Oleksandr Shatyrov

Ether (ETH-USD) has carried out comparatively poorly in the course of the present cycle. Whereas there are legitimate questions round Ethereum’s performance and adoption in real-world use instances, I feel that a few of Ether’s struggles are merely the results of tighter financial coverage. Declining inflation may result in decrease rates of interest later in 2024 although, which can help Ether’s price. Inflows into Ethereum ETFs may additionally present a lift, though I imagine that the fragmentation of demand throughout competing chains will stay a headwind within the close to time period.

Provide

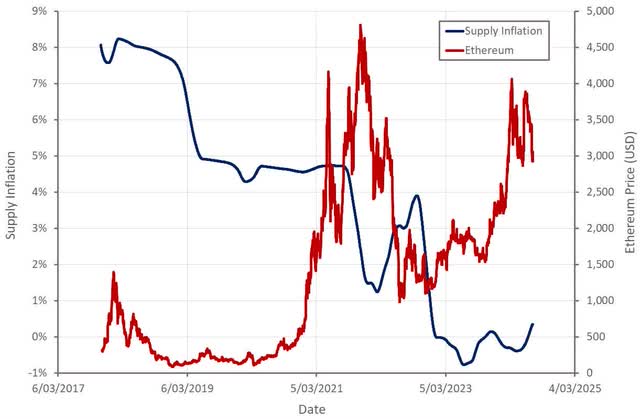

Ethereum turned modestly deflationary in 2022 with the change to proof of stake. This transfer was extensively anticipated to drive Ether’s price increased, though I are inclined to assume the significance of provide adjustments is usually overstated, significantly when considered in isolation.

Ethereum is now returning to an inflationary provide to assist try to cut back transaction charges, with the Dencun improve in March 2024. Inflation is modest, although, and I do not imagine this might be an vital determinant of Ether’s price going ahead.

Determine 1: Ethereum Provide Inflation (supply: Created by creator utilizing knowledge from Yahoo Finance and Etherscan)

Demand

The variety of Ethereum lively addresses means that demand has elevated together with price in current months, though this has been pretty modest. In contrast to 2020, price has led demand fairly than the opposite approach round, which I feel is considerably regarding.

Whereas DeFi and NTFs created hype in 2021, the same progress driver hasn’t actually emerged within the present cycle. That is an space the place scalability is hurting Ethereum. Low price and quick transactions have been driving DeFi and NFT adoption on Solana. Solana has additionally seen a surge in meme coin exercise.

Determine 2: Ethereum Lively Addresses (supply: Created by creator utilizing knowledge from Yahoo Finance and Etherscan)

AI

Synthetic intelligence and autonomous brokers could possibly be an rising tailwind for Ethereum. It’s because generative AI and brokers threaten to create a world the place:

- The vast majority of content material is created by AI

- Publicly accessible data is used to coach fashions with out attribution or compensation

- Web customers are unable to find out whether or not content material is actual or pretend

- The exercise of many brokers must be coordinated

Crypto can assist to alleviate a few of these points by:

- Transparently proving possession

- Offering a supply of id

- Offering financial incentives which coordinate the exercise of brokers and assist allocate assets

It’s too early to say how giant the impression of AI might be or how these kind of points might be managed, although. For instance, possession, id and exercise coordination is also offered by a centralized service.

Ethereum ETF

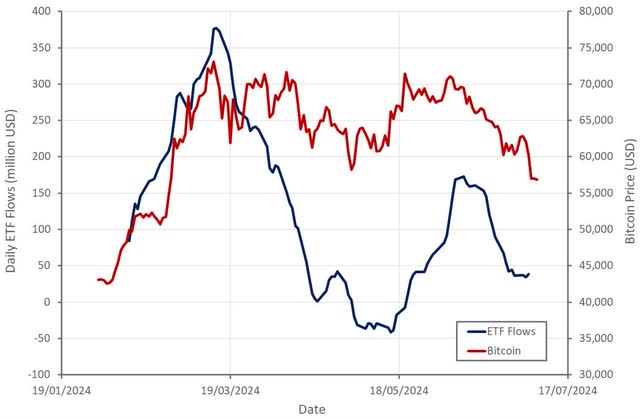

Ethereum’s current ETF approval could possibly be thought-about a tailwind based mostly on Bitcoin’s expertise. The launch of Bitcoin ETFs has most likely opened up demand considerably, with ETF flows an vital driver of price in the intervening time. ETF inflows have fallen off in current weeks, however Bitcoin’s price seems to have led this transfer.

