NAIROBI (CoinChapter.com) —Bitcoin (BTC) stays range-bound with weak volatility, Chainlink (LINK) sees whale accumulation regardless of price drops, and Toncoin (TON) struggles to interrupt out. Market uncertainty and low momentum outline their present developments.

Bitcoin Stagnates Amid Weak Volatility and Market Uncertainty

Bitcoin (BTC) continues to face lackluster momentum as numerous market indicators sign weak point. In accordance with K33 Analysis, BTC’s buying and selling quantity, yields, and CME futures premium have dropped to ranges not seen since earlier than the final U.S. presidential election. The futures premium slipped beneath 5%, suggesting a possible shift towards a bearish section.

A descending channel sample on BTC’s day by day chart suggests continued draw back danger. Key resistance ranges lie at $100,415 (0.5 Fib) and $102,512 (0.618 Fib), with a breakout probably focusing on $109,302 and $120,286 (1.618 Fib extension).

Regardless of this, enterprise intelligence agency Technique (previously MicroStrategy) stays dedicated to accumulating BTC. The corporate introduced plans to lift $2 billion by senior convertible notes, with proceeds directed towards Bitcoin purchases. This aligns with Technique’s 21/21 plan to amass $42 billion value of BTC over three years.

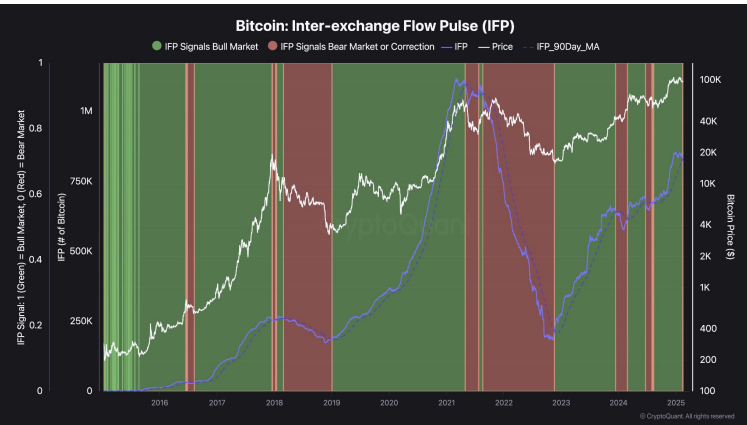

Nonetheless, BTC stays trapped in a consolidation vary between $94,000 and $100,000, with market uncertainty exacerbated by geopolitical and macroeconomic issues. In accordance with Bitfinex’s newest Alpha report, Bitcoin’s Inter-Trade Movement Pulse (IFP) turned bearish for the primary time since June 2024, hinting at diminished danger urge for food.

In the meantime, QCP Capital notes that Bitcoin’s implied volatility continues to say no, mirroring previous intervals the place BTC struggled to interrupt out of a multi-month vary.

Chainlink (LINK) Sees Elevated Whale Accumulation Regardless of Worth Declines

Chainlink (LINK) has been on a rollercoaster trip. It ranks as the highest Actual World Belongings (RWA) protocol by improvement however has suffered a 9% drop in price over the previous day. LINK at present trades at $17.51, down practically 70% from its all-time excessive. Regardless of this, on-chain knowledge factors to robust accumulation by whales, an element that would present much-needed price stability.

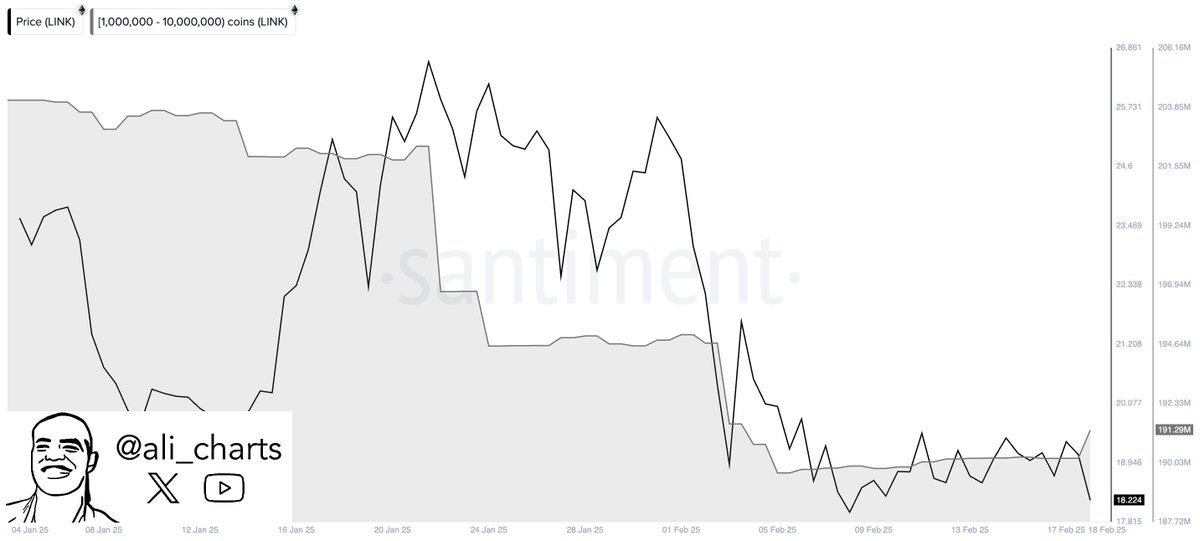

In accordance with blockchain analytics agency Santiment, high LINK holders have been steadily growing their holdings since early February. Giant traders gathered 1.6 million LINK between Feb. 3 and Feb. 17, valued at roughly $28 million.

