Fast Take

Knowledge from The Block exhibits that as of Might 2024, hedge funds have taken a notable bearish stance on Bitcoin, holding the most important web quick positions in CME Micro Bitcoin Futures because the finish of 2021. These micro contracts, every representing 0.1 BTC, cater to merchants searching for exact publicity with decrease capital necessities than normal CME Bitcoin Futures, representing 5 BTC per contract.

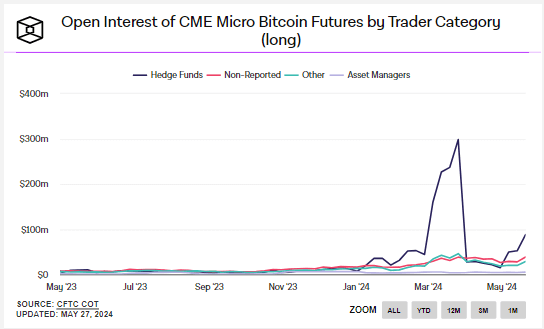

The chart from The Block signifies that hedge funds have markedly elevated their quick positions in micro contracts, reflecting a cautious or bearish outlook regardless of Bitcoin’s robust year-to-date price efficiency, which noticed it rise from $40,000 to over $68,000. Hedge funds have been additionally at comparable quick ranges throughout Bitcoin’s all-time excessive in March. In distinction, different dealer classes, like asset managers and non-reported merchants, preserve comparatively secure positions.

The elevated hedge fund shorting in micro futures suggests they’re hedging in opposition to potential draw back dangers, even because the spot market exhibits bullish sentiment.

If we take a look at the inverse, hedge funds’ lengthy positions in CME Micro Bitcoin Futures stay comparatively muted in comparison with the degrees throughout Bitcoin’s all-time excessive in March, in keeping with knowledge from The Block.

Knowledge from Coinglass exhibits that the combination whole open curiosity in CME Bitcoin futures is roughly $11 billion, encompassing each micro and normal contracts. CME is the main trade for Bitcoin futures buying and selling.