- 800,000 ETH (value $3 billion) had been withdrawn from exchanges post-ETF approval.

- Massive buyers and establishments could also be positioning for a bullish future.

Ethereum’s [ETH] market efficiency has proven exceptional resilience within the face of current fluctuations, sustaining a secure price degree beneath the $4,000 mark regardless of slight volatility.

Over the previous week, Ethereum’s worth oscillated between $3,800 and $3,700, closing just lately at roughly $3,768.

This comparatively regular state, characterised by a modest 2.1% decline over the week and a 1.1% dip within the final 24 hours, might sound uneventful at first look.

Nonetheless, this could possibly be indicative of a extra profound dynamic at play throughout the crypto market.

The current calm in Ethereum’s price coincides with vital developments within the regulatory panorama and market construction, significantly with the U.S. Securities and Alternate Fee’s (SEC) approval of the Ethereum Spot Alternate-Traded Fund (ETF).

This regulatory milestone has set off a notable response within the crypto exchanges, resulting in a considerable shift in Ethereum holdings.

Whale actions and market influence

Put up-ETF approval, Ethereum noticed a dramatic enhance in exercise, with round 800,000 ETH, valued at practically $3 billion, being withdrawn from exchanges inside simply eight days.

This mass exodus of Ethereum from exchanges mirrors the same sample noticed beforehand with Bitcoin following its ETF approvals, suggesting a strategic positioning by buyers in anticipation of heightened demand.

These withdrawals had been highlighted by Cryptoquant’s analysis, which pointed to a attainable orchestrated transfer by institutional gamers making ready to cater to their purchasers’ wants within the wake of the ETF launch.

Supply: Cryptoquant

The implications of such vital market actions are fairly profound.

Crypto analyst Burak Kesmeci, reporting on the CryptoQuant QuickTake platform, speculated that both large-scale buyers (“whales”) or establishments is perhaps gearing up for a bullish future for Ethereum post-ETF.

The huge outflow, in response to Kesmeci, is prone to positively influence Ethereum’s price within the medium time period, as these massive holdings cut back accessible market provide, doubtlessly resulting in price will increase as demand continues to rise.

Investor urge for food for ETH grows, however what do fundamentals say?

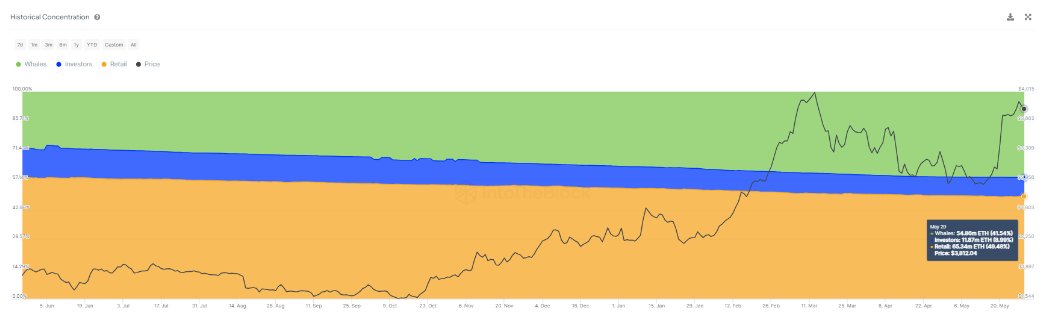

Supporting this analysis, knowledge from IntoTheBlock revealed a rising focus of Ethereum holdings amongst massive buyers.

As of thirty first Could, 2024, 41% of Ethereum wallets held greater than 1% of whole circulation, a big enhance from earlier within the 12 months. This focus suggests a rising confidence amongst vital stakeholders in Ethereum’s long-term worth.

