Key Takeaways

- All crypto transactions have to be reported on 2024 tax returns as per IRS.

- Use Type 8949 and Schedule 1 or C for reporting crypto features and revenue.

Share this text

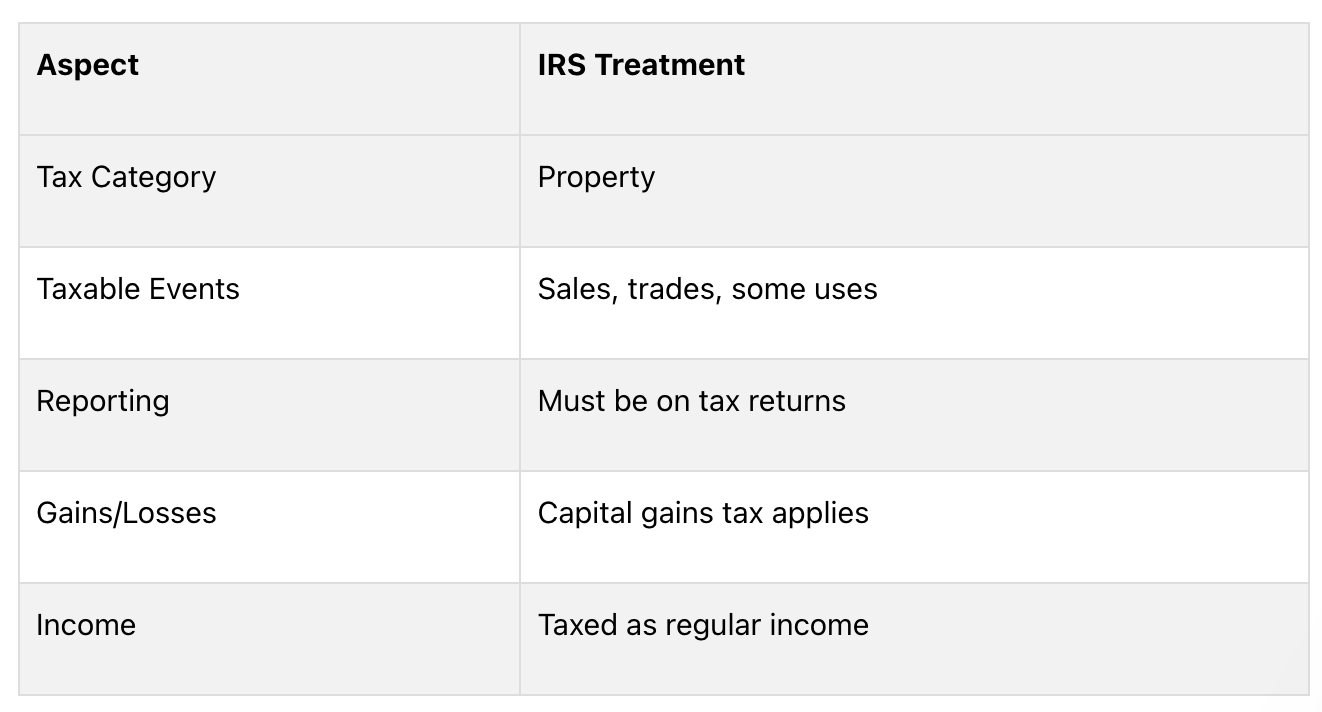

Right here’s what you could learn about reporting crypto in your 2024 taxes:

- The IRS treats crypto as property, not foreign money

- It’s essential to report all crypto transactions, even small ones

- Taxable occasions embody promoting, buying and selling, and utilizing crypto to purchase items

- Use Type 8949 to report crypto features/losses

- Report crypto revenue on Schedule 1 or Schedule C

Key steps for crypto tax reporting:

- Collect all transaction data

- Calculate features/losses for every transaction

- Fill out Type 8949 and Schedule D

- Report any crypto revenue

- Reply the digital asset query on Type 1040

Frequent pitfalls to keep away from:

- Not reporting all transactions

- Incorrect value foundation calculations

- Misclassifying transaction sorts

Use crypto tax software program to simplify reporting. Keep up to date on IRS rule adjustments for 2024, together with new reporting necessities for exchanges.

