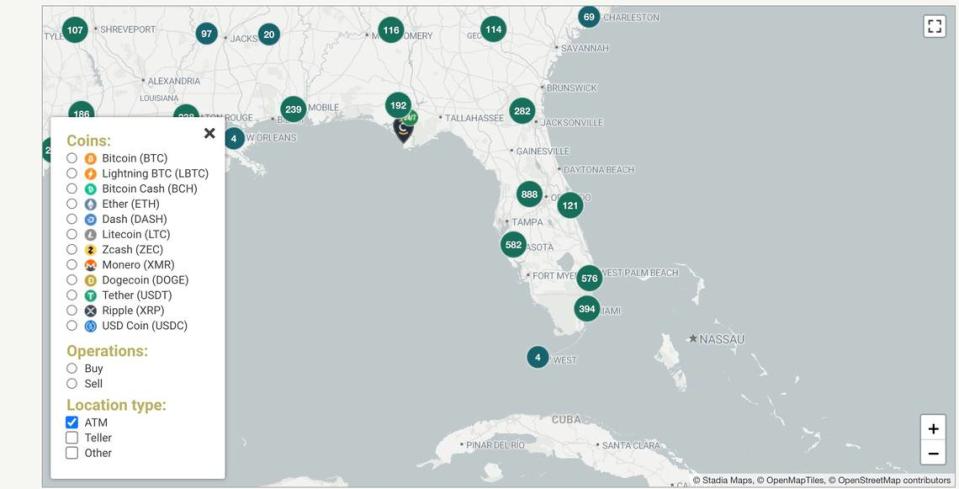

There are 2,616 crypto ATMs working in Florida, in accordance with the web site CoinAMTRadar, which alerts customers to places of machines nationwide. South Florida is house to a big focus of crypto ATMs. The trade web site CoinAMTRadar stated there are almost 700 working in South Florida, 376 legally in operation in nice Miami Dade and its environs and one other 306 within the Fort Lauderdale space.

In Miami, there’s a heavy focus in and round Miami Worldwide Airport. There are 33 crypto ATMs in Hialeah and one other 35 across the Miami Gardens space. The ATMs additionally are usually in poorer neighborhoods, the place there’s extra of a money economic system and extra crime.

The FBI, in its first public nationwide estimate of the scope of the issue, instructed OCCRP that losses within the U.S. from scams carried out through crypto ATMs exceeded $120 million in 2023. And people numbers don’t even seize the nationwide safety and money-laundering dangers related to these hard-to-track transactions.

The U.S. Secret Service, which investigates illicit exercise involving cost methods, instructed OCCRP it had discovered “transnational criminal networks that aim to exploit the United States’ financial systems often operate out of countries that lack legal agreements with the United States.”

“The Secret Service is committed to identifying, disrupting, and dismantling those networks,” the assertion stated.

A United Nations report from 2023 painted a broader image of how on-line scams — from unlawful playing to crypto fraud — have been linked to worldwide human trafficking, estimating that greater than 200,000 individuals in Myanmar and Cambodia could also be held in conditions the place they’re pressured to hold out web fraud.

A Monetary Traits Evaluation report from the U.S. Treasury Division’s Monetary Crimes Enforcement Community in February stated it had obtained greater than 2,300 experiences from monetary establishments referencing cryptocurrency in reference to human trafficking and little one sexual exploitation in 2020 and 2021. Seventeen of these experiences concerned crypto ATMs, also called crypto kiosks.

The flexibility of scammers to cowl their tracks — particularly after they’re based mostly abroad — is a serious problem for U.S. investigators.

Matthew Hogan, a Connecticut State Police detective specializing in crypto investigations, stated organized fraudsters who contact U.S. victims and persuade them to pay money into crypto ATMs are usually based mostly in Southeast Asia, India or West Africa, and that Ukrainian and Russian nationals have additionally been concerned.

Hogan added that whereas crypto actions could be simpler to observe than money transfers as a result of they use open supply blockchain know-how, scammers make use of quite a lot of obfuscation techniques to make them arduous to hint, reminiscent of “bridges” which switch property between totally different blockchain networks.