Supply: IntoTheBlock

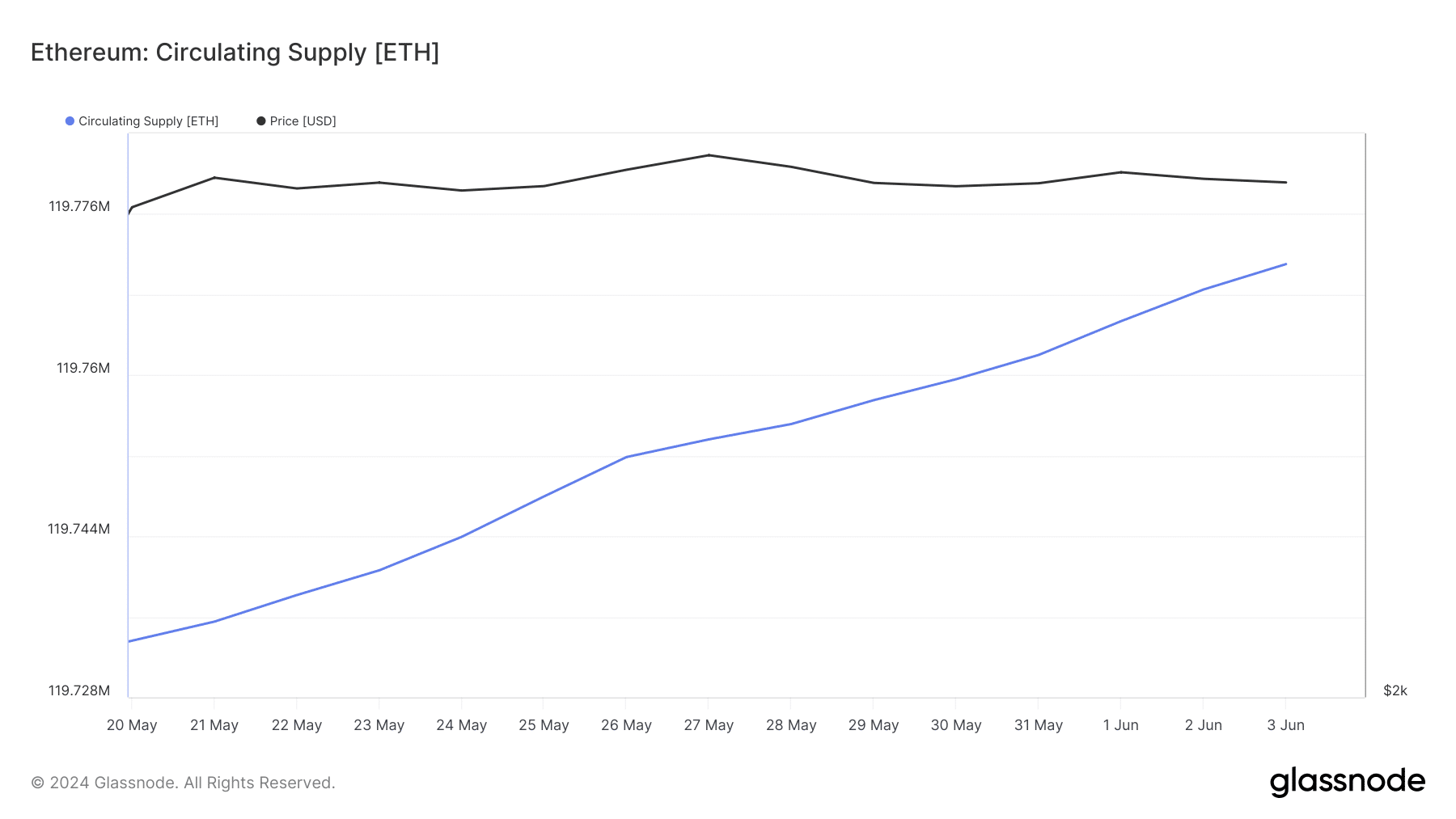

Nonetheless, it’s important to contemplate the broader market dynamics. Regardless of the potential for a provide squeeze, the general circulating provide of Ethereum has continued to rise, indicating that not all massive holders are in accumulation mode.

Supply: Glassnode

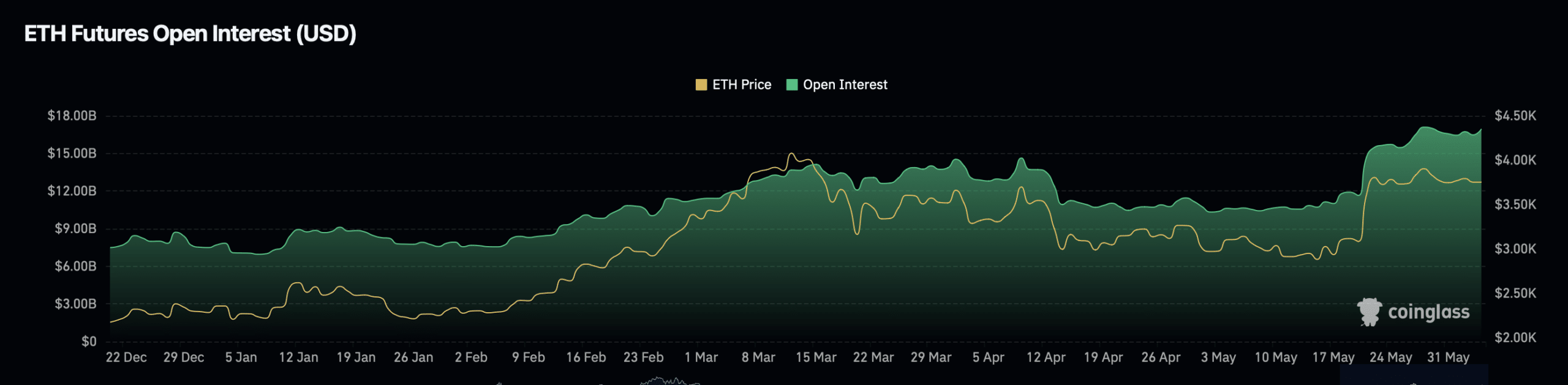

Moreover, buying and selling metrics akin to open curiosity and buying and selling quantity on futures markets have proven substantial will increase, suggesting a strong and energetic buying and selling setting that would affect Ethereum’s price trajectory.

Supply: Coinglass

Up to now 24 hours, Ethereum’s open curiosity has seen a big uptick, rising by practically 3% to a valuation of $17 billion. This surge has additionally boosted open curiosity quantity, which has elevated by roughly 15% to $21.40 billion.

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

In the meantime, an analysis of Santiment’s knowledge by AMBCrypto reveals that holders of 0.01-10 ETH have diminished their general ETH holdings, whereas addresses with greater than 10 ETH have additionally offered off a portion of their belongings.

This profit-taking conduct, noticed amongst each retail buyers and whales, has not been intense sufficient to negatively influence costs.