Picture supply: Getty Pictures

Many traders are interested in the inventory market by the prospect of producing a wholesome degree of passive earnings. However when a high-yielding inventory’s additionally rising quickly, the potential returns could be much more spectacular.

Take M.P. Evans Group (LSE:MPE), the Indonesian palm oil producer, for example.

Good for earnings and progress

In respect of its 2024 monetary yr, the group’s declared a dividend of 52.5p a share, a rise of 17% on the earlier yr. This implies the inventory’s presently yielding a really respectable 5.3%.

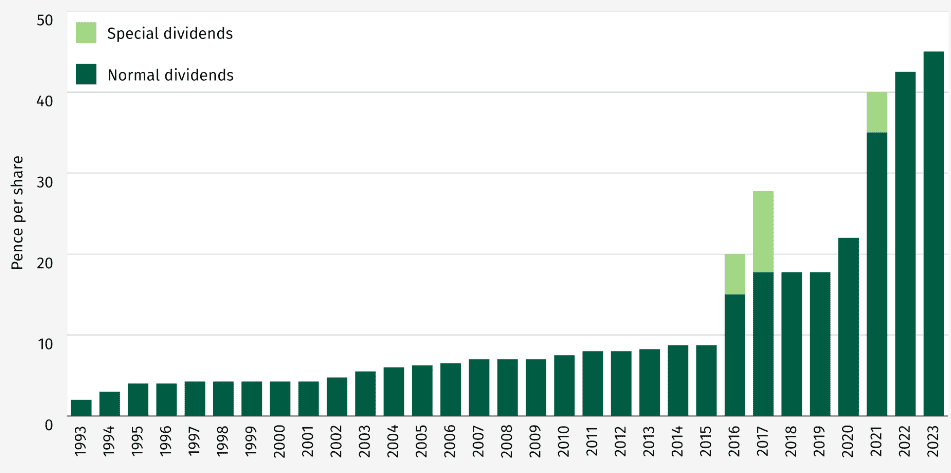

The corporate first paid a dividend in 1993. Since then, it’s elevated (or maintained) its payout yearly. Extra not too long ago — since 2020 — it’s grown by a median annual price of 24.3%.

Additionally, over the previous 5 years, its share price has risen by an annual common of 17%.

That is a powerful mixture.

Assuming the inventory continues to yield 5.3%, and its share price efficiency over the previous 5 years is repeated for one more twenty years, a £10,000 funding made in the present day would develop to £649,060. This assumes all dividends are reinvested, shopping for extra shares.

At this level, the inventory could be producing annual passive earnings of £34,400.

Nevertheless, this kind of analysis comes with some well being warnings. There’s no assure that historical past will likely be repeated. Virtually inevitably, its price of progress will gradual. And it’s by no means a good suggestion to place your entire cash into one inventory.

But it surely does give an thought of the potential return obtainable from a high-yielding progress share.

And now might be an excellent time to take a position. That’s as a result of, regardless of its spectacular price of progress, the corporate seems to be undervalued in comparison with its friends, together with a few of its bigger Asian rivals.

In 2024, M.P. Evans Group reported earnings per share of 129.6p. This implies its historic price-to-earnings (P/E) ratio is 7.8. In distinction, Sime Darby has a P/E ratio of 13.6. Wilmar Worldwide trades on a a number of of 10.1.

Some considerations

However the manufacturing of palm oil is controversial. Historic allegations of widespread deforestation and the exploitation of labour have broken the popularity of the trade. M.P. Evans Group has sought to beat this by selling its sustainable credentials. It’s been licensed by the Spherical Desk on Sustainable Palm Oil (RSPO).

Additionally, it’s entered into numerous partnerships with native producers. In return for providing land to the group, members of those cooperatives obtain compensation, a wage, and a share of the income.

Like different commodities, the price of palm oil could be unstable. It spiked after Russia invaded Ukraine, though it’s been comparatively secure because the summer time of 2022.

Crucially, climate situations can have an effect on a crop. In 2024, the group’s manufacturing was 1% decrease than within the earlier yr. Nevertheless, this was greater than compensated for by a 13% enhance within the common price earned.

Different potential issues embody pests, illness, and floods.

However I feel the inventory has tons going for it.

Palm oil is utilized in half of the packaged merchandise present in a typical grocery store. And the bushes from which it comes are extremely productive. The group’s monitor report of steadily rising its dividend can be encouraging. On steadiness, I feel it’s a inventory that long-term traders might take into account including to their portfolios.