ozgurdonmaz

Again in March, I coated the Ethereum (ETH-USD) blockchain for Looking for Alpha. Contemporary off a Wall Avenue Breakfast survey of Looking for Alpha readers indicating crypto will not be an investable asset class, I argued that networks like Ethereum, whereas definitely dangerous, ought to be considered as infrastructure enhancements to how cash is transacted over the web:

Let’s as a substitute consider the distributed ledger know-how the place every of those property dwell extra via the attitude of banking reasonably than the greenback itself. Over the past couple of many years we’ve seen the web disrupt quite a few types of medium that beforehand utilized bodily supplies. Letters are actually emails. Bodily newspapers are actually on-line. Each terrestrial radio and linear tv are being changed by streaming.

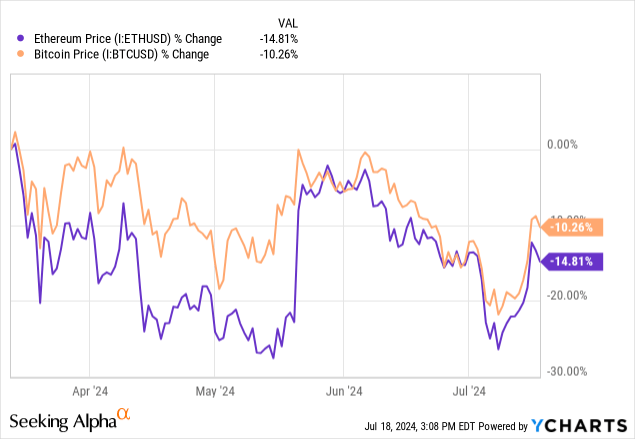

With the backdrop of the community’s Dencun improve high of thoughts, I made the argument that enhancements to Ethereum’s scalability was in the end bullish for the native asset of the ETH ecosystem, since it’s usually required to facilitate transactions. Since publishing, Ethereum has not solely declined, however is trailing Bitcoin (BTC-USD) as properly:

On this replace, I would wish to go over what we’re seeing out there within the 4 months since my Dencun piece and why Ethereum could have some hurdles that should be addressed going ahead.

TPS and Fund Flows

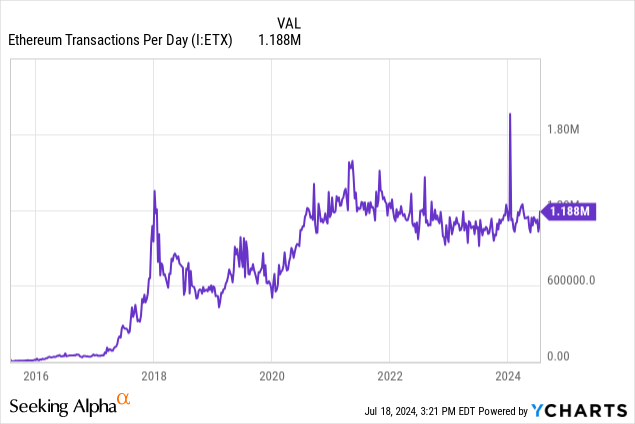

It could be stunning for some to see, however the fact is day by day transactions on Ethereum have been in decline for the reason that second half of 2021. On the floor, this appears to be like dangerous. However the actuality is Ethereum tackle scaling is certainly taking place on layer 2 networks like Arbitrum (ARB-USD), Optimism (OP-USD), and Base. The latter of which makes use of a sequencer operated by Coinbase (COIN).

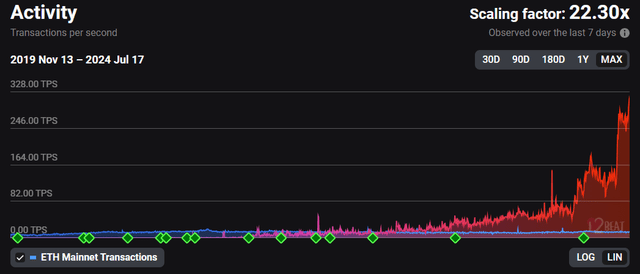

Scaling Exercise (L2Beat)

As of July seventeenth, Ethereum’s mainnet transactions per second determine, or TPS, got here in at little above 13. The aggregated layer 2 chains collectively added 306 TPS for a scaling issue of twenty-two.3x. For the broader Ethereum ecosystem, that is nice for utility. Nonetheless, for ETH holders it hasn’t confirmed to ship the next price for ETH, the asset.

