YEREVAN (CoinChapter.com) — Charles Schwab plans to roll out a spot crypto buying and selling platform inside 12 months. CEO Rick Wurster shared the replace through the firm’s current earnings name. He stated regulatory modifications may quickly enable direct crypto buying and selling for Schwab shoppers.

“Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto and our goal is to do that in the next 12 months and we’re on a great path to be able to do that,”

Wurster stated.

Charles Schwab already presents publicity to Bitcoin futures and crypto ETFs. Nevertheless, the upcoming platform would enable customers to purchase and promote cryptocurrencies instantly. This modification would place Schwab in direct competitors with crypto exchanges like Coinbase and Binance.

Wurster additionally acknowledged that curiosity within the firm’s crypto-related merchandise is rising. He famous this demand as a motive for the enlargement into spot crypto buying and selling.

Spike in Curiosity Round Charles Schwab’s Crypto Merchandise

Charles Schwab has seen a 400% improve in visits to its crypto-focused pages. Wurster revealed this information through the earnings name. He added that 70% of this site visitors got here from people who find themselves not Schwab clients.

This pattern suggests excessive curiosity in Charles Schwab’s crypto merchandise past its present consumer base. The agency believes direct spot crypto buying and selling may entice new customers.

Presently, Charles Schwab presents Bitcoin futures and crypto ETFs. The upcoming platform would develop the agency’s product lineup and allow direct publicity to digital property.

The platform’s improvement follows broader shifts in investor habits. Extra customers are searching for entry to digital property by way of conventional brokerage corporations.

Rick Wurster Ties Schwab’s Crypto Enlargement to Regulation

Rick Wurster related Charles Schwab’s crypto platform launch plan to ongoing modifications in U.S. monetary regulation. He pointed to the present administration’s efforts to create clearer guidelines for digital property. These efforts embrace proposals and coverage shifts from federal our bodies that regulate monetary markets.

One of many fundamental regulatory gamers is the U.S. Securities and Change Fee (SEC). In 2025, the SEC elevated its deal with how crypto property are traded, saved, and provided to buyers. The company can be engaged on defining which crypto property fall beneath its jurisdiction and what guidelines apply to them. This impacts how corporations like Charles Schwab can legally present crypto companies.

As regulation turns into extra outlined, Schwab believes it is going to be in a stronger place to enter the market with spot crypto buying and selling. Such a buying and selling permits clients to purchase and promote precise cryptocurrencies, akin to Bitcoin, in actual time—fairly than solely gaining publicity by way of futures or ETFs.

Wurster defined that the corporate is able to transfer ahead as soon as regulators finalize the foundations. If situations align, Charles Schwab plans to launch the platform earlier than mid-2026. Till then, Schwab is preserving monitor of the newest updates from businesses just like the SEC and making ready to adjust to all required authorized requirements.

Charles Schwab Holds Custodial Position for Fact.Fi

Charles Schwab is already concerned in crypto by way of its function with Fact.Fi. The digital funding platform is a part of Trump Media and Expertise Group. Schwab acts because the custodian for crypto merchandise provided on the platform.

Fact.Fi plans to supply Bitcoin entry, individually managed crypto accounts, and different digital asset companies. Charles Schwab’s involvement on this mission provides to its expertise in dealing with crypto infrastructure.

The custodial relationship with Fact.Fi exhibits Schwab is already lively within the house whereas making ready its personal buying and selling platform. The partnership may additionally assist its inner product improvement course of.

Trade Executives Reply to Schwab’s Spot Crypto Trading Plan

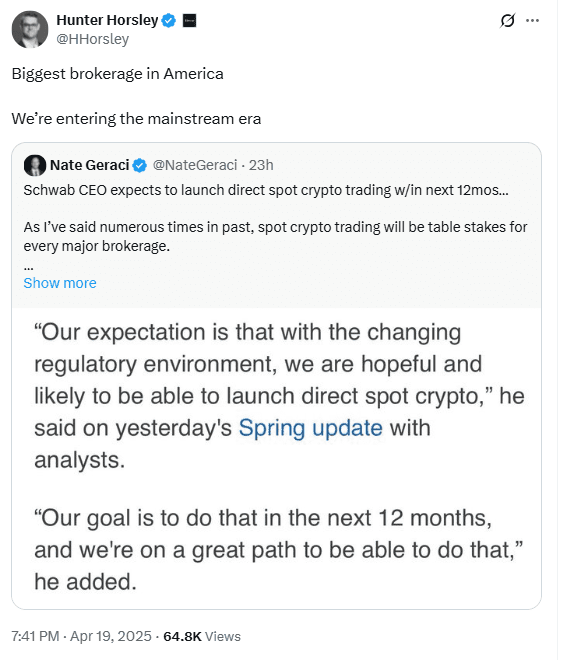

Charles Schwab’s crypto enlargement obtained consideration from different monetary business leaders. Bitwise CEO Hunter Horsley commented on the plan. He known as it a milestone in digital property gaining floor within the conventional monetary sector.

Rachael Horwitz, Chief Advertising Officer at Haun Ventures, additionally reacted. She urged Charles Schwab may discover crypto-collateralized lending sooner or later.

“Schwab should implement crypto-collateralized lending as part of its banking services next,”

Horwitz stated.

Schwab has not confirmed any new crypto banking options. The main target stays on regulatory readiness and launching spot crypto buying and selling by 2026.