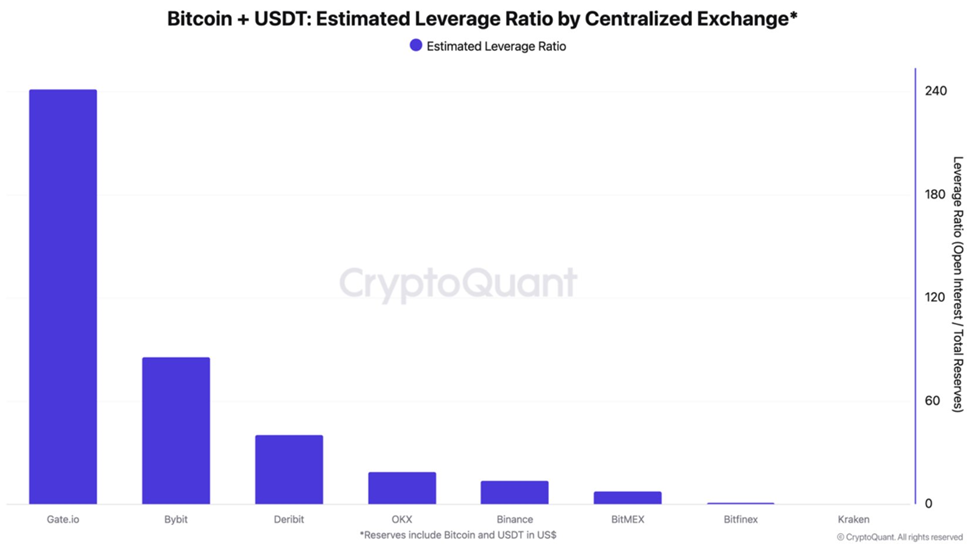

Whereas the rising anticipation for a possible crypto bull run, CryptoQuant has analyzed the leverage ranges on various centralized crypto exchanges. CryptoQuant’s analysis coping with the CEX leverage ranges highlights default danger, liquidity, and the extent of help that the crypto reserves help for the buying and selling of perpetual futures amidst the strategy bull run. In its current social media publish, the on-chain analytics supplier examined this market state of affairs.

Binance Takes Distinguished Place amongst CEXs for Sustaining Resilient Reserves

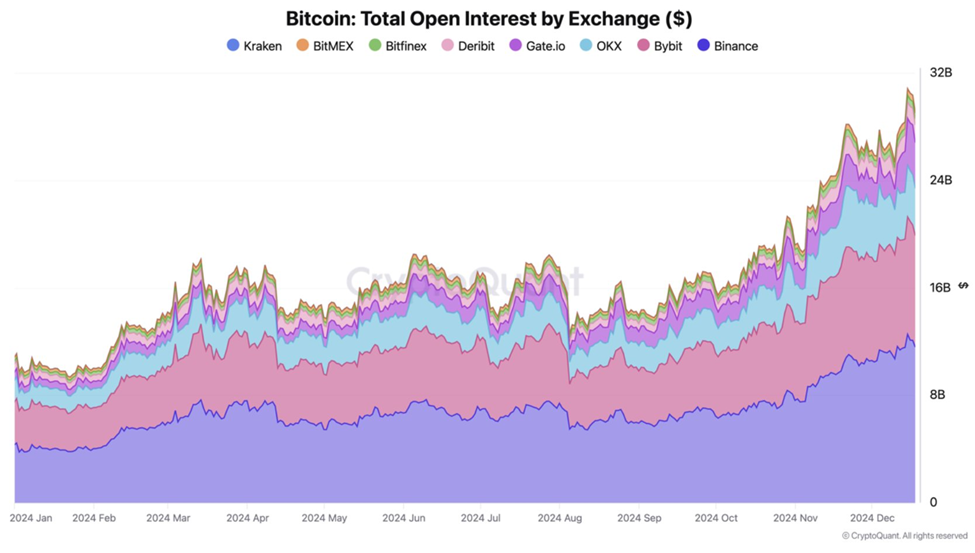

CryptoQuant talked about that its analysis takes into consideration the leverage ratio to measure the leverage that the merchants make use of. Along with this, it additionally gauges the every crypto alternate’s monetary well being. On this respect, an elevated leverage ratio probably denotes probably liquidity dangers. Binance dominates the key exchanges for sustaining resilient reserves regardless of the huge progress in open curiosity throughout 2024.

Moreover, Binance’s reserves in $BTC, $ETH, and $USDT conveniently surpassed the open curiosity thereof. The crypto alternate moreover reported the least in addition to most regular leverage ratio compared with the highest exchanges. In December final yr, it noticed a ratio of up to 12.8 which reportedly elevated to 13.5 this December. This stability combines with a notable 2.6x enhancement in Bitcoin’s open curiosity that rose to $11.64B from simply $4.45B. Therefore, this total mixture underscores the crypto alternate’s potential to sort out market liquidity together with the next liquidations.

Deribit, Bybit, and Gate.io’s Open Curiosity Surpasses or Approaches the Reserves

Alternatively, Deribit, Bybit, Gate.io, and different such exchanges have the height leverage ratios at 32, 86, and 106, respectively. The respective figures show the open curiosity surpasses or nears the reserves with analogous patterns recorded for Ethereum. Maintaining this in view, CryptoQuant deems observing alternate leverage essential based mostly on the important thing function of excessive leverage within the FTX crash in 2022’s November.