Ethereum price is up 4 consecutive days, reaching its highest level since July third.

ETH has rallied by 20% from its lowest level this month, getting into a technical bull market. Ether token was pushed by three key catalysts. First, there may be optimism that Donald Trump is the extra crypto-friendly candidate and can win the U.S. election in November, particularly if Joe Biden doesn’t bow out from the race.

These odds began rising after the primary debate two weeks in the past and accelerated after the previous survived an assasisnation try over the weekend. Since then, many high-profile people like Elon Musk and Invoice Ackman have formally endorsed the previous president.

Trump is seen favorably within the crypto neighborhood as a consequence of his assist for the business. He has offered NFTs as an ex-president, disavowed Central Financial institution Digital Currencies (CBDCs), and vowed to guard non-custodial wallets.

The second catalyst is the growing chance that the Securities and Change Fee (SEC) will approve a number of spot ETFs. Firms like VanEck, Blackrock, and Invesco have already submitted their ultimate filings, main analysts to anticipate approval as quickly as this week.

Ethereum’s ETF approval is signficant as a result of it’s the second-biggest crypto within the business. Nonetheless, as I wrote final week, buyers should pay a payment and in addition forego staking rewards that Ether holders earn.

Third, Ether is rising as the quantity of the token in exchanges drops. The provision dropped to a document low of 16.76 million, down from over 32.5 million in July 2016. Which means Ethereum is getting rarer because the ETF approval nears.

ETH balances in exchanges

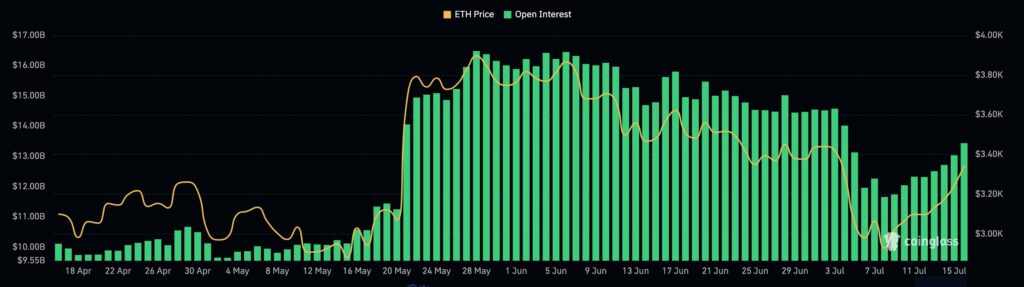

Moreover, ETH price jumped as futures open curiosity continued rising. Knowledge by CoinGlass confirmed that the open curiosity rose to over $13.4 billion on Monday, greater than this month’s low of $11.66 billion. Most of this curiosity was from Binance, Bybit, and Bitget.

ETH open curiosity

Ethereum price discovered robust assist

ETH’s rebound occurred after the coin discovered a robust assist at round $2,850 this month. This was an essential degree because it was the bottom level on April thirteenth, Might 1st, and Might 14th of this yr. It was additionally a notable degree because it was barely above the 50% Fibonacci Retracement level.

Due to this fact, with the token additionally flipping the 200-day Exponential Shifting Common (EMA), merchants anticipate that the rally can go on. Additionally, the buildup and distribution indicator has continued rising, signaling that buyers are shopping for the dip. The subsequent key reference degree to observe would be the psychological level at $3,500.