Picture supply: Getty Photos

An investor opening a Shares and Shares ISA earlier than the 5 April deadline has a golden alternative to supercharge their wealth, harnessing the ability of tax-free compounding. With platforms like Hargreaves Lansdown and AJ Bell, setting up an ISA is fast, and funding it earlier than the tax 12 months ends ensures that some, or all, of the £20,000 annual allowance is put to work. As soon as the clock strikes midnight on 5 April, any unused portion is gone for good.

get going

Rising a portfolio is all about good decisions and persistence. Novice buyers are sometimes suggested to choose a mixture of international equities, index funds, and funding trusts spreads danger whereas capturing market features. Extra skilled buyers might want to put money into particular person shares. This can be a riskier strategy, however a various portfolio of well-chosen shares can progress a lot sooner than the index common. It fairly merely pays to undertake thorough research and keep away from widespread pitfalls like throwing good cash after unhealthy and emotional investing.

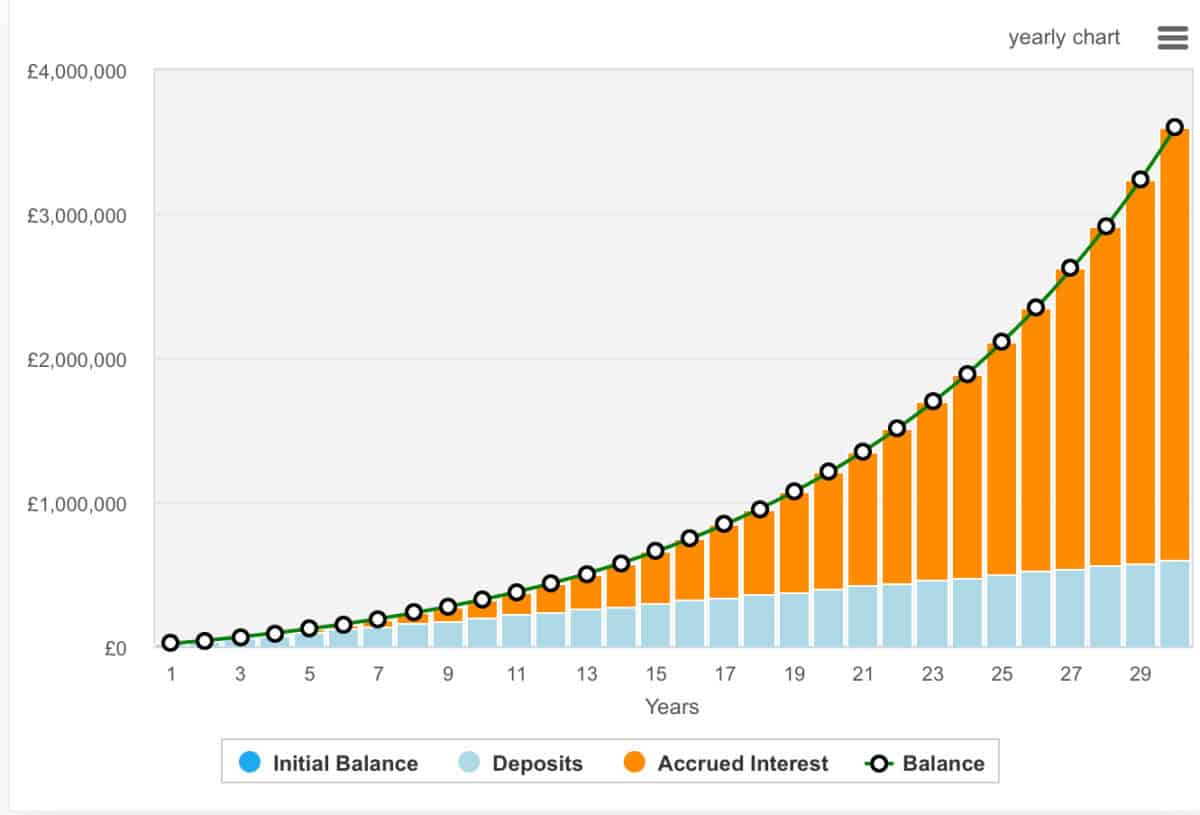

The magic occurs with compounding. That is after we put money into firms that reinvest earnings for us — like growth-oriented tech shares — and reinvest dividends ourselves. This results in regular capital appreciation, which snowballs over time, turning modest investments into severe wealth.

Dream massive, it’s achievable

Hitting the £1m mark isn’t only a dream. It’s maths. With a mean 7% return, a portfolio may double each 10 years. Utilizing this formulation, maxing out the ISA allowance every year places millionaire standing properly inside attain in underneath 25 years. Extra skilled buyers could possibly obtain double-digit returns when averaged over the long term. Actually, 10% returns would imply hitting millionaire standing in simply 19 years. Nonetheless, these of us making smaller contributions can get there too. It’ll simply take slightly longer. Fortunately, our funding will develop sooner over time — that’s compounding.

The true edge? No tax, ever. Not like common funding accounts, an ISA shields each acquire and dividend from tax, letting the complete pressure of progress and reinvestment work with out interference.

Please notice that tax remedy relies on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is offered for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

The sensible bit

Market dips develop into shopping for alternatives, whereas diversification throughout sectors and areas offers stability. One funding that delivers each diversification and progress potential is The Monks Funding Belief (LSE:MNKS). This belief goals for long-term capital progress by investing globally in a various portfolio of quoted equities. The Monks staff emphasises investing in adaptable firms that may navigate altering market situations, spreading investments throughout 4 progress classes: Stalwart, Fast, Cyclical, and Latent.

Monks’ high holdings embrace tech giants like Meta Platforms, Amazon, and Microsoft, with a big allocation to US shares. It’s really a really diversified portfolio with the highest 5 holdings accounting for simply lower than 20% — I’ve seen that determine a lot larger in different trusts. This diversification technique has helped the belief ship sturdy returns, outpacing its benchmark index in current durations.

Nonetheless, buyers ought to concentrate on the belief’s use of gearing, which stood at 4.96% as of the newest information. Whereas gearing can amplify features in beneficial market situations, it may additionally improve losses throughout downturns, doubtlessly resulting in larger volatility within the belief’s efficiency and share price.

Regardless of this gearing, it’s a inventory that pursuits me loads. Actually, it’s one I’ve added to my daughter’s SIPP.