Erin West, a deputy district legal professional in Santa Clara County, California, who makes a speciality of cryptocurrency scams, stated the crypto exchanges that finally obtain cash generated by fraud are usually situated offshore and do not need to cooperate with U.S. authorities. Whereas some at the moment are opting to take action, others are usually not. “There’s always going to be an exchange that will pull dirty money,” she stated.

Within the new figures equipped to OCCRP, the FBI stated it had obtained greater than 4,300 complaints in 2023 associated to cryptocurrency ATMs. The FBI’s current Elder Fraud report cited greater than 2,000 complaints final 12 months from individuals aged 60 or older saying they have been victims of fraud involving crypto ATMs.

Hogan stated solely round 10 p.c of reported instances get some quantity of restitution.

Nonetheless, whereas instances of particular person fraud could be arduous to prosecute, a handful of main convictions in U.S. courts point out the potential scale of crypto ATMs’ function in broader criminality.

Probably the most distinguished was the case of Victoria Jacobs, sentenced to 18 years in April after a jury trial in New York Metropolis for funneling $18,000 to a tactical coaching group that helps Syria’s Hay’at Tahrir al-Sham, designated as a international terror group by the State Division. She used a crypto ATM within the coronary heart of the town as a part of the scheme.

A month later, Robert Taylor was convicted by a New York State Supreme Court docket jury for working a community of greater than 40 unlicensed crypto ATMs out of laundromats within the metropolis. He’s awaiting sentencing. The Manhattan DA described his machines, which have been marketed as offering full anonymity to customers, as “intentionally targeted toward criminal clientele.”

Prosecutors stated Taylor transformed greater than $5.6 million in money into cryptocurrency through his clandestine community and investigators discovered $250,000 in money in his condominium. He additionally had operations in New Jersey and Miami.

Taylor was charging up to twenty p.c in charges for transactions carried out on his machines, as was former Bitcoin of America CEO Sonny Meraban, who was convicted final 12 months for violating licensing necessities on his community of crypto ATMs in Ohio and benefiting from scams carried out at his machines.

Meraban, who was arrested in Miami, was sentenced to 5 years of probation and forfeited property together with the equal of $3.9 million in Bitcoin on the time and a cigarette speedboat.

Prosecutors stated that Bitcoin of America had annual nationwide transaction volumes of at the very least $250 million in 2022, conserving $50 million of the cash moved as charges.

