Picture supply: Getty Pictures

Nvidia (NASDAQ: NVDA) inventory took a little bit of a bruising in January, falling 13% at one level. Nonetheless, it’s bounced again and is now 3.4% larger in 2025. Over 5 years, it’s up by a scarcely plausible 1,817%!

The AI chip king is because of launch its This fall 2025 earnings on 26 February. Right here, I’ll check out the newest forecasts heading into the outcomes report.

Unbelievable progress

Since ChatGPT was launched in late 2022, Nvidia’s quarterly outcomes have blown away Wall Road’s estimates.

The desk under reveals the income and earnings per share (EPS) figures, together with the shock outstripping of EPS expectations.

| Quarter* | Income | Income shock | EPS | EPS shock |

|---|---|---|---|---|

| Q1 24 | $7.2bn | 10.1% | $0.11 | 18% |

| Q2 24 | $13.5bn | 20.7% | $0.27 | 29.7% |

| Q3 24 | $18.1bn | 11.2% | $0.40 | 18.5% |

| This fall 24 | $22.1bn | 8.4% | $0.52 | 12.3% |

| Q1 25 | $26bn | 5.8% | $0.61 | 9.2% |

| Q2 25 | $30bn | 4.4% | $0.68 | 5.4% |

| Q3 25 | $35.1bn | 5.8% | $0.81 | 8.3% |

As we are able to see, Nvidia was crushing estimates by double digits round a yr in the past. Nonetheless, because the AI revolution has matured and analysts have a greater grip on demand for chips, these surprises have understandably fallen into the only digits.

After all, that’s nonetheless spectacular, and it means Nvidia has overwhelmed estimates on each the highest and backside strains each single quarter because the begin of 2023. And over the interval, it has added a mind-boggling $2.8trn in market capitalisation!

For This fall 25, Wall Road expects income of $38bn and EPS of $0.84. That may characterize distinctive respective progress of 72% and 64%.

These are the headline figures that traders ought to look out for. Although the factor that may most likely determine the route of the share price afterwards is ahead steerage for Q1 26. Buyers will wish to know that AI chip demand goes to stay sturdy this yr.

Proper now, analysts are forecasting income of $41.7bn and EPS of $0.91 for the present quarter (Q1). If the corporate revises this upwards, the inventory may bounce larger, and vice versa.

Worth goal

Dealer share price targets ought to at all times be taken with a pinch of salt, particularly in terms of a unstable inventory like Nvidia. Having stated that, they’ll present worthwhile perception into potential market disparities.

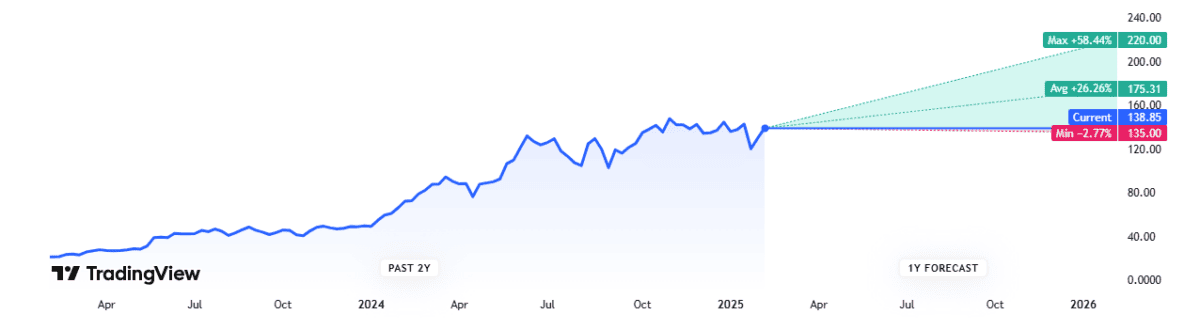

So, what’s the newest on this entrance for Nvidia? Primarily based on 52 analysts masking the inventory, the common 12-month price goal is $175. That’s round 26% larger than the present share price of $138.

Valuation

Lastly, we have now the valuation. Primarily based on present FY26 estimates, the inventory is buying and selling at roughly 31 occasions ahead earnings. That doesn’t look too demanding to me, given the corporate’s speedy progress.

Combining this with the $175 price goal, a convincing case may very well be made that this can be a progress inventory to contemplate shopping for.

What may go improper?

Nonetheless, as Stanford laptop scientist Roy Amara as soon as stated: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

In different phrases, transformative new applied sciences have not often averted early speculative bubbles all through historical past. The web was essentially the most well-known instance, although there have been others.

Furthermore, round 36% of Nvidia’s gross sales got here from simply three prospects within the final quarter. If these prospects reduce their AI infrastructure spending after preliminary build-outs, the chipmaker may expertise a direct slowdown in income progress.

Given this medium-term uncertainty, I’m not going to purchase the inventory at right now’s price.