Picture supply: Getty Photographs

In some methods, it feels illogical to match the FTSE 100 to the S&P 500. The elements that have an effect on markets regionally and overseas differ significantly. Whereas the US is saturated with fast-moving tech hatchlings, the UK is weighed down by centuries-old monetary dinosaurs.

Investor habits differ too. The British exhibit a bent in direction of slow-and-steady earnings investing, whereas the US is known for its high-growth shares. That is mirrored within the common dividend yield — 3.5% right here vs 1.3% throughout the pond.

However there are some areas the place the 2 markets overlap. In actual fact, nearly 75% of firms listed on the Footise truly obtain their income in {dollars} however report income in sterling. Presumably, they’ve discovered this manner of working most helpful.

So what shares get the very best of each worlds? I feel I’ve discovered one.

3i Group

3i Group (LSE: III) is a London-based non-public fairness and enterprise capital firm on the FTSE 100. Most of its holdings are in non-public fairness equivalent to European non-food retailer Motion and US journey expertise firm Arrivia. It additionally has its personal infrastructure arm specializing in transport, logistics and utilities firms in Europe and America.

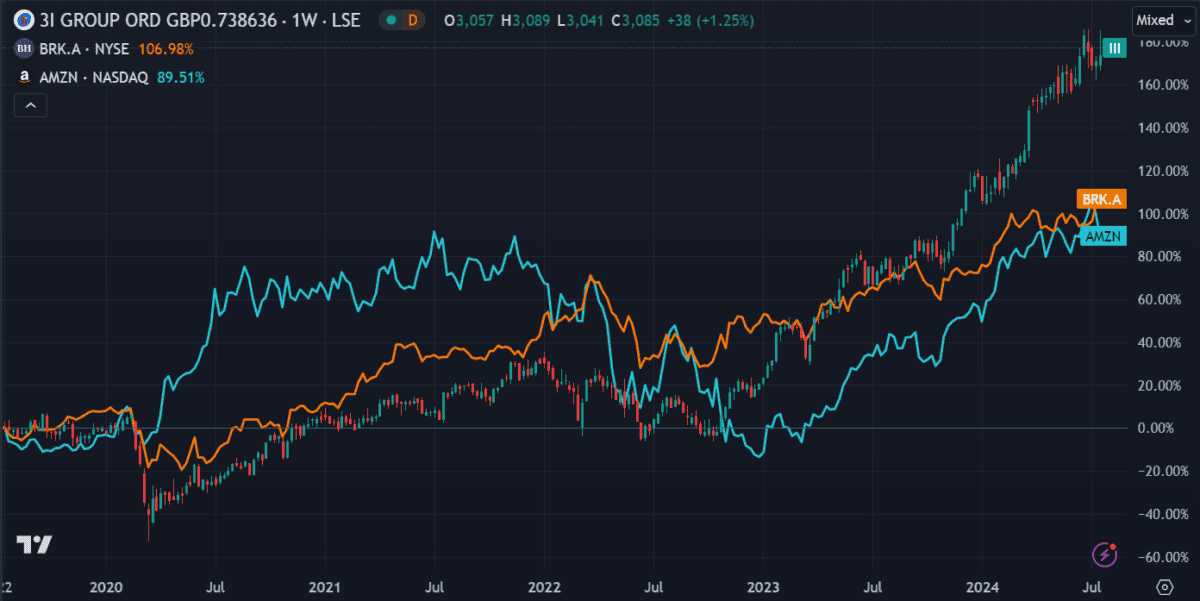

Except for Motion, a lot of its holdings don’t seem like well-known firms. Nonetheless, its efficiency speaks for itself. The price is up 56% prior to now 12 months and 177% over 5 years. That’s greater than double the S&P 500 and 20 occasions the FTSE 100. It’s additionally outperformed some main US shares like Berkshire Hathaway and Amazon.

As such, it acts extra like a US progress share than most UK listings. It additionally advantages from investments which can be diversified throughout a number of areas.

Valuation

Utilizing a reduced money move mannequin, analysts estimate the shares to be undervalued by greater than 60%. And with earnings growing quicker than the share price, its price-to-earnings progress (PEG) ratio’s solely 0.7. So it seems undervalued.

Nonetheless, with funds like 3i, the price might not precisely mirror the underlying worth of the belongings. This will make the valuation much less dependable than regular shares so it’s essential to additionally consider the fund’s holdings.

Dangers

Non-public fairness is inherently much less clear and liquid than publicly traded shares. This will make it tougher to worth and requires extra belief within the fund managers.

Since 3i Group has an 80% stake in Motion, any points with the retailer may harm its share price. This additionally will increase its publicity to dangers within the European retail sector.

So whereas it has a promising monitor file, there’s no assure this can proceed. Relying on their funding technique and danger urge for food, some buyers might desire deciding on particular person shares they will assess themselves.

A protracted-term consideration

There’s quite a lot of nice worth in each the S&P 500 and the FTSE 100. Each provide distinctive worth propositions that attraction to totally different buyers.

3i Group is only one instance of a FTSE inventory that displays US-style progress mixed with the steadiness typical of European shares. It’s the type of inventory I’d really feel blissful to put money into for the long run, so I plan to purchase the shares subsequent month.