Readers will discover immediately’s analysis of Ethereum (ETH) fascinating. On June 11, about 542,000 ETH moved out of exchanges— the biggest outflow of the 12 months.

Nevertheless, the development didn’t take lengthy to alter, prompting hypothesis that the potential enhance to $4,000 could also be delayed.

Ethereum Opens the Flooring for Bears

In accordance with knowledge from CryptoQuant, the variety of ETH withdrawn from exchanges has decreased. For example, the determine recorded on June 12 fell by virtually half from what it was the day earlier than.

As of this writing, BeInCrypto observes that 70,839 ETH has flown out of high exchanges. In easy phrases, change outflow is the entire quantity of cash retired from exchanges into chilly wallets or self-custody.

By holding extra cryptocurrencies off-ramp, property might face reducing promoting stress. Nevertheless, for Ethereum, that might not be the case. A low change outflow might result in consolidation.

Learn extra: Learn how to Purchase Ethereum (ETH) and All the things You Must Know

Additionally, if change influx will increase, costs might lower considerably. For context, change influx measures the variety of cash despatched into exchanges. When this determine will increase, it places promoting stress on the price. Then again, a lower in change influx reduces the probabilities of a serious nosedive.

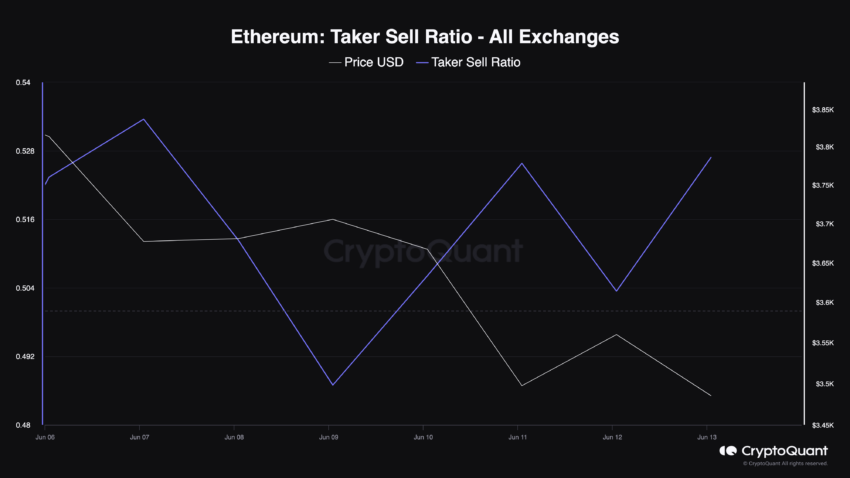

Ethereum’s price trades at $3,494, down from an earlier peak of $3,881 final week. Just like the metric above, the Taker Promote Ratio paints a bearish image. By definition, the Taker Promote Ratio is calculated because the variety of promote orders divided by the entire perpetual swaps out there. If the worth is over 0.50, it implies that sellers are dominant.

Nevertheless, a studying decrease than 0.50 exhibits that promoting sentiment is under the doable peak. For ETH, the Taker Promote Ratio was 0.52, indicating a excessive presence of bears out there.

Will ETH Value Mirror Bitcoin’s Response?

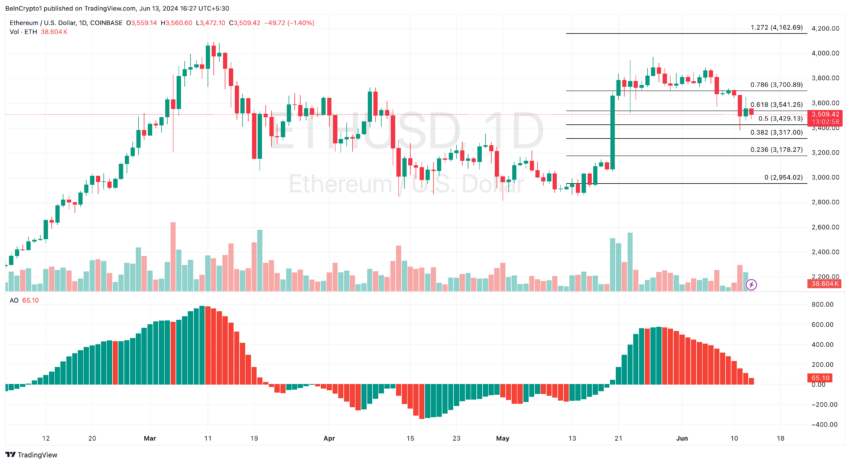

Additional, a take a look at the ETH/USD Every day chart exhibits a double-top formation with the ceiling at $3,885. In buying and selling, a double high is a bearish reversal sample. It occurs when a cryptocurrency hits a excessive worth two consecutive instances whereas registering slight declines between the 2 highs.

In accordance with the chart under, the bearish construction broke the assist degree at $3,665. If this development continues and bulls don’t seem, ETH might fall to $3,317, which was the subsequent main assist.

As well as, the Superior Oscillator (AO) studying has dropped to 65.10. This comes with crimson histogram bars. The AO is a technical instrument that compares latest market actions to historic tendencies to find out momentum.

On the each day chart, the indicator’s reducing studying means that ETH is sliding towards a downward momentum. Ought to this development proceed or the studying turns into unfavourable, the price of Ethereum might drop to $3,317.

Curiously, that is the place the 0.382 Fibonacci Retracement Indicator was positioned. The Fibonacci Retracement Indicator identifies potential reversal price ranges. Therefore, $3,317 is one spot to observe.

Learn extra: Learn how to Spend money on Ethereum ETFs

Nevertheless, this prediction could also be invalidated if the lately authorized Ethereum spot ETFs begin buying and selling reside. Regardless of the inexperienced gentle from the U.S. Securities and Change Fee (SEC), a number of the candidates haven’t fulfilled all the necessities.

Nevertheless, as soon as a excessive buying and selling quantity begins getting into the ETFs, ETH might mirror Bitcoin’s (BTC) response to an analogous growth within the first quarter of 2024. If this occurs, ETH’s price might bounce, and the primary vital goal possibly $4,162.

Disclaimer

In step with the Belief Challenge pointers, this price analysis article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal research and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.