Picture supply: Aston Martin

If somebody provided to offer you a pound coin and requested for a £20 be aware in return, that may sound like a horrible deal. But it will nonetheless be a greater return than shopping for shares in Aston Martin (LSE: AML) when the luxurious carmaker listed in 2018 and holding them till now.

Throughout that point, the Aston Martin share price has fallen by 98%. But that is an iconic model with a well-heeled buyer base, fascinating automobiles and powerful pricing energy. So would possibly the share price bounce again – and may I spend money on the hope it does?

A fantastic enterprise is just not essentially an important funding

Whereas Aston Martin has rather a lot going for it, I feel its predicament comprises some highly effective classes for traders.

The primary lesson is that having nice belongings doesn’t essentially equate to having an important enterprise. Final yr, for instance, regardless that it generated income of £1.6bn, Aston Martin nonetheless recorded an working lack of nicely over £1m every week.

Aston Martin automobiles will not be low cost so it might appear odd that the enterprise is dropping cash making and promoting them. However the economics of a enterprise matter. Promoting just some 1000’s automobiles a yr could make it more durable to swallow mounted prices than with a lot larger volumes.

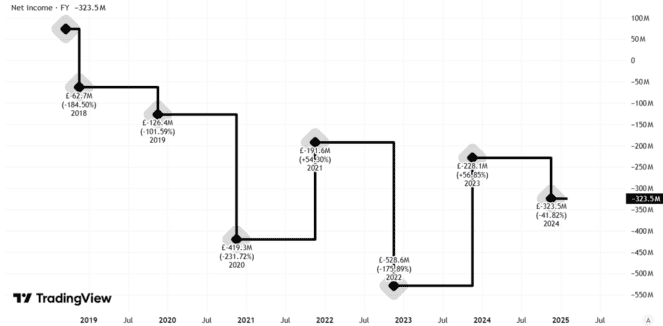

The second lesson is {that a} enterprise’s steadiness sheet at all times must be thought of alongside its operational efficiency. Aston Martin’s working loss final yr was £83m, however its total loss for the yr was £290m.

Created utilizing TradingView

The place did that additional £200m+ of pink ink come from? Non-operating prices.

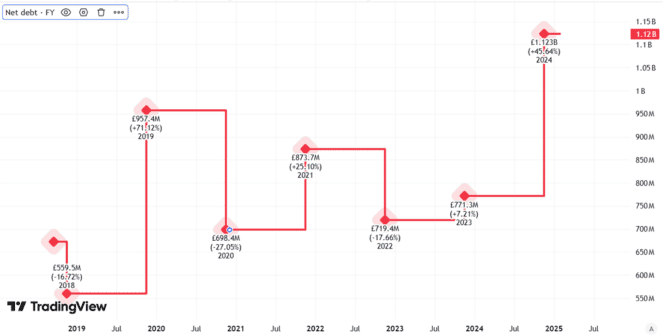

Particularly, the corporate had £180m of financing prices. That’s what comes of getting web debt of £1.2bn, as Aston Martin did at yr finish, particularly when a lot of it’s at a excessive rate of interest. Aston Martin is paying 10% or extra curiosity on a few of its borrowings.

Created utilizing TradingView

A lot must go proper for a share price revival

So may the Aston Martin share price ever bounce again? To take action, I feel the enterprise would first must cease spilling pink ink on the working degree and secondly kind out its funds by eliminating most debt. That would contain issuing extra shares, diluting current shareholders.

Whereas that’s doable, for now I don’t assume the indicators are encouraging. Revenues fell final yr by 3% and wholesale gross sales volumes have been down 9%. The truth that gross sales volumes fell greater than revenues demonstrates positively that the corporate has pricing energy, however neither development is a optimistic one, in my opinion.

Because the chief government stated this week as a part of the annual outcomes announcement: “We have all the vital ingredients for success”.

That’s true, but it surely has lengthy been true. In the meantime, the Aston Martin share price has lurched from one disappointment to a different. I’ve no plans to take a position.