Determine 3: Bitcoin ETF Flows (supply: Created by creator utilizing knowledge from Yahoo Finance)

Spot Ethereum ETFs are anticipated to start buying and selling within the coming days/weeks. Whereas there are prone to be inflows which might be supportive of Ether’s price, outflows from Grayscale’s Ethereum Belief may weigh on the price initially. The same dynamic occurred with Bitcoin, the place there was 6.5 billion USD of outflows from Grayscale within the first month. The truth that Ethereum ETFs won’t provide staking rewards to buyers might also restrict their attraction.

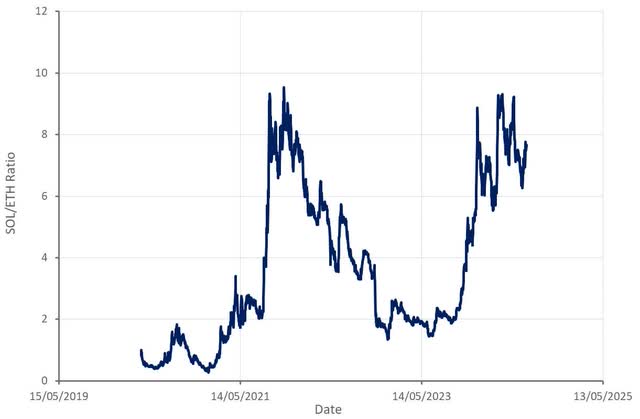

Relative Efficiency

Ethereum’s efficiency has been comparatively poor in current months/years compared to some cryptocurrencies, like Bitcoin and Solana. Whereas a few of this will doubtless be attributed to sentiment and monetary circumstances, Ethereum can also be going through competitors from inside its personal ecosystem in addition to competitors with different blockchains. That is much less about competitors from any explicit chain, as I do not assume there’s a actual competitor to Ethereum at this cut-off date. Slightly, Ethereum is competing towards many chains, a few of which have managed to craft compelling narratives at varied deadlines (Solana, Avalanche, Binance).

With the approval of Ethereum ETFs, it has been recommended that different cryptocurrencies may observe, particularly Solana. Solana continues to be liable to being labeled a safety although, and at present lacks a futures-based ETF within the US.

Determine 4: SOL/ETH Ratio (supply: Created by creator utilizing knowledge from Yahoo Finance)

Monetary Situations

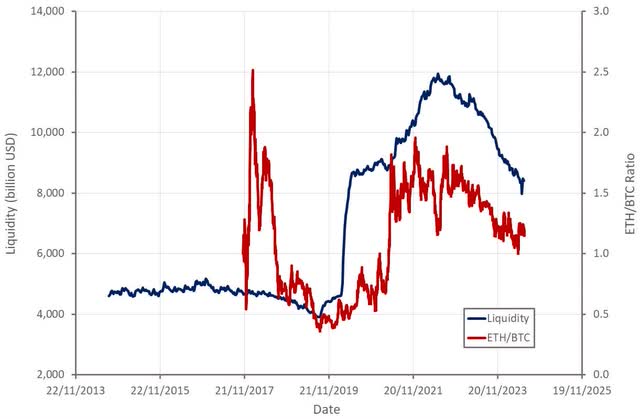

I feel that financial coverage could possibly be a part of the explanation for Ethereum’s comparatively poor efficiency within the present cycle. Rates of interest stay elevated, and the Federal Reserve continues to empty liquidity from the system. This has had a dramatic impression on some property and equities, though many property and equities stay unaffected. Ethereum’s underperformance relative to Bitcoin seems to have been correlated with the discount within the Federal Reserve’s steadiness sheet over the previous few years.