Transaction sorts and their tax remedy

- Shopping for crypto: not taxable.

- Promoting crypto: topic to capital achieve or loss.

- Trading crypto: topic to capital achieve or loss.

- Receiving as cost: handled as common revenue.

- Mining rewards: handled as common revenue.

When unsure, seek the advice of a tax skilled acquainted with crypto laws.

Fundamentals of crypto taxation

Understanding how cryptocurrencies are taxed is vital for anybody utilizing digital belongings. The IRS has guidelines for taxing crypto, and understanding these guidelines helps you comply with the legislation and keep away from penalties.

How the IRS views crypto

The IRS treats crypto as property, not cash. This impacts how they’re taxed:

As a result of tokens are property, the IRS makes use of the identical tax guidelines for them as for different property. This implies you could report any features or losses from crypto in your taxes.

Taxable vs. non-taxable occasions

Realizing which crypto actions are taxable is necessary for proper reporting. Right here’s a easy breakdown:

Taxable occasions

- Promoting crypto for normal cash

- Trading one token for an additional

- Shopping for issues with crypto

- Getting paid in crypto

- Mining crypto

- Receiving staking rewards

- Receiving airdrops or exhausting forks

Non-taxable occasions

- Shopping for crypto with common cash

- Transferring tokens between your personal wallets

- Donating crypto to permitted charities

- Gifting crypto (be aware: present tax guidelines could apply)

Even for non-taxable occasions, maintain data. They may have an effect on your taxes later.

Preparing for tax reporting

Making ready for crypto tax reporting requires good group. By gathering the appropriate paperwork and preserving good data, you can also make the method simpler and comply with IRS guidelines.

Gathering required paperwork

To report your crypto transactions accurately, you’ll want these paperwork:

Doc kind and descriptions

- Trade Statements: data of all of your trades.

- Type 1099-B: reveals cash from gross sales (supplied by some platforms).

- Pockets Addresses: listing of all wallets you used.

- Buy Receipts: data of if you purchased crypto.

- Sale Data: data of if you offered crypto.

- Price Data: particulars of buying and selling and community charges.

Get these paperwork nicely earlier than taxes are due so you will have time to report accurately.

Protecting observe of transactions

Good record-keeping is vital for correct tax reporting. Right here’s what to do:

1. Use a crypto transaction journal: maintain an in depth log with:

- Date of every transaction

- Kind of token

- Quantity traded or moved

- Worth in US {dollars} on the time

- Why you made the transaction (commerce, purchase, promote)

- Charges you paid

2. Use tax software program: consider using particular crypto tax software program that will help you. It may well:

- Herald transactions from totally different exchanges and wallets

- Determine your features and losses

- Make tax types for you

3. Type your transactions: group your transactions by how lengthy you held the crypto:

- Quick-term: Held for lower than a yr

- Lengthy-term: Held for greater than a yr

4. File non-taxable occasions: even when some crypto actions aren’t taxed, maintain data of:

- Transferring crypto between your personal wallets

- Shopping for crypto with common cash

- Giving crypto as presents (present tax guidelines would possibly apply)

Report Crypto on Your Taxes

Reporting crypto in your taxes may be difficult. Right here’s a step-by-step information for the 2024 tax season:

Figuring Out Positive factors and Losses

To report your crypto transactions accurately:

- Discover the price foundation for every transaction

- Calculate how a lot you bought from every sale or commerce

- Subtract the price foundation from what you bought to search out your achieve or loss

Bear in mind:

- Quick-term: Held lower than a yr (taxed like common revenue)

- Lengthy-term: Held greater than a yr (decrease tax charges apply)

Filling Out Type 8949

Type 8949 is vital for reporting crypto transactions:

- Use separate types for short-term and long-term transactions

- Fill within the high half, checking field (c) for crypto

- For every transaction, embody:

Data

What to Write

Description

Kind of crypto (e.g., 1.5 BTC)

Date acquired

Whenever you purchased or acquired it

Date offered

Whenever you offered or traded it

Proceeds

How a lot you bought for it

Value foundation

What you paid for it

Achieve or loss

Proceeds minus value foundation

Tip: Record your transactions in date order to make it simpler.