The argument may definitely be made that ETH ran up too shortly between February and March with Bitcoin’s spot ETF approvals lifting all boats, however capital flows into the asset class appear to inform a distinct story:

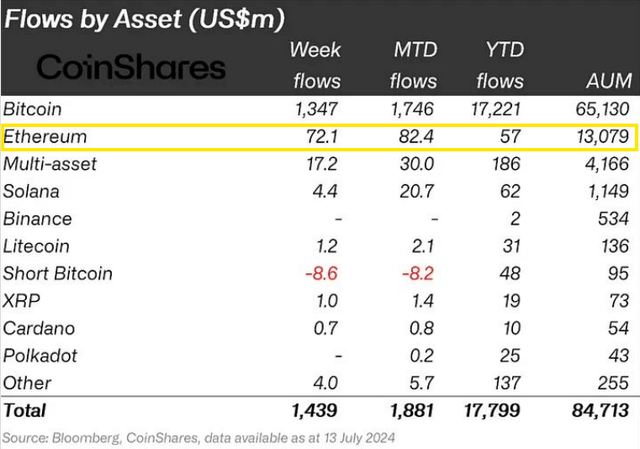

Crypto Funding Flows (CoinShares)

Funding flows into ETH have solely lately gone optimistic yr to this point and truly lag good contract peer Solana (SOL-USD). With out funding capital flowing into Ethereum merchandise, ETH’s major demand drivers are both transaction charge fee or asset staking for yield.

Staked ETH vs Community Reward Price (StakingRewards)

There are 33.1 ETH in stake as of article submission. That is up a whopping 52% over the past yr. Whereas it is clearly true that extra ETH has been staked over the past twelve months, the reward fee has come down dramatically with the elevated stake. At a 3.5% reward fee from staking ETH at present, buyers are literally higher off in T-bills if the price of ETH stays flat. This brings us to charges.

The Payment Paradox

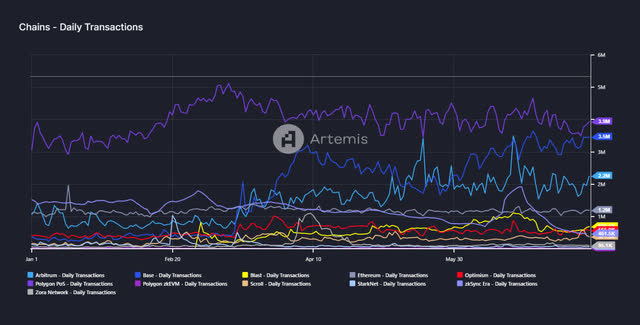

Each day Transactions (Artemis)

One of many main promoting factors of the Dencun improve is that it reduces charges for L2 scaling chains. That has certainly been the case, and we have seen the surge in exercise on L2s as proof optimistic that charge discount will increase utilization. Optimism, Base and Arbitrum have been massive beneficiaries right here, with these three chains producing a mixed 169.6 million transactions in June – up 270% from 45.9 million transactions in February. However the excellent news can also be dangerous information:

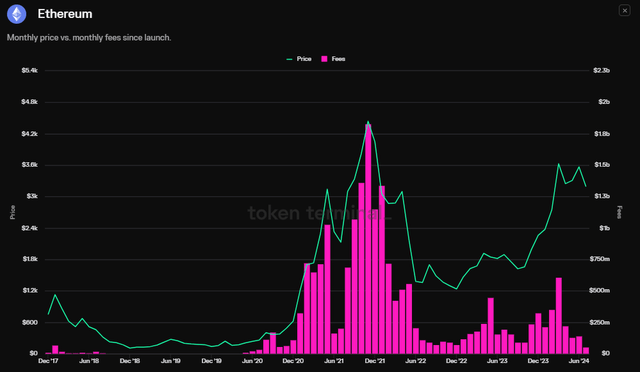

Month-to-month Charges (Token Terminal)

