YEREVAN (CoinChapter.com) — Dogecoin holders marked April 20 as “Dogeday,” an unofficial group occasion tied to the token’s meme origins. The celebration began in 2021 throughout Worldwide Weed Day and gained recognition amongst Dogecoin supporters.

Dogecoin holders now join the day with important developments. This yr, consideration focuses on the approaching choices by the U.S. Securities and Trade Fee (SEC) on a number of Dogecoin ETF filings. The timing provides weight to this yr’s Dogeday.

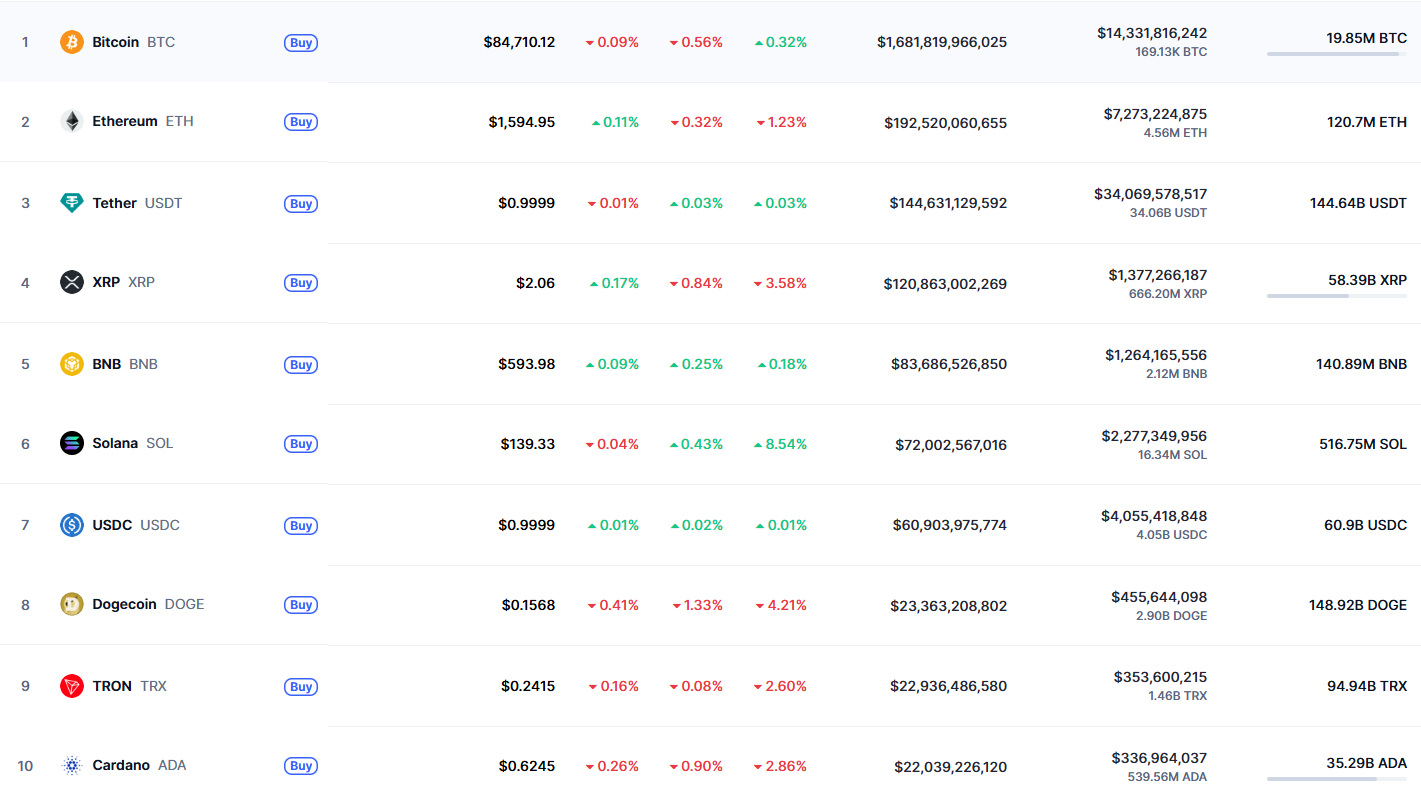

Dogecoin stays one of many prime ten cryptocurrencies. Its present market capitalization stands at $23.3 billion, primarily based on CoinMarketCap knowledge from April 20.

Dogecoin Inflation Price Tops $2 Million Each day

The Dogecoin community points round 14.4 million DOGE each day. This quantity ends in a each day Dogecoin inflation charge exceeding $2.16 million. Regardless of inflation, Dogecoin holders proceed to assist the token, citing accessibility and familiarity.

Dogecoin inflation differs from Bitcoin or Ethereum. The token has no cap on provide. As an alternative, about 5 billion DOGE are added annually. This regular enhance retains the price comparatively low, typically below $1, and contributes to its huge retail circulation.

Dogecoin holders typically emphasize the simplicity of the token’s use and branding. The token was created as a parody in 2013 however has developed a constant person base.

