Picture supply: Getty Photos

One share I’ve in each my Shares and Shares ISA and SIPP portfolios is Ferrari (NYSE: RACE). Whereas the enduring Italian sportscar firm seemingly wants no introductions, it’s removed from any outdated automotive inventory.

No, Ferrari is valued as an ultra-luxury model. That is why the inventory is commonly ranked amongst friends like Hermès Worldwide and LVMH (Moet Hennessy Louis Vuitton) reasonably than grubby carmakers like Stellantis and Ford.

Whereas the inventory has raced 185% larger in 5 years, it’s fallen 16% in simply over a month. This pullback has prompted analysts at each Barclays and Kepler Cheuvreux to improve Ferrari inventory to Purchase from Maintain.

Barclays mentioned the corporate retains relative “safe-haven” standing in comparison with different European automakers hit by US tariffs. Beginning on 2 April, Ferrari will hike costs by up to 10% on some fashions within the US. This demonstrates the corporate’s pricing energy.

In the meantime, Kepler mentioned: “This is the pit stop we were long awaiting to turn more positive.”

However ought to I purchase extra shares on the dip?

Protected haven

For starters, I agree that Ferrari inventory is considerably of a secure haven. President Trump’s 25% tariffs on auto imports goals to encourage extra US automotive manufacturing. However Ferrari solely manufactures its supercars in Maranello, northern Italy, and that gained’t be altering.

Prospects worth the truth that the vehicles are largely hand-assembled in the identical historic manufacturing unit in Italy. This craftmanship and heritage is a vital a part of the model’s attraction.

In the meantime, the corporate limits manufacturing to keep up exclusivity. In consequence, the order backlog extends into early 2027 attributable to unimaginable demand.

In different phrases, you possibly can’t simply exit and purchase a brand new Ferrari, even in case you have the cash. And present house owners have a much better probability of securing limited-edition fashions than newbies.

The result’s extraordinary earnings visibility, which traders worth extremely. So long as the order ebook extends two years into the long run, I feel the inventory will carry a major premium to the broader market.

After all, we will grumble about how giant that premium needs to be, however the reality the corporate deserves one is hardly doubtful. Proper now, the ahead price-to-earnings ratio is 43, which is decrease than a couple of months in the past (simply over 50).

Marginal margin strain

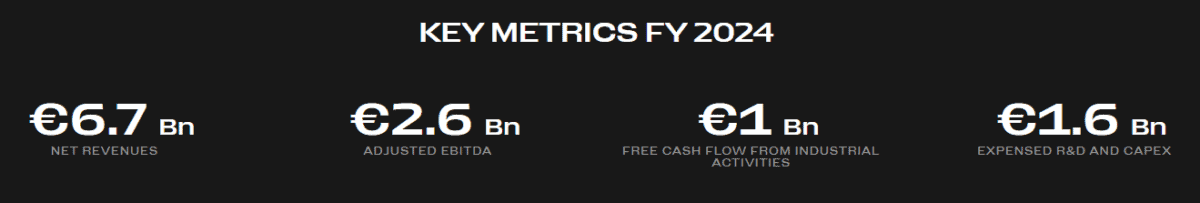

Final yr, income rose 11.8% to €6.7bn. Shipments totalled 13,752 items, up simply 1%, but web revenue jumped 21% to simply over €1.5bn.

The primary danger I see is a few kind of injury to the model. Ferrari takes unimaginable care of its status, however no model is fully immune.

It’s additionally value noting that administration sees a possible 50 foundation level hit to margins this yr attributable to tariffs. Then once more, Ferrari’s working margin was 28.3% final yr, so it has a good bit of flexibility.

My transfer

Whether or not we’re snug with it or not, the wealthy are getting richer all over the world. And that’s undoubtedly a really supportive pattern for ultra-luxury manufacturers like Ferrari.

I have already got a considerably giant place throughout my ISA and SIPP. The 16% dip isn’t giant sufficient to justify me making it even greater.

However for traders eager to spend money on the rising international wealth theme, I feel Ferrari inventory continues to be value contemplating as a long-term holding.