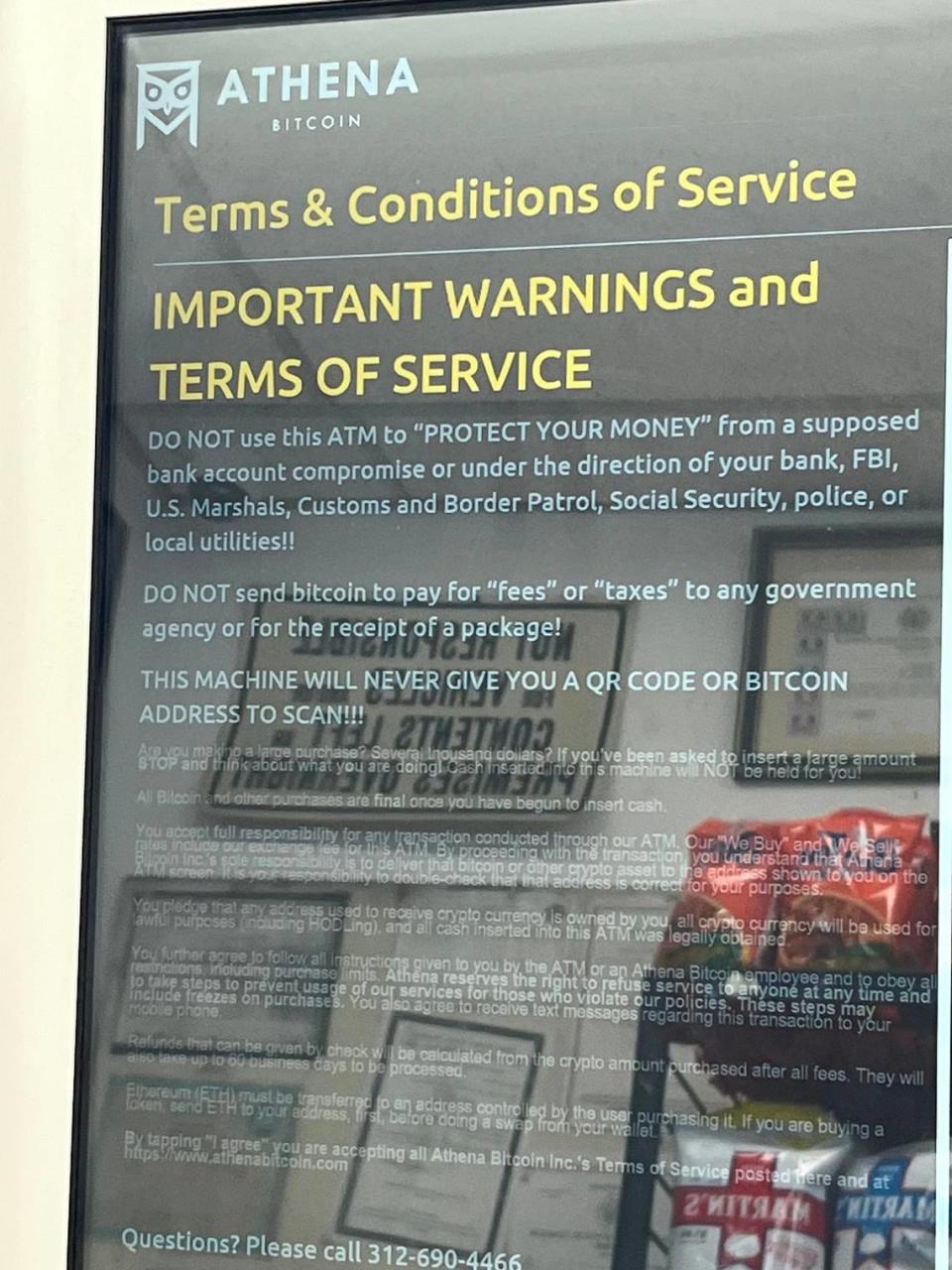

The ATM the place Anne, the aged Chicago girl, was instructed to put her money was owned and operated by Bitcoin of America. The corporate introduced it had ceased working in March 2023 and warned impostors have been utilizing its title and emblem.

The Meraban case confirmed how a bootleg community of ATMs paved the best way for scammers.

However consultants say scams are additionally occurring through machines linked to a lot bigger and higher recognized operators.

