Bitcoin is difficult the age-old attract of gold. As these two titans of worth vie for dominance, the way forward for mining each belongings stands at a crossroads.

Gold, with its lengthy historical past, symbolizes conventional wealth. Bitcoin, then again, represents the forefront of digital innovation.

Gold vs Bitcoin: Which Is Higher Now?

Gold mining has stood the take a look at of time. For hundreds of years, it has been an emblem of wealth and stability. The method of extracting gold from the earth is labor-intensive and environmentally taxing. But, it stays a cornerstone of the worldwide financial system.

Gold’s tangible nature and historic significance make it a dependable retailer of worth, particularly throughout financial uncertainty.

In stark distinction, Bitcoin mining represents the reducing fringe of digital innovation. It entails fixing mathematical issues to validate transactions on the blockchain, a decentralized ledger. This course of, generally known as Proof-of-Work (PoW), requires important computational energy and, consequently, giant quantities of power.

Rob Chang, CEO of Gryphon Digital Mining, instructed BeInCrypto about Bitcoin miners’ strategic method. He emphasised that Bitcoin mining can stabilize native grids and help renewable power initiatives, providing a singular profit that conventional gold mining lacks.

“Miners seek low-cost power, usually in areas with low demand or where there might not even be enough demand to support a stable grid. The presence of a Bitcoin miner who uses consistent amounts of power is beneficial for regions where the local area may not have the demand to justify a stable grid,” Chang stated.

Each gold and Bitcoin mining have important environmental footprints. Gold mining usually results in deforestation, water air pollution, and habitat destruction. Efforts to mitigate these results embrace stricter rules and the event of extra sustainable practices.

Nevertheless, the inherent bodily nature of gold extraction poses ongoing environmental challenges.

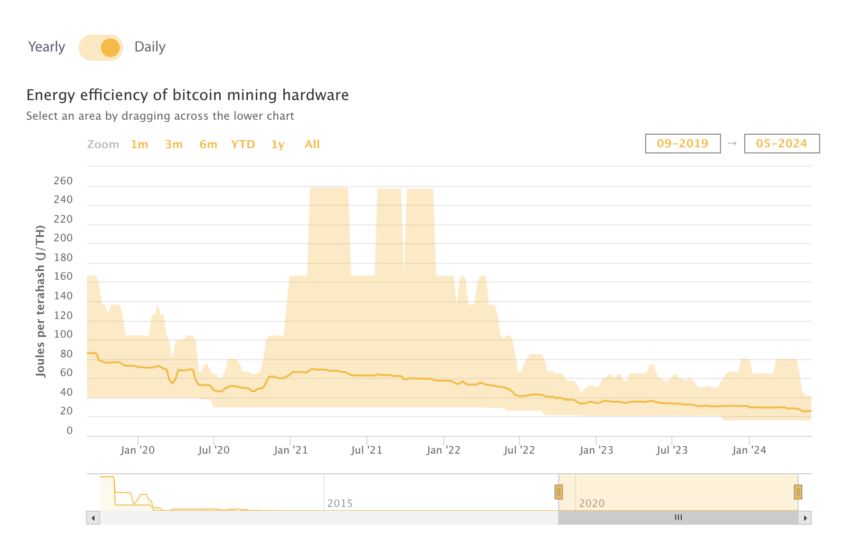

Bitcoin mining, then again, is criticized for its excessive power consumption. Though Bitcoin’s carbon footprint has drawn scrutiny, the trade more and more turns to renewable power sources.

Chang famous that Bitcoin mining’s aggressive nature drives effectivity and innovation, which might result in extra sustainable practices over time.

“Bitcoin mining difficulty is an inevitable outcome of Bitcoin’s success and is something miners should expect and in fact embrace since it would only occur if Bitcoin continues to succeed. It incentivizes miners to be as efficient as possible and to innovate to stay as low cost as possible,” Chang added.

