The decentralized finance (DeFi) sector confronted a pointy decline within the first quarter of 2025. In response to a report by crypto analytics agency DappRadar, the overall worth locked (TVL) in DeFi protocols fell by 27% in comparison with the earlier quarter. This drop introduced DeFi’s TVL down to $156 billion by the tip of March.

DappRadar cited world financial uncertainty particularly as a result of Trump Tariffs and the aftermath of a Bybit hack as the important thing causes behind the autumn. These components triggered market volatility and led traders to withdraw funds from DeFi platforms.

Ethereum and Different Main Chains Undergo Main Losses

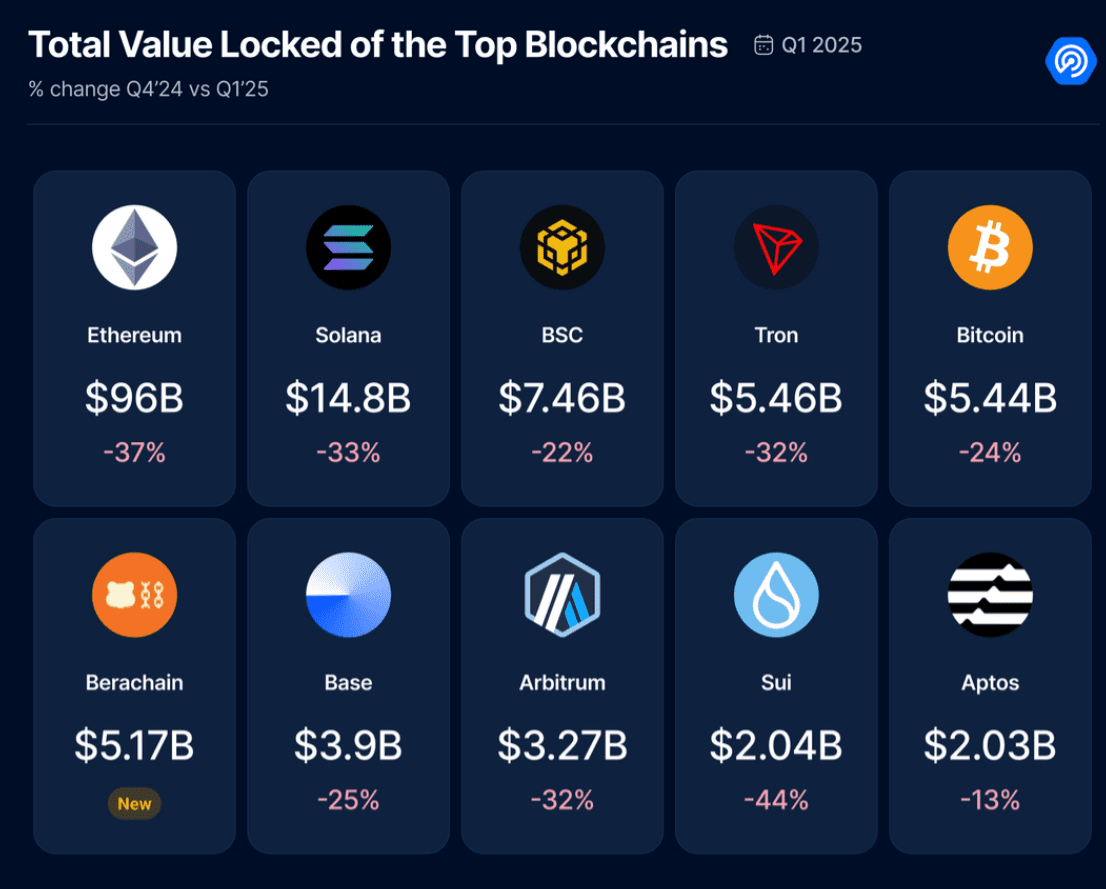

Ethereum, the most important blockchain when it comes to DeFi TVL, was not spared. The Ethereum community noticed a 37% drop in its TVL, falling from $152 billion to $96 billion throughout the first quarter. This occurred because the price of Ether (ETH) fell 45% to $1,820. This price decline contributed to the lower within the worth of belongings held inside DeFi protocols.

Different main blockchains additionally skilled substantial declines. Sui, a top-10 blockchain by DeFi TVL, recorded the most important proportion loss, falling 44% to $2 billion. Solana, Tron, and Arbitrum every noticed their DeFi holdings shrink by over 30% as customers withdrew funds and token costs dropped.

