- Ethereum’s trade reserve declined sharply on the thirtieth of Could.

- Metrics recommended that ETH was in an overbought place.

Ethereum [ETH] lovers bought excited final week because the king of altcoins’ price as soon as once more exceeded $3.9k. Nonetheless, ETH couldn’t maintain its momentum and shortly fell from that stage. Within the meantime, whales took the chance to stockpile extra ETH.

Curiosity in Ethereum is rising

ETH had a rollercoaster experience final week because it managed to go above $3.9k on the twenty seventh of Could. However bears arrived quickly as its worth dropped.

It was attention-grabbing to notice that the ETH ETF approval couldn’t propel substantial progress for the coin during the last week.

In keeping with CoinMarketCap, ETH was down by over 1% within the final seven days. On the time of writing, the token was buying and selling at $3,759.66 with a market capitalization of over $451 billion.

Whereas the token’s price volatility remained excessive, whales made their transfer.

Ali, a well-liked crypto analyst, just lately posted a tweet highlighting that there’s been a notable improve in Ethereum addresses holding greater than 10,000 ETH.

This improve within the variety of addresses recommended that whales had been transferring from a distribution section to an accumulation section.

AMBCrypto’s take a look at Glassnode’s information identified yet one more metric that recommended an increase in accumulation. Ethereum’s stability on exchanges witnessed a serious decline on the thirtieth of Could, indicating excessive shopping for strain.

Supply: Glassnode

The flip facet of the story

Although the aforementioned information recommended that traders had been shopping for ETH, AMBCrypto’s take a look at CryptoQuant’s information revealed a distinct story.

As per our analysis, Ethereum’s web deposit on exchanges was excessive in comparison with the final seven-day common, hinting at an increase in promoting strain.

On high of that, ETH’s Coinbase Premium was purple. This clearly meant that promoting sentiment was dominant amongst US traders.

A doable purpose behind this could possibly be ETH being overbought. Each ETH’s Relative Energy Index (RSI) and stochastic had been in overbought positions.

Supply: CryptoQuant

AMBCrypto then analyzed Ethereum’s each day chart to see how this alteration in shopping for and promoting strain may affect its price within the coming days.

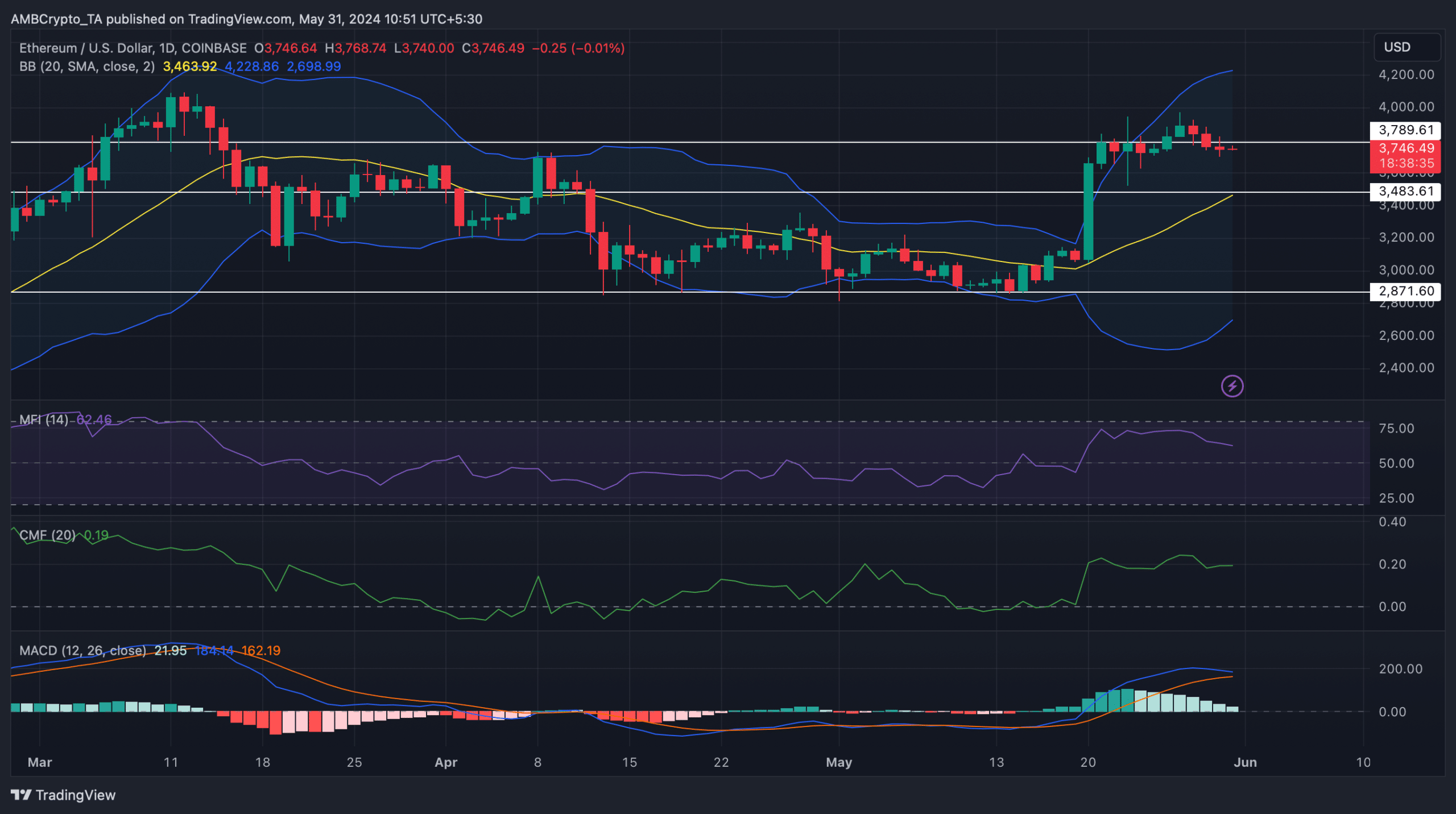

The technical indicator MACD displayed the potential for a bearish crossover. The Cash Circulation Index (MFI) registered a slight downtick.

As per Bollinger Bands, ETH’s price was in a extremely unstable zone and was nonetheless resting nicely above its 20-day Easy Transferring Common (SMA).

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

Due to this fact, if the price decline continues, then ETH may first plummet to its 20-day SMA earlier than rebounding.

Nonetheless, the Chaikin Cash Circulation (CMF) regarded bullish because it went northward. This may enable ETH to interrupt above its resistance at $3.789k prior to anticipated.

Supply: TradingView