Determine 5: Central Financial institution Liquidity and Efficiency of Ethereum Relative to Bitcoin (supply: Created by creator utilizing knowledge from Yahoo Finance)

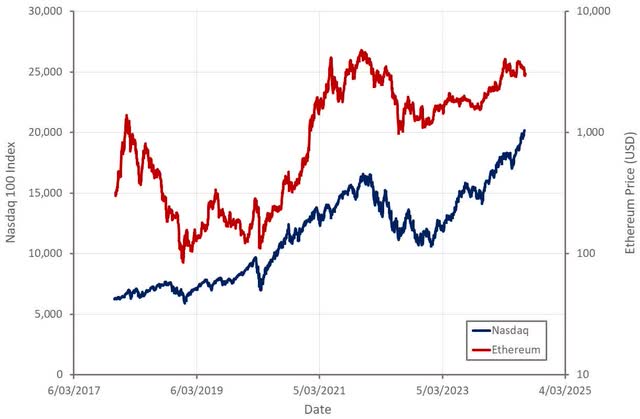

Ethereum is a risk-on asset and usually trades in keeping with different risk-on property, just like the Nasdaq index. The Nasdaq 100 index has considerably outperformed Ethereum in current months, although. I feel a few of this is because of rates of interest and quantitative tightening. AI has additionally been largely chargeable for the robust efficiency of huge cap tech shares.

Determine 6: Nasdaq 100 and Ethereum Efficiency (supply: Created by creator utilizing knowledge from Yahoo Finance)

Ethereum Fundamentals

Other than exterior forces, there additionally must be consideration of the truth that technical progress has been sluggish, and that real-world adoption continues to be restricted. Ethereum is prioritizing decentralization, and because of this, scalability stays an issue. Proposals for bettering throughput embody sharding and shifting transaction volumes to layer 2 networks. Sharding entails splitting up block producers so that every producer does not should course of each transaction.

Layer 2 networks, together with sidechains and rollups, sit on high of Ethereum and are designed to supply quicker and cheaper execution. They do that by bundling a bunch of transactions collectively and sending them to Ethereum as a single piece of information. Rollups execute transactions however don’t want a consensus to confirm them and are thought-about the best choice for execution. Optimistic Rollups assume all knowledge is legitimate and use fraud proofs to make sure transaction correctness, whereas zk-Rollups use zero-knowledge proofs for enhanced privateness and safety.

Slightly than making an attempt to implement sharding, Ethereum is now pursuing danksharding. In danksharding, bundles of layer 2 rollup transactions are processed collectively with out completely storing all their knowledge. The Dencun Improve was not too long ago carried out, introducing proto-danksharding. Proto-danksharding reduces the quantity of information completely saved on chain. Separate “data availability” layers may additionally assist with scalability by lowering the variety of occasions knowledge must be downloaded from the primary community.

Ethereum’s roadmap contains a variety of adjustments that promise to enhance efficiency, together with:

- Single-Slot Finality – blocks are proposed and finalized in the identical slot.

- Verkle Bushes – mix “Vector commitment” and “Merkle Trees”, enabling stateless shoppers. That is vital as stateless shoppers solely require a small quantity of cupboard space to confirm new blocks.

- Account Abstraction – Permits good contracts to provoke transactions. It will help new options, like batch transactions and the power to recuperate misplaced account keys.

These adjustments will doubtless take years to implement although and are unlikely to be drivers of price within the close to time period. Improvements that enhance scalability and the consumer expertise may assist to drive adoption. I query whether or not expertise is the one factor stopping broader adoption of cryptocurrencies, although.

Conclusion

Ethereum’s efficiency in the course of the present bull market has been comparatively poor. Whereas this could possibly be the results of competitors or uncertainty concerning the cryptocurrency’s roadmap, I imagine a lot of it has been on account of financial coverage. Ethereum is a excessive beta, risk-on asset, and as such has been negatively impacted by excessive rates of interest and quantitative tightening. With current inflation knowledge pointing in the direction of a possible easing of financial coverage, there’s a probability Ethereum’s efficiency strengthens going ahead. That is additionally supported by imminent ETF inflows and a decreased likelihood of Ethereum being labeled as a safety.

Ethereum lacks Bitcoin’s digital gold narrative, although, and as such is extra depending on demonstrating actual world utilization. Whereas decrease charges are supportive of utilization and transaction volumes, Ethereum is usually restricted by throughput however is making an attempt to take care of this by means of using layer 2 networks. Even when Ethereum turns into extensively adopted, facilitating a considerable amount of financial exercise, the present roadmap muddies valuation. Presumably many of the worth will accrue to the bottom layer, as I’ve written earlier than, however that is speculative. As such, I do not count on Ethereum’s worth to proceed rising quickly long run, even when near-term elements are supportive.