The report defined that blockchains with much less publicity to stablecoins—cryptocurrencies tied to conventional currencies—noticed much more strain. With fewer stablecoins locked in, these blockchains have been extra weak to market declines, resulting in a sooner and steeper drop in DeFi worth.

Whereas most blockchains noticed their DeFi numbers fall, newly launched Berachain stood out as an exception. In response to DappRadar, Berachain amassed $5.17 billion in TVL between Feb. 6 and March 31. This development made it the one top-10 blockchain to see a rise in locked worth throughout the quarter.

Berachain’s rise means that new networks can nonetheless entice liquidity, particularly if they provide contemporary incentives.

AI and Social dApps Surge Whereas DeFi and GameFi Exercise Shrinks

In distinction to DeFi, blockchain purposes targeted on synthetic intelligence (AI) and social interplay noticed robust consumer development in Q1. DappRadar reported that every day distinctive lively wallets (DUAWs) interacting with AI protocols elevated by 29%, whereas these utilizing social dApps rose by 10%.

These figures present that whilst traders pulled cash out of DeFi, customers remained lively on blockchain networks. AI apps noticed a mean of two.6 million lively wallets per 30 days, whereas social platforms had 2.8 million month-to-month customers.

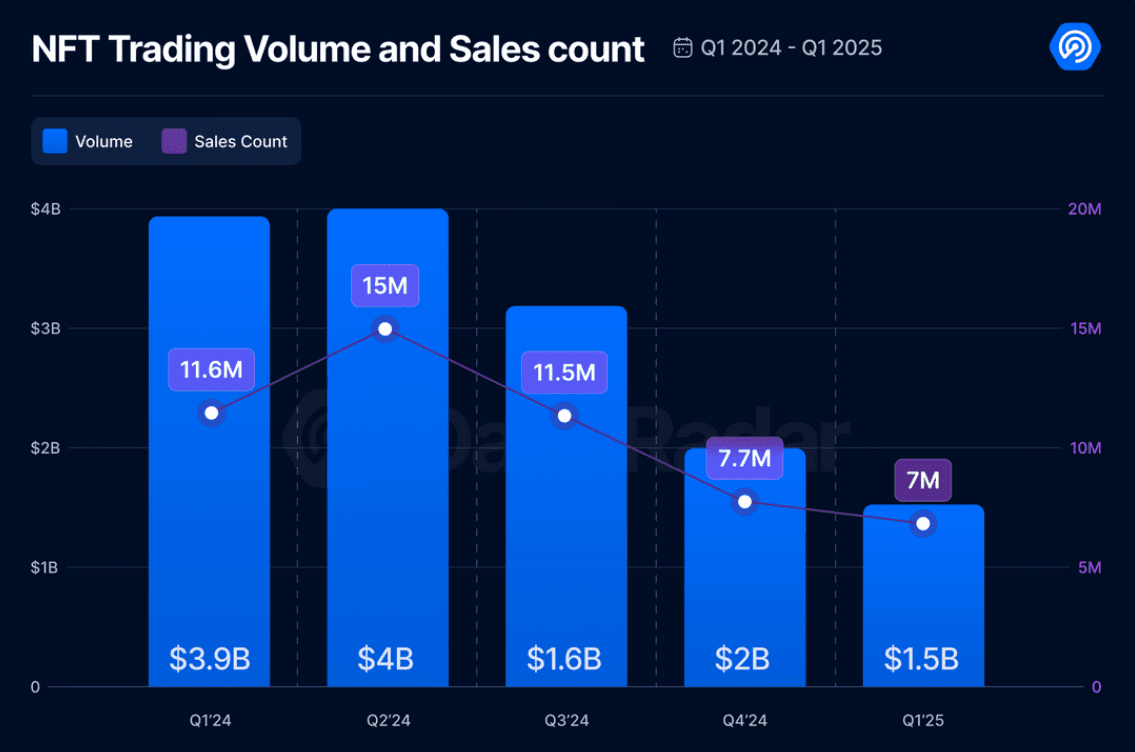

Whereas AI and social apps gained customers, different elements of the blockchain area continued to lose floor. Non-fungible tokens (NFTs) and GameFi—blockchain-based gaming platforms—each skilled decreased exercise in Q1.

NFT buying and selling quantity dropped 25% from the earlier quarter, falling to $1.5 billion. Amongst NFT marketplaces, OKX took the lead with $606 million in trades. OpenSea and Blur adopted intently, recording $599 million and $565 million in buying and selling quantity, respectively. On the similar time, the trade is seeing main platforms pulling again from NFTs altogether. Cryptocurrency change Bybit has already introduced to close down its NFT market on April 8.