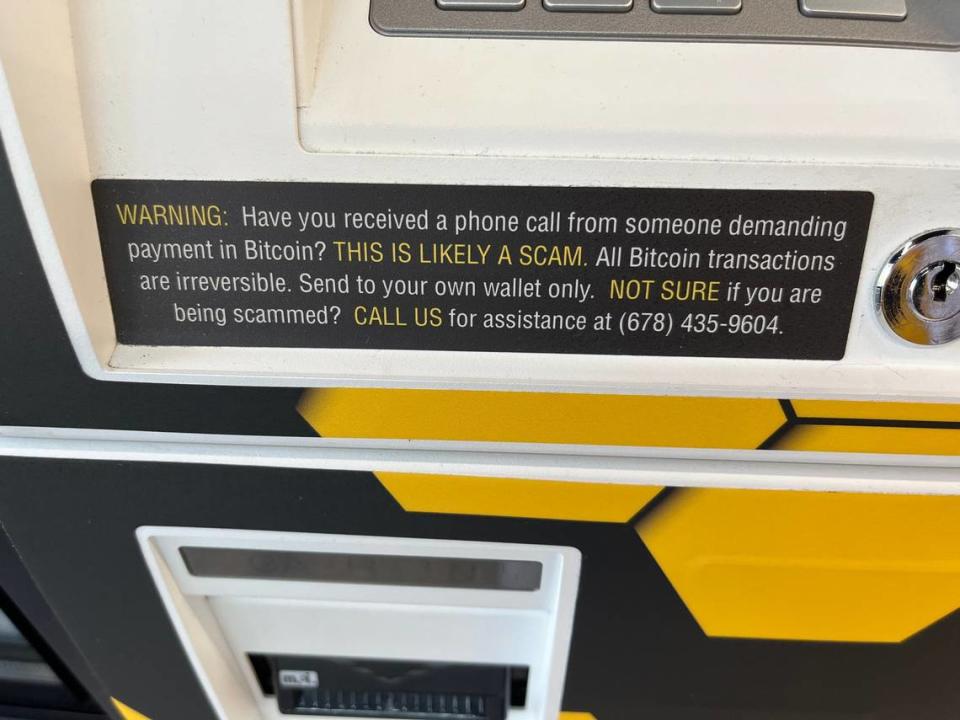

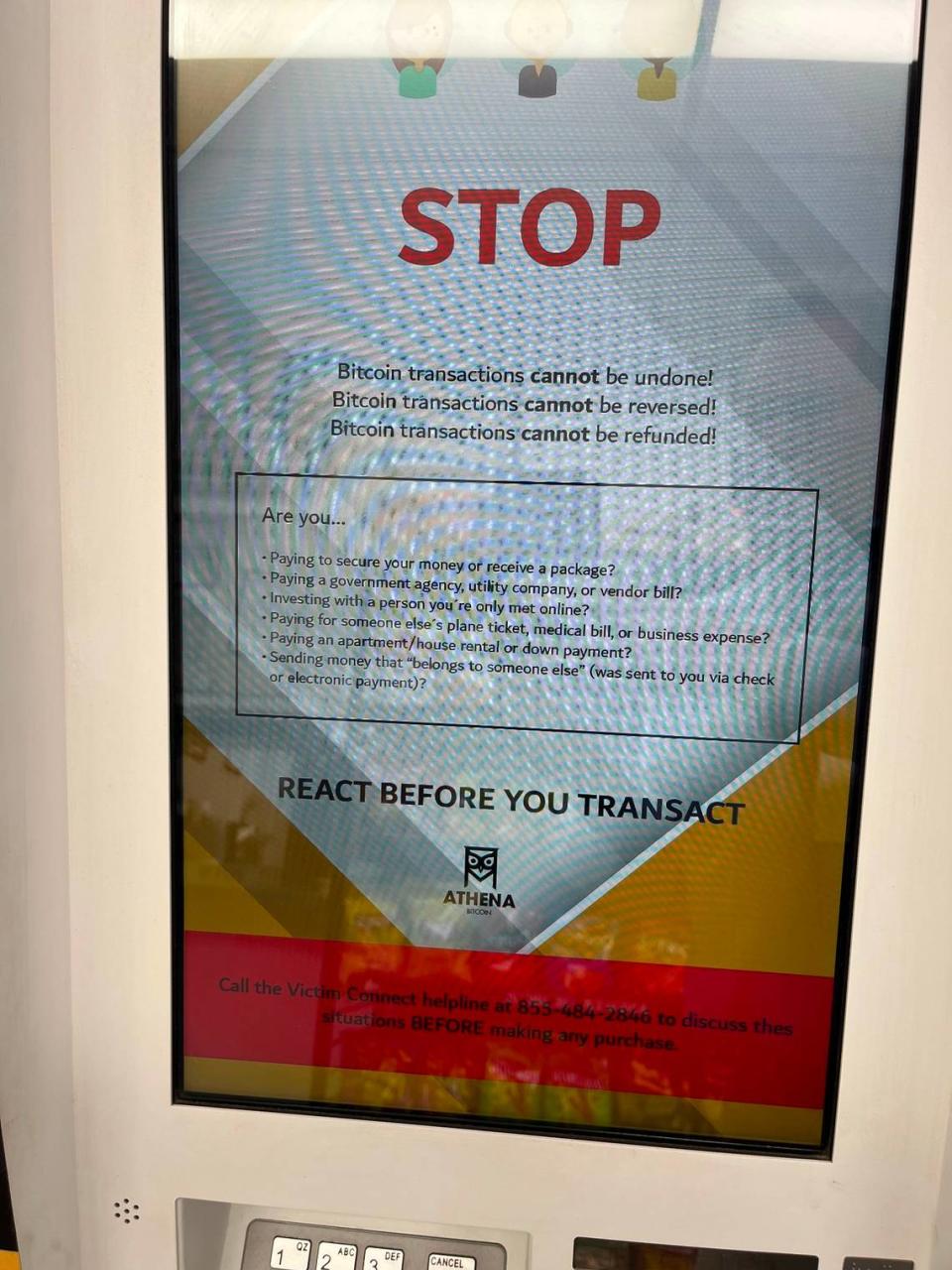

Bitcoin Depot and Coin Flip stated they place warnings about fraudster techniques on their machines or through textual content and educate their buyer assist employees to search for warning indicators. Bitcoin Depot additionally stated it runs digital wallets receiving funds by a database of suspicious wallets to detect fraud earlier than transactions are confirmed.

Seth Sattler, chief compliance officer on the ATM supplier DigitalMint, stated the corporate checks vacation spot wallets towards sanctions lists and stops these switch makes an attempt. It regularly calls prospects about transactions when a vacation spot pockets is related to an change solely obtainable in a dangerous nation, and solely converts crypto into native foreign money, he stated.

Sattler argued that prospects use the corporate’s machines for a well-recognized ATM expertise and to “dip their toes” into crypto.

However a number of legislation enforcement brokers throughout the U.S. instructed OCCRP that many crypto ATM operators are usually not doing sufficient to discourage scams on their platforms.

“In my experience, it seems like more of just a willing blindness to the fraud that is happening using their machines,” stated Chris Siliciano, a particular agent within the FBI’s Los Angeles subject workplace.

Lack of laws and enforcement

In line with trade database CoinATMRadar, which compiles figures supplied by ATM operators, there are greater than 31,000 crypto ATMs within the U.S. and virtually 7,000 extra world wide. The bulk have been put in in 2021 and 2022 as cryptocurrency costs reached all-time highs.

Beneath federal legislation, operators of crypto ATMs should register with the Treasury Division’s FinCEN, which obliges them to observe exercise on their machines and report something suspicious. Aside from that, laws for operators are set at state stage. Some states explicitly require crypto ATM operators to acquire a cash transmitter license. Others, like Illinois, don’t contemplate cryptocurrency to be cash as a result of it isn’t issued by a authorities.

