CryptoPunks, the top-tier NFT assortment of the blockchain, has just lately confronted a belief loss from buyers after a tax evasion bust. It occurred after many scandals as of late, from jaw-dropping price swings to million-dollar missteps. However past the headlines, the NFT market in 2025 stays a battleground of danger and reward.

CryptoPunks Beneath Hearth: Taxes and Huge Drops

A latest scandal has rocked the CryptoPunks group. Waylon Wilcox, a Pennsylvania investor, admitted to dodging $3.3 million in taxes on $13 million in income from promoting 97 CryptoPunks between 2021 and 2022. This responsible plea marks the primary U.S. legal case linking NFTs to tax evasion, signaling tighter scrutiny of digital asset features. Wilcox now faces up to 6 years in jail—a stark warning to buyers navigating the murky waters of crypto wealth.

GUY MADE $13M FLIPPING PIXELATED NFTS—TOLD THE IRS “LOL, NEVER HEARD OF CRYPTO”

Waylon Wilcox, 45, of Pennsylvania, pleaded responsible to hiding over $13 million in income from flipping 97 CryptoPunks NFTs—reporting nothing to the IRS in 2021 and 2022.

However when tax time got here?… pic.twitter.com/RJACf8z6IU

— Mario Nawfal (@MarioNawfal) April 12, 2025

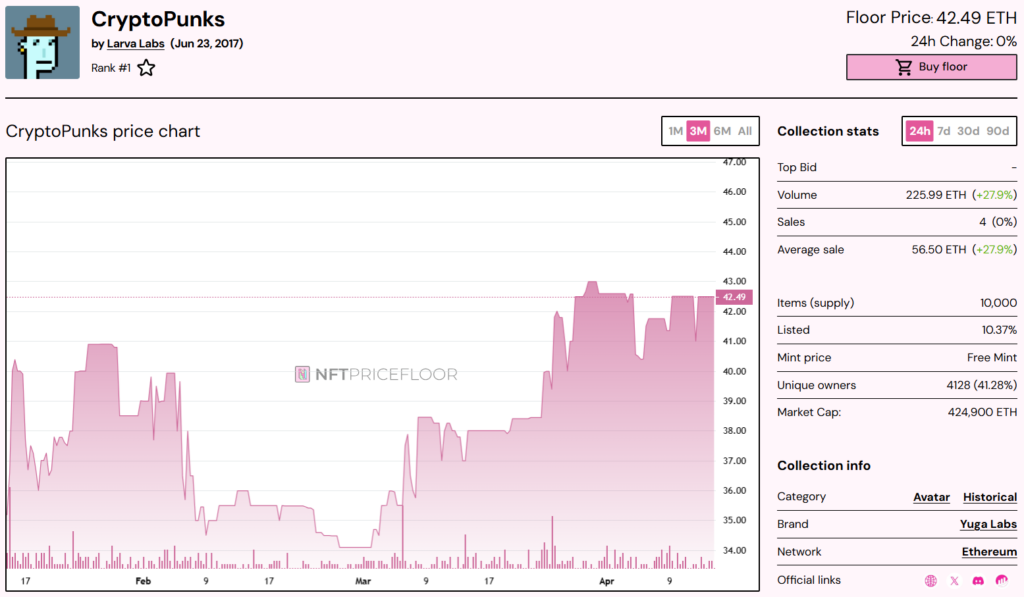

In the meantime, CryptoPunks’ market efficiency tells a narrative of extremes. The gathering’s buying and selling quantity surged 95% to $163 million, with ground costs climbing previous $100,000, cementing its standing as a blue-chip NFT.

Supply: NFT Value Ground

But, not each transaction spells success.

CryptoPunk #3100, a uncommon Alien Punk, bought for 4,000 ETH ($6 million) in April 2025. This transfer witnessed a $10 million loss from its $16 million buy (4,500 ETH) a 12 months earlier. The drop displays a 57% decline in ETH’s worth, costing the vendor 500 ETH and hundreds of thousands in USD. Facilitated by Fountain, the transaction possible concerned a serious investor, as the client’s pockets obtained funds from a Coinbase Prime deal with. Regardless of Alien Punks’ dominance in high-value gross sales, CryptoPunks’ ground price fell 44% to $65,373, signaling a steep decline from their 2021 peak. Such swings spotlight the high quality line between fortune and failure within the NFT area.

