Picture supply: Getty Photographs

Most of the holdings in my Shares and Shares ISA have been doing rather well this yr. And I’m not simply speaking about AI high-flyers like ASML (up 40% yr to this point) and Taiwan Semiconductor Manufacturing (up 77%). FTSE 100 shares like Rolls-Royce (50%) and Pershing Sq. Holdings (16.7%) are additionally flying.

However there’s at all times one or two stinking the portfolio out. For a while, this has been Diageo (LSE: DGE). The inventory is down 11% yr to this point and 25% throughout 5 years. Because the New Yr celebrations that ushered in 2022, it’s fallen 37%. Not nice.

Fortuitously, my winners are far outpacing underperformers like this. However it does current a little bit of a headache as a result of there may be the chance price related to hanging onto losers for too lengthy.

Ought to I name time on this one? Or maybe order in one other spherical of shares whereas they’re down? Right here’s my view.

What’s gone unsuitable?

Within the 10 years to the tip of 2021, the Diageo share price rose round 200%. This unbelievable efficiency mirrored the agency’s rising gross sales and income, pushed by its portfolio of timeless manufacturers. These embrace Guinness, Smirnoff, Johnnie Walker, and Tanqueray gin.

Nonetheless, as a result of difficult client backdrop, gross sales have gone into reverse just lately. For this monetary yr (which resulted in June), income is predicted to say no barely to round $20.4bn.

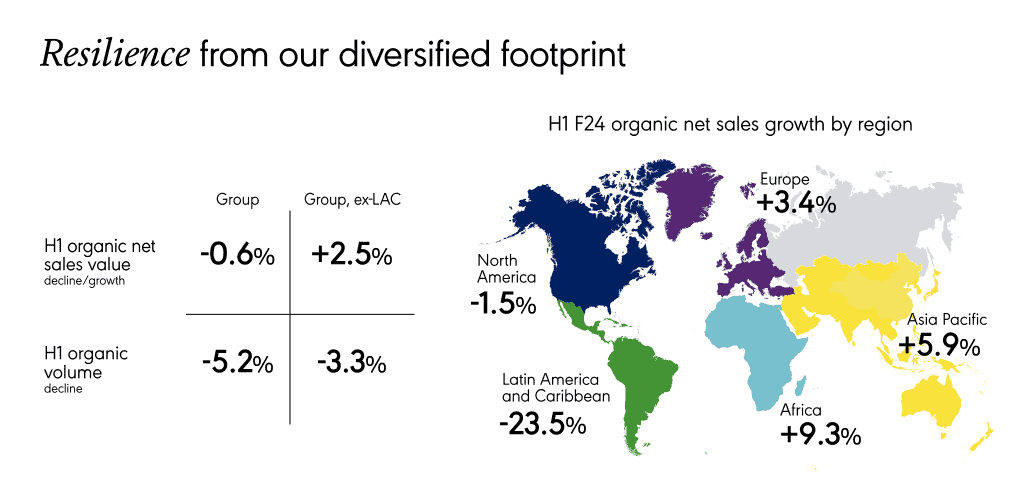

Its key US market, which accounts for round 35% of gross sales, continues to be sluggish. And gross sales have just lately fallen off a cliff in its Latin America and Caribbean market.

Balancing this, there’s been resilience elsewhere, notably in Asia Pacific and Africa. Nonetheless, there’s no getting away from the truth that buying and selling is hard proper now and any restoration may take some time.

Right here was the geographic breakdown for the primary half.

Generational shift?

One danger that is perhaps hanging over the inventory is a possible shift away from consuming alcohol amongst youthful generations. That is notably noticeable within the West.

Certainly, we just lately noticed Carlsberg snap up UK soft-drinks maker Britvic (proprietor of Tango and Robinsons) for £3.3bn. Is that this an indication of issues to return from? Would possibly we see Diageo comply with swimsuit into smooth drinks? It’s too early to say, but it surely’s value keeping track of.

One other potential problem on the horizon is the rise of GLP-1 weight-loss medication. These can cut back cravings, together with the urge to drink alcohol, in keeping with some experiences. So this might additionally start to weigh on the share price shifting ahead.

Total, there’s plenty of uncertainty surrounding Diageo’s progress story proper now (maybe greater than ever).

My determination

Alternatively, historical past tells us that instances of uncertainty may be the very best instances to take a position. So, is that this a possibility? To be sincere, I’m torn.

The ahead dividend yield is now above 3% and I just like the long-term prospects for revenue progress (Diageo is a Dividend Aristocrat).

Plus, the consensus price goal amongst brokers is 2,836p. That’s 11.75% greater than the present price.

Diageo is because of launch its annual outcomes on 30 July. I’m going to attend until then to see what administration says earlier than making a call. My inclination is to maintain holding the shares of a high-quality agency like this.