Felix Shipkevich, a New York-based legal professional specializing in cryptocurrency and cash transmitter legislation, stated state regulators are stretched for sources and produce other priorities than to proactively be certain that crypto ATM operators are following anti-money laundering guidelines.

“I don’t think that the states do such a great job of forcing some of these operators from operating without a license or from doing the proper protection of consumers,” he stated. “That opens up room for fraud.”

Crypto ATM fraud has grown steadily for the reason that explosion of recognition in crypto buying and selling through the Covid-19 pandemic, stated Sgt. Bridget Duran from the Miami-Dade Police Division’s cyber crimes investigations unit.

Duran stated the machines enable criminals to work virtually invisibly due to the problem in figuring out the last word homeowners of wallets receiving fraudulent cash.

OCCRP reviewed a whole lot of complaints about crypto ATMs filed to the U.S. Federal Commerce Fee, the federal company charged with shopper safety, and police and state attorneys basic workplaces in 4 states since 2019. Many concerned a scammer impersonating legislation enforcement, financial institution officers, or tech firm buyer assist, following comparable techniques utilized in reward card or cash wire scams.

Miami’s Duran stated investigators are hindered in chasing down rip-off perpetrators as a result of the greenback quantity of losses is usually under the brink wanted to request the assistance of a international nation to freeze property in an offshore crypto change, which is the place consultants imagine victims’ cash typically ends up.

“I don’t want to say ‘not worth it’, but the juice isn’t worth the squeeze,” she stated

Nonetheless, though the quantities concerned are sometimes small, crypto ATMs are typically used for much bigger fraud.