Dogecoin ETF Purposes Await SEC Response

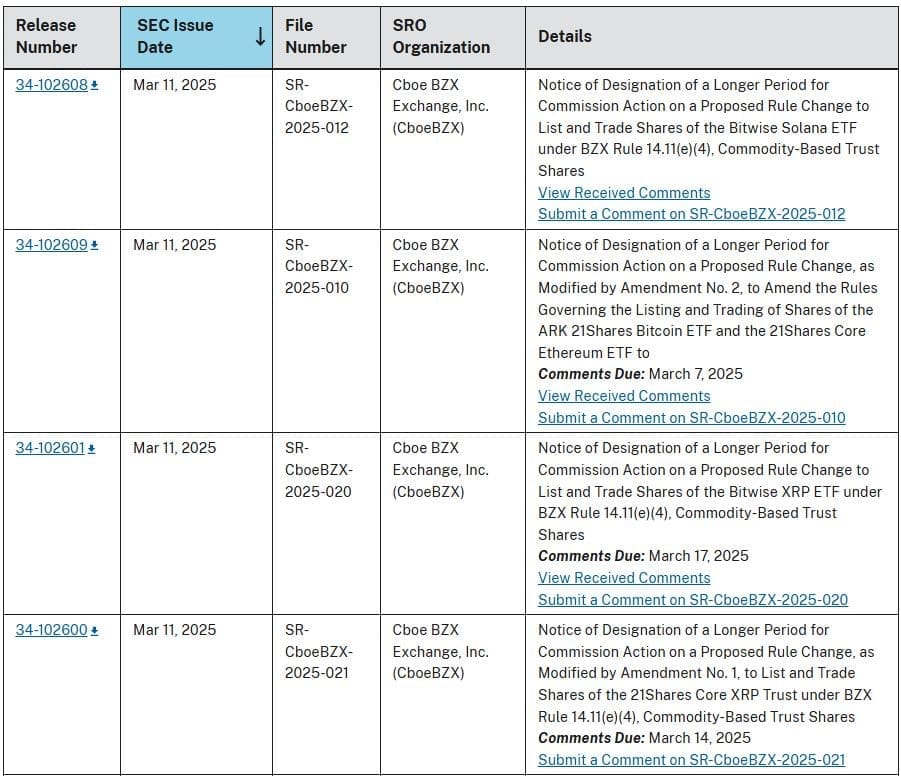

The SEC has acquired 4 Dogecoin ETF proposals. These embody the Bitwise Dogecoin ETF, Grayscale Dogecoin ETF, 21Shares Dogecoin ETF, and the Osprey Fund Dogecoin ETF.

The SEC should reply to Bitwise’s Dogecoin ETF utility by Could 18. That deadline marks the top of the 75-day preliminary evaluate below Rule 19b-4. Nevertheless, the SEC can delay the method to 240 days. That extension would push a closing resolution to October 2024.

Grayscale’s Dogecoin ETF utility has a Could 21 response deadline. The SEC already delayed this submitting as soon as earlier within the yr. Each filings observe the usual ETF timeline.

In the meantime, the SEC has not launched deadlines for the Dogecoin ETF filings submitted by 21Shares and Osprey. These two purposes stay within the early evaluate section.

The Dogecoin ETF choices arrive at a time of ongoing debate round cryptocurrency-based funding merchandise. The SEC lately delayed rulings on a number of altcoin ETF proposals.

Dogecoin ETF approval timelines rely upon commonplace SEC procedures. The company might both settle for, reject, or delay the purposes through the prolonged interval. As of now, no Dogecoin ETF has acquired closing approval.

Dogecoin holders proceed to trace the filings intently. The end result might have an effect on DOGE’s availability to a broader set of buyers by way of regulated monetary merchandise.

Dogecoin Retail Demand Linked to Value and Familiarity

Dogecoin holders typically cite the low unit price as a motive for continued curiosity. Blockchain writer Anndy Lian informed

“Unlike Bitcoin or Ethereum, Dogecoin’s inflationary supply — adding roughly 5 billion coins annually — keeps prices accessible, typically under $1.”

He added that the meme-based identification makes it relatable to internet-native customers. The branding stays a consider its endurance regardless of the dearth of broader use circumstances or sensible contract options.

Dogecoin has no direct position in decentralized finance or real-world asset tokenization. Nevertheless, it persistently ranks among the many most talked-about digital belongings on-line.

Dogecoin As soon as Surpassed Porsche’s Market Cap

In November 2024, Dogecoin briefly surpassed Porsche in market capitalization. The rise adopted continued social media consideration, together with posts from Elon Musk. That surge positioned Dogecoin above a number of established corporations in market worth.

Regardless of that second, Dogecoin’s efficiency stays pushed by retail participation and group exercise. In contrast to platforms equivalent to Ethereum or Solana, Dogecoin doesn’t assist decentralized purposes or sensible contract protocols.

Nonetheless, Dogecoin holders stay energetic, notably throughout occasions like Dogeday. The token’s group continues to interact in social media campaigns and monitor ETF developments as Could deadlines strategy.