Picture supply: Getty Pictures

Buyers typically strive calculating their passive earnings potential when investing within the inventory market. This can be a key a part of formulating an income-based technique, as the result depends on assembly sure standards. Notably, it’s vital to know the way a lot to take a position when aiming to attain a selected return

For instance, an investor desires to earn an additional £250 every week to complement their present earnings. That equates to a return of roughly £1,000 a month (or £12,000 a yr). How a lot would they should make investments to return £12,000 of earnings per yr?

Formulating a technique

An funding gives returns via each capital appreciation and dividends. Revenue buyers sometimes favor dividends as a result of common funds they ship.

One of the best dividend shares for passive earnings are these with a protracted observe file of progress. This reduces the danger of a dividend reduce within the close to future.

A excessive yield can also be vital — however not so excessive that it’s unsustainable. Danger tolerance and diversification are additionally key standards to contemplate. A less-diversified portfolio might present increased returns on the threat of better losses.

For instance, diversifying into risky US tech shares could be dangerous. Nevertheless, the chance for progress is sweet. Alternatively, low-volatility client items or healthcare shares are much less dangerous however slow-growing.

How a lot to take a position

Think about a portfolio with a 7% common yield and three% annualised progress. With £120,000 invested, that might return roughly £12k per yr.

That quantity could possibly be reached by investing £200 a month for 20 years. It will require reinvesting the dividends to compound the returns so the funding grows exponentially.

By upping the month-to-month contribution to £300, the time could possibly be diminished to fifteen years. And an investor with already £20,000 in financial savings may additional scale back it to solely 11 years. After all none of these returns are assured.

What sort of inventory meets these standards?

Ideally, the portfolio ought to have 10 to twenty shares with yields between 5% and 9%. They need to span a spread of various industries and geographical areas.

One instance I believe is value contemplating is the FTSE 250 inventory Investec (LSE: INVP). The worldwide wealth administration group is among the largest firms on the index, with a market cap of £4.66bn. Bigger-cap shares are usually much less risky.

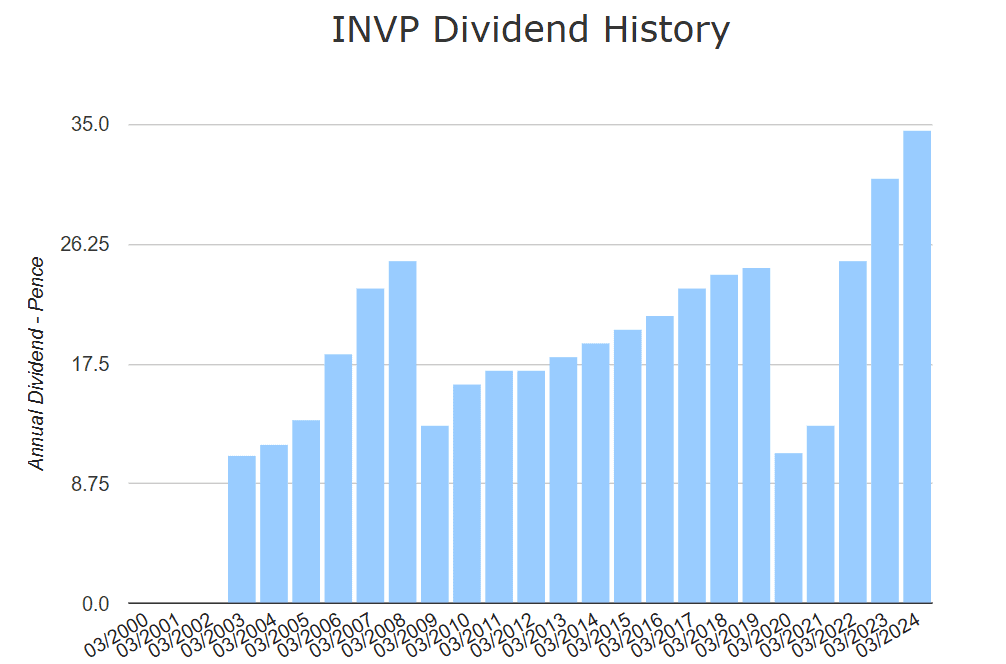

It maintains a reasonably secure yield between 5% and seven%, which is increased than common. Though it has made two cuts previously 20 years, dividends have grown at a charge of 6.9%.

As an funding agency, Investec is at increased threat from macroeconomic elements that result in market volatility. These embrace rate of interest adjustments, geopolitical conflicts and provide and demand points. Earnings can also undergo if an organization it invests in defaults on its debt or falls into administration.

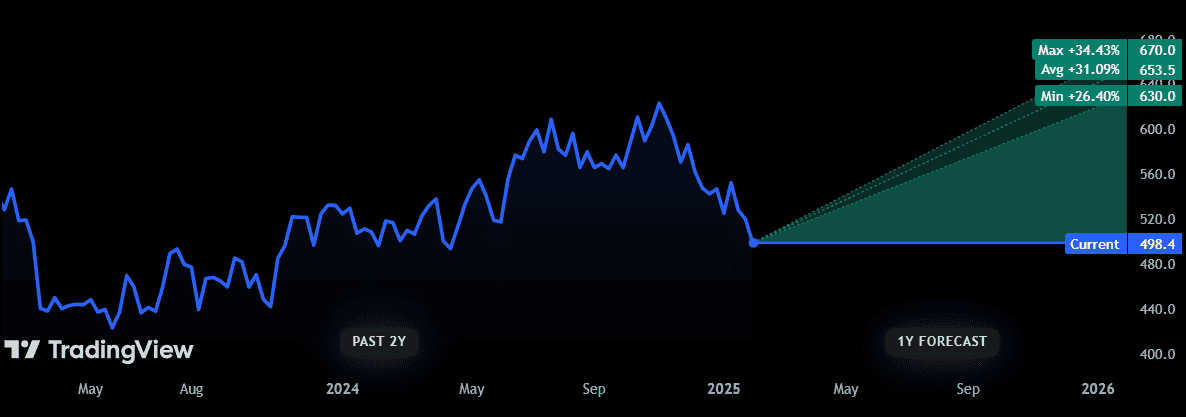

To this point, it seems to have made good funding selections. Analysts on common anticipate a 12-month price of 653p, 31% increased than right now.

The share price has elevated at an annualised charge of seven.3% over the previous decade. That makes it a beautiful addition to an earnings portfolio, as dividend shares sometimes have decrease price progress.

It additionally has good ratios, with a price of solely 6.7 instances earnings and a price-to-sales (P/S) ratio of 0.87.