The NFT Panorama in 2025: Dangers and Rewards

The narrative round NFTs in 2025 blends warning with alternative. Whereas scandals and losses dominate discussions, some buyers are quietly capitalizing on market developments. A standout case from the primary quarter of 2025 illustrates how strategic strikes can yield spectacular returns.

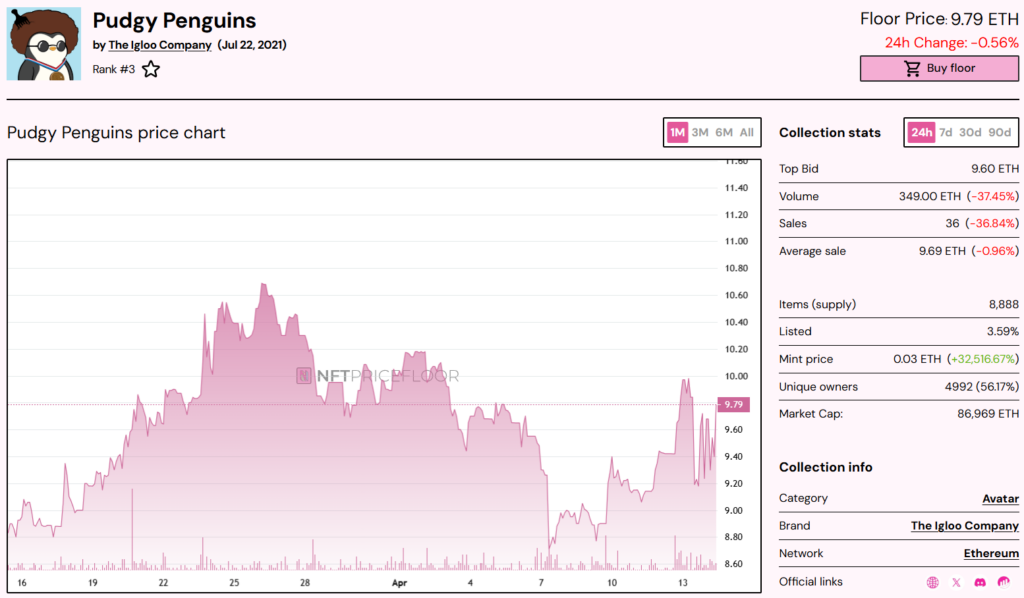

Take into account the Pudgy Penguins, a group that has risen to prominence by intelligent branding and group buzz. In January 2025, an investor bought a uncommon Pudgy Penguin for 15 ETH—equal to $24,000 on the time. By April, that very same NFT bought for 50 ETH, delivering an $80,000 revenue in three months. The surge stemmed from Pudgy Penguins’ savvy advertising and marketing, together with unique merchandise and a viral TikTok marketing campaign that boosted its cultural cachet.

Supply: NFT Value Ground

A comparable case of NFT assortment efficiency in 2025 entails the Doodles assortment. It noticed a outstanding achieve pushed by strategic partnerships and group engagement. In February 2025, an investor acquired a uncommon Doodle NFT for 10 ETH, roughly $18,000 on the time. By April, the identical NFT bought for 35 ETH, yielding a $45,000 revenue in two months. The surge was fueled by Doodles’ collaboration with a serious trend model for limited-edition attire and a viral augmented actuality marketing campaign on social media, enhancing its mainstream attraction.

Supply: Open Sea

In contrast to CryptoPunks’ turbulent trip, these circumstances present how smaller, community-driven collections can provide regular features for individuals who spot potential early. This success displays broader developments within the NFT market. Solana-based tasks are gaining traction, whereas Ethereum giants like CryptoPunks keep their attract.