Distinguished analyst Ali Martinez additionally reported that 1.1 million LINK ($19 million) was purchased by whales previously 24 hours, signaling long-term confidence within the asset.

Cardano founder Charles Hoskinson additionally expressed optimism about Chainlink, stating that integrating its oracle options is significant for blockchain adoption in conventional finance.

Toncoin (TON) Eyes Breakout as Whale Demand Surges

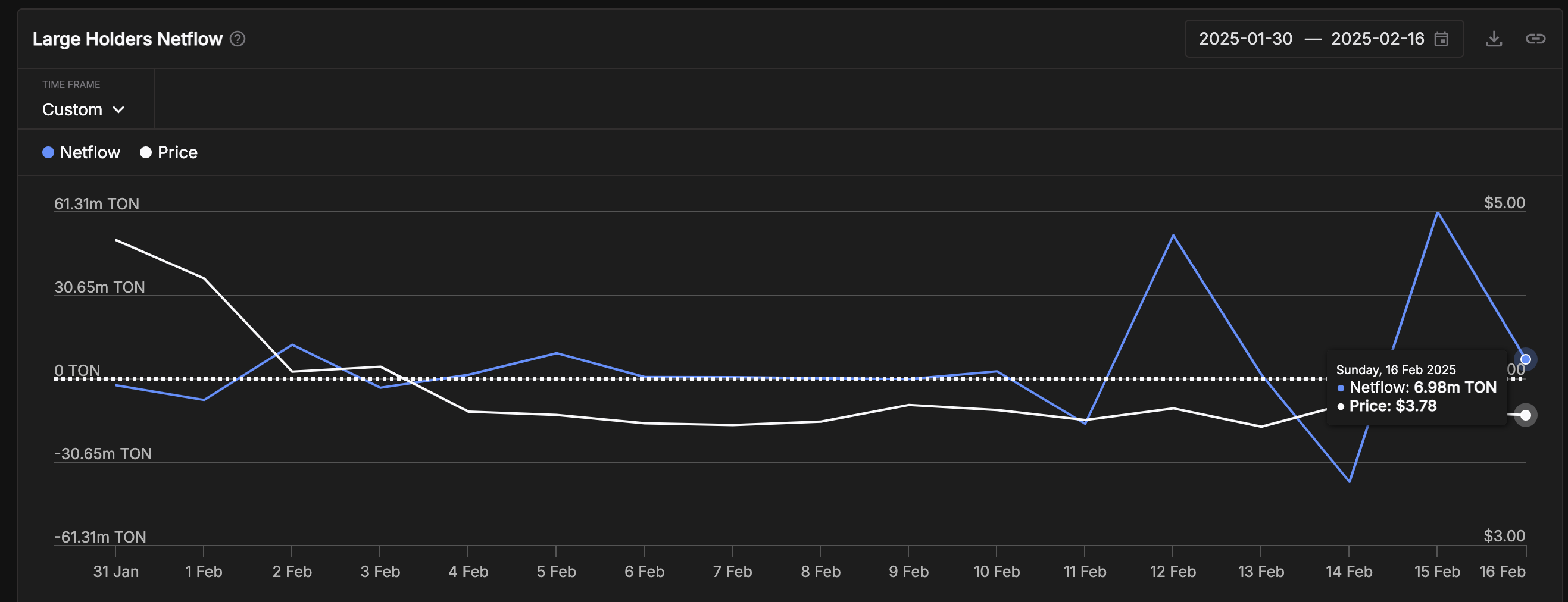

Toncoin (TON) has remained in a sideways pattern between $3.70 and $3.90 for practically two weeks, however massive holders have ramped up their accumulation.

On-chain knowledge from IntoTheBlock signifies that whales have acquired 68 million TON tokens, value roughly $250 million, because the U.S. Securities and Trade Fee (SEC) acknowledged the Dogecoin ETF submitting on Feb. 14.

This robust shopping for exercise suggests rising confidence amongst institutional traders, traditionally a precursor to price recoveries. If the pattern continues, TON might break above its $4.00 resistance and goal $4.50 within the coming weeks.

TON’s TVL surges, then drops alongside price. Supply: CryptoQuant

Whereas TON’s Whole Worth Locked (TVL) has declined, staking participation has surged, indicating a shift in investor desire towards secure yield-generating alternatives. The upcoming integration of USDT borrowing on the Factorial Finance protocol additional enhances TON’s ecosystem, probably boosting demand for the asset.

Bitcoin’s weak volatility, Chainlink’s whale accumulation, and Toncoin’s rising investor curiosity replicate a transition market. Whereas BTC stays range-bound, massive traders proceed accumulating LINK and TON, hinting at long-term optimism regardless of short-term uncertainty.