Learn extra: Free Cloud Mining Suppliers to Mine Bitcoin in 2024

Aggressive Mining Market for Each Belongings

The financial viability of mining operations is essential for each industries. Gold’s worth is influenced by geopolitical stability, forex fluctuations, and market demand. Regardless of its stability, the profitability of gold mining could be affected by fluctuating ore grades and rising manufacturing prices.

Bitcoin’s market dynamics are much more unstable. Its worth is topic to market sentiment, regulatory modifications, and technological developments.

Chang defined that power costs are probably the most essential value variable for Bitcoin miners. Environment friendly power administration could make or break a mining operation.

“The best measure of this is the Bitcoin efficiency ratio, which measures the amount of Bitcoin generated per deployed exahash. A good way to think about this is Bitcoin is to oil as hashrate is to oil derricks. The more exahashes or oil derricks a company has, the more Bitcoin or oil they should generate,” Chang instructed BeInCrypto.

Learn extra: Prime International locations The place You Can Mine Bitcoin Legally

Furthermore, {hardware} competitors on the ASIC miner degree is welcome and good for the trade. Traditionally, just a few dominant gamers managed the mining machine market, squeezing profitability by repricing gear primarily based on real-time Bitcoin costs. This has made it troublesome for miners to compete, as most are compelled to supply giant upfront funds to acquire machines.

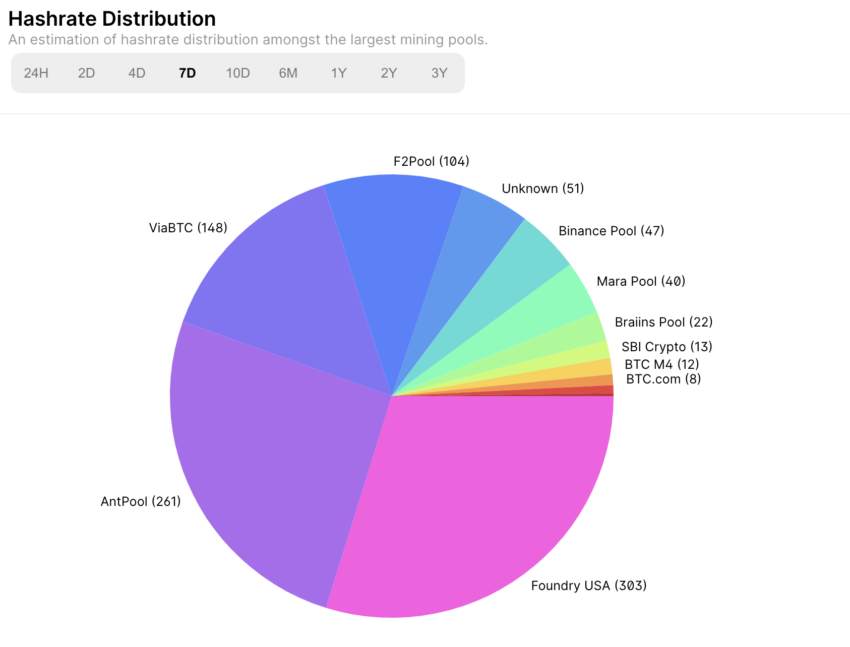

The centralization of mining energy is a possible concern for the Bitcoin community. Whereas not a difficulty at the moment, vigilance is critical to forestall dangerous actors from gaining management over the worldwide hashrate. Decentralization is essential to making sure a safe blockchain.

Laws additionally play a vital function in the way forward for mining. Poor political environments can kill off mining operations altogether. Chang identified that the majority legal guidelines impacting Bitcoin mining relate to its power use.

If a miner is carbon impartial, they’ll keep away from rules concentrating on carbon-emitting operations.

Learn extra: 5 Greatest Platforms To Purchase Bitcoin Mining Shares Forward of 2024 Halving

Wanting forward, gold will stay a secure haven asset, however its environmental impression could drive stricter rules and push for greener mining applied sciences. With its potential for supporting renewable power and stabilizing grids, Bitcoin could pave the way in which for a extra sustainable future in digital asset mining.

Disclaimer

Following the Belief Mission pointers, this characteristic article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm info independently and seek the advice of with an expert earlier than making selections primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.