Utilizing Schedule D

After Type 8949, transfer the totals to Schedule D:

- Put short-term transactions in Half I

- Put long-term transactions in Half II

- Add up your complete achieve or loss on Line 16

For those who misplaced cash on crypto in previous years, embody that on Schedule D too.

Reporting Crypto Earnings

For crypto revenue not from shopping for and promoting:

- Use Schedule 1 of Type 1040 for many crypto revenue (like mining or staking)

- For those who work for your self, use Schedule C

- Report the worth of crypto you bought as cost on the day you acquired it

Don’t neglect to reply “Yes” to the digital asset query on Type 1040 for those who did something with crypto throughout the yr.

Particular Instances in Crypto Taxes

Crypto-to-Crypto Trades

Whenever you swap one token for an additional, it’s a taxable occasion. Right here’s what to do:

Step

Motion

1

Discover the market worth of the crypto you’re buying and selling if you make the swap

2

Determine the distinction between what you paid for the crypto and its present worth

3

Report this distinction as a achieve or loss on Type 8949

Notice: It’s essential to report these trades even for those who don’t change your crypto to common cash.

Airdrops and Exhausting Forks

Airdrops and exhausting forks can result in surprising taxes:

Occasion

Tax Therapy

Airdrops

Taxed as common revenue

Exhausting Forks

New tokens normally taxed as common revenue

For each, use the worth of the tokens if you get them or can use them. Report this on Schedule 1 of Type 1040.

Misplaced or Stolen Crypto

Coping with misplaced or stolen crypto is difficult for taxes:

State of affairs

Tax Therapy

Misplaced Crypto

Often can’t be deducted

Stolen Crypto

Not tax-deductible for people in 2024

Nevertheless, you may need some choices:

1. Abandonment Loss:

- May be your best option for taxpayers

- You want proof that you just meant to desert the crypto and took motion to take action

2. Trade Shutdowns or Scams:

- Reporting losses on Type 8949 is dangerous

- Discuss to a CPA earlier than you resolve what to do

3. Chapter Instances:

- You would possibly get a tax deduction as soon as you know the way a lot you’ll get again

- The deduction is what you paid minus what you get again

- It’s normally handled as an everyday loss, not a capital loss

Frequent Errors and Keep away from Them

When coping with crypto taxes, many individuals make errors. Listed here are some widespread errors and methods to keep away from them:

Not Reporting All Transactions

Some crypto homeowners suppose they solely have to report huge transactions. That is incorrect. The IRS desires you to report all crypto transactions, regardless of how small. Not doing this may trigger issues:

Downside

Keep away from It

IRS audits

Preserve data of all transactions

Fines

Use software program to trace all crypto actions

Further costs

Report even small transactions beneath $600

Attainable authorized points

Know the most recent IRS guidelines

The IRS has methods to search out unreported crypto transactions. It’s necessary to report all of your crypto actions accurately to remain out of bother.

Fallacious Value Foundation Calculations

Getting the price foundation incorrect can change how a lot tax you owe. Frequent errors embody:

- Getting the acquisition date incorrect

- Forgetting about charges

- Not counting earlier trades

To keep away from these errors, use crypto tax software program. It may well work out the price foundation and maintain observe of your transactions for you.

Misclassifying Transactions

It’s necessary to label your crypto transactions accurately for taxes. Right here’s a easy information:

What You Did

How It’s Taxed

Traded crypto for cash

Capital achieve/loss

Traded one crypto for an additional

Capital achieve/loss

Earned crypto as pay

Common revenue

Acquired crypto from mining

Common revenue

Acquired crypto from staking

In all probability common revenue (ask a tax professional)

To get this proper:

- Write down why you made every transaction

- Use software program to type your transactions

- For those who’re undecided, ask a crypto tax professional

Instruments for Crypto Tax Reporting

Reporting crypto taxes may be exhausting, however there are instruments to assist. Let’s have a look at some helpful software program and IRS sources.