The patron division of the Maryland Legal professional Common’s workplace registered a case final 12 months of a person who fell sufferer to a false virus pop-up and believed he was working with officers from Microsoft, Wells Fargo, and the FBI.

The fraudsters initially persuaded him to deposit almost $40,000 right into a crypto ATM for “safekeeping.” Over the subsequent 4 months, they satisfied him to maneuver more cash into cryptocurrency wallets, culminating in him depositing $900,000 in retirement financial savings by a wire switch service that converts {dollars} into bitcoin.

How scammers transfer cash

The case of Anne in Chicago illustrates each the cruelty of rip-off techniques and the best way wherein victims’ cash is shortly spirited away.

After receiving the e-mail warning her in regards to the warrant out for her arrest in late 2022 and sharing her cellphone quantity, a scammer who launched themselves as an FTC investigator known as her at her suburban house, then despatched a screenshot of his government-issued ID .

Speaking principally by textual content, he guided her to withdraw $9,000 in money from her financial institution and deposit it on the gasoline station crypto ATM machine close to her house.

About 10 minutes after Anne inserted the payments, the cash was transferred to a pockets related to OKX, an change within the Seychelles. The path went chilly from there, in accordance with an analysis for OCCRP by the forensics agency Crystal Intelligence.

OKX is the third-largest crypto change by quantity on this planet. It didn’t reply to a request for remark in regards to the case.

The Crystal analysis advised the pockets the place Anne’s cash was final seen seemingly belonged to a peer-to-peer service, presumably a smaller crypto dealer. Such companies typically enable their customers to purchase and promote crypto with out in depth know-your-customer checks and are nested inside bigger centralized crypto exchanges.

With out correct oversight, illicit actors can run cash laundering companies with out the bigger change realizing, stated Nicholas Sensible, Crystal’s director of intelligence and safety.

Anne’s household filed a police report with the Chicago Police Division’s monetary crimes division however the case has since been suspended, the division confirmed to OCCRP, with no purpose listed.

One other case shared with OCCRP by the Maryland Legal professional Common’s workplace confirmed how a crypto pockets utilized in an analogous rip-off despatched a sufferer’s cash offshore.

In Could 2023, the sufferer paid $4,500 right into a Bitcoin Depot ATM at a gasoline station close to Baltimore after being instructed their checking account had been compromised. They transferred the cash to a bitcoin pockets they believed belonged to representatives from Microsoft and Financial institution of America.

An analysis for OCCRP by Crystal confirmed the bitcoin was moved to a second pockets lower than three hours later.

Between April 2022 and July 2023, that pockets processed property value someplace between $1.4 million and $3.6 million, in accordance with the analysis. It despatched cryptocurrency to a number of different wallets throughout that point and is now empty.

The pockets despatched almost 14 bitcoins to wallets related to 1xBet, a web-based betting firm with Russian origins which holds its gaming licenses within the Dutch Caribbean island of Curacao. Its Curacao-based entities have been sanctioned by Ukraine final 12 months as a part of its response to Russia’s full-scale invasion.

The pockets additionally made a number of transactions to HitBTC, a small-scale change with unclear authorized standing. (In line with its personal web site, HitBTC is registered within the island nation of Saint Vincent and the Grenadines. Nonetheless, that nation’s monetary authority not too long ago denied that and warned “against engaging in any business transactions with this entity, as individuals may become vulnerable to fraudulent activities.”)

Bitcoin Depot had not responded to a request for touch upon the particular case on the time of publication.

Connecticut detective Hogan and California deputy district legal professional West each recognized HTX, KuCoin and MEXC, all situated within the Seychelles, as exchanges the place the cash path regularly runs chilly of their investigations. The three exchanges didn’t reply to requests for remark.

“If you really want to make a significant change, we need the partnership of the locations where these exchanges are located, whether it’s Southeast Asia or the Seychelles, or wherever they’re actually based,” Hogan stated.

This story was reported in a collaboration between the Organized Crime and Corruption Reporting Mission and the Miami Herald.