Once more, if we view public blockchain networks as web fee infrastructure, then Ethereum’s Dencun improve has arguably damage the bull money for ETH as an asset within the quick to medium time period. Following Dencun, mainnet charges have primarily collapsed from $606.8 million in March to $142.4 million in June. With out L2 scaling chains paying mainnet to the diploma that they had been earlier than Dencun, ETH has flipped again to inflationary since March:

ETH Inflation vs Worth (StakingRewards)

Pre-Dencun, there had been a correlation between ETH’s inflation fee and the price of ETH. As a deflationary asset, provide destruction created asset price will increase. We will consider this just like how buybacks have aided in pushing inventory costs greater. Long term, that is much less of a priority, offered scaling via L2s (and even L3s) continues going ahead. And there may be nothing at this time limit that will point out that progress will not proceed. Like mainnet, L2s usually require ETH for transaction charges as properly, they’re simply far cheaper per transaction.

Key Threat: Fragmentation

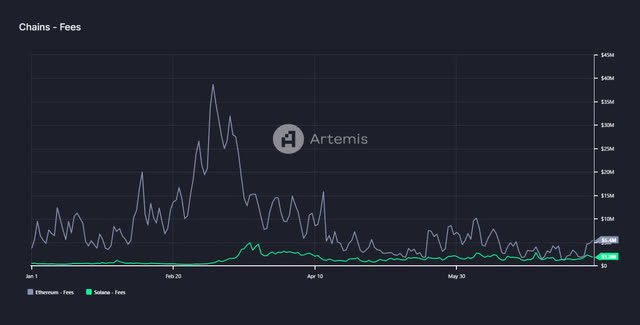

Past mainnet charge discount, I see community fragmentation as one of many largest dangers at present dealing with the Ethereum ecosystem right now. Interoperability wants enchancment. It is easy to bridge from an L2 to Ethereum and again. What’s much less easy is shifting liquidity between the L2s. This isn’t an issue that competing L1 chain Solana has in the mean time, and we have seen the utilization of that chain start to problem Ethereum in latest weeks based mostly on day by day charges:

Each day Charges (Artemis)

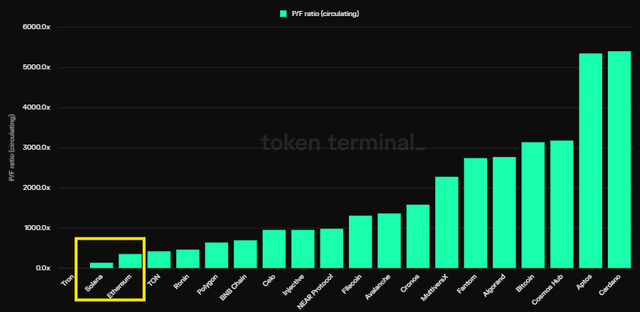

This phenomenon has truly created a state of affairs the place Solana trades a decrease price-to-fee a number of than Ethereum:

P/F Comparability, July seventeenth (Token Terminal)

As I’ve stated quite a few occasions via my Looking for Alpha work, there aren’t but well-defined valuation multiples that may assist buyers decide what is relatively low-cost or costly. For good contract networks, I like price to charges personally, however others could have a distinct view.

Closing Ideas

I am nonetheless lengthy Ethereum and consider that spot ETFs within the US will carry extra funding capital into the asset class. In my opinion, there have been noticeable adjustments in how the U.S. regulatory equipment is treating the business. We have lately seen the Securities and Alternate fee drop its investigation into stablecoin issuer Paxos World over Binance USD (BUSD-USD) after issuing a Wells Discover final yr.

Moreover, former President Donald Trump, who has launched NFTs on Polygon (MATIC-USD), is anticipated to talk at Nashville’s Bitcoin convention in late July. For long-term crypto buyers, Ethereum continues to be a should. Regardless of the price of ETH lagging vital enhancements within the usability of the EVM ecosystem, future progress in on-chain exercise ought to propel ETH greater, as it’s nonetheless the fuel that retains the engine going.

Editor’s Notice: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.