Crypto Tax Software program

Crypto tax software program could make reporting simpler. Listed here are some fashionable choices:

Software program

What It Does

Finest For

CoinTracker

Tracks wallets, updates portfolio

Individuals who wish to see all their crypto in a single place

TurboTax Premium

Recordsdata full tax return, presents professional assist

Individuals with advanced taxes

CoinTracking

Helps with worldwide tax legal guidelines

Individuals who want steerage on totally different nations’ guidelines

TokenTax

Calculates features/losses robotically

Individuals who need easy reporting

When choosing software program, take into consideration:

- What number of transactions you will have

- Which exchanges you utilize

- For those who want further options like tax loss harvesting

IRS Sources

The IRS additionally has instruments to assist with crypto taxes:

1. Digital Forex Steerage: Official guidelines on how to deal with crypto for taxes

2. Type 8949: Use this to report crypto features and losses

3. Schedule D: Use with Type 8949 to indicate complete features and losses

4. FAQ on Digital Forex: Solutions widespread questions on crypto taxes

5. Publication 544: Common data on promoting belongings, which may apply to crypto

These sources will help you perceive the official guidelines and fill out your types accurately.

Protecting Up with Tax Guidelines

Realizing the most recent crypto tax guidelines is vital for proper reporting. The IRS typically adjustments its guidelines for digital belongings, so taxpayers want to remain knowledgeable.

2024 IRS Rule Adjustments

Listed here are the primary updates for the 2024 tax yr:

1. New Type: The IRS has a draft of Type 1099-DA for digital asset transactions.

2. Trade Reporting: Beginning in 2023, crypto platforms should report transactions to the IRS and customers.

3. $10,000 Rule: Companies don’t have to report crypto transactions over $10,000 till new guidelines come out.

4. Tax Charges: New charges for 2024 have an effect on how crypto features are taxed:

Tax Fee

Single

Married Submitting Collectively

Head of Family

0%

$0 – $47,025

$0 – $94,050

$0 – $63,000

15%

$47,026 – $518,900

$94,051 – $583,750

$63,001 – $551,350

20%

Over $518,900

Over $583,750

Over $551,350

5. NFT Guidelines: The IRS now treats NFTs as collectibles for taxes.

What’s Subsequent

As crypto grows, tax guidelines will change. Right here’s what to observe for:

1. Extra Checks: The IRS has employed crypto specialists to look nearer at tax stories.

2. New Legal guidelines: Keep watch over proposed guidelines about crypto mining taxes and wash gross sales.

3. DeFi Guidelines: The IRS is engaged on how to tax decentralized finance trades.

4. International Guidelines: Anticipate extra teamwork between nations on crypto taxes.

To remain up-to-date:

- Examine the IRS web site typically

- Use good crypto tax software program

- Discuss to a tax professional who is aware of about crypto

- Be a part of on-line teams that discuss crypto taxes

Conclusion

Reporting crypto taxes accurately is necessary. This information has proven you how to do it proper and why it issues.

Principal Factors to Bear in mind

- Report all crypto actions on the appropriate IRS types

- Use crypto tax software program to make reporting simpler

- Preserve up with new crypto tax guidelines

- Preserve good data of all of your crypto actions

- Be careful for widespread errors like lacking transactions or incorrect calculations

When to Ask for Assist

Generally, it’s finest to get assist from a tax professional. Contemplate this if:

State of affairs

Cause to Get Assist

Advanced Trades

DeFi, NFTs, or frequent buying and selling want professional data

Huge Portfolios

Giant holdings may have particular tax methods

Uncommon Instances

Exhausting forks, airdrops, or misplaced crypto may be difficult

Audit Worries

A tax professional will help if the IRS contacts you

FAQs

When do I have to report crypto on taxes?

It’s worthwhile to report crypto in your taxes in these conditions:

State of affairs

Tax Reporting

Shopping for and holding crypto

Not required

Promoting crypto

Required

Trading one crypto for an additional

Required

Utilizing crypto to purchase items or companies

Required

Receiving crypto as revenue (mining, staking, cost)

Required as revenue

Key factors to recollect:

- Report all crypto transactions, even small ones

- Shopping for and holding alone doesn’t want reporting

- Promoting, buying and selling, or utilizing crypto triggers tax reporting

- Crypto revenue (like mining rewards) have to be reported

For those who’re undecided about your scenario, it’s finest to ask a tax professional for assist.

Share this text

![]()