Key Takeaways

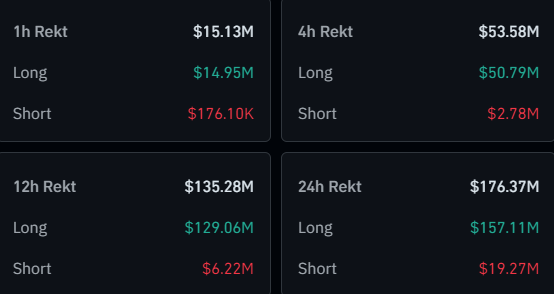

- Bitcoin fell 4.4% in 24 hours, dropping under $60,000 and triggering $157m in lengthy place liquidations.

- Market considerations stem from potential Mt. Gox creditor sell-offs and Fed Chairman Powell’s remarks on US financial instability.

Share this text

Bitcoin (BTC) is down 4.4% prior to now 24 hours after shedding the $60,000 price flooring as we speak, in accordance to information aggregator CoinGecko. This motion prompted a price droop in the entire market, leading to almost $157 million in lengthy positions being liquidated intraday.

The damaging efficiency of Bitcoin and different crypto could possibly be tied to the looming fears of a Mt. Gox collectors’ sell-off this month, and a possible damaging response to Jerome Powell’s remarks yesterday concerning the US financial system.

As reported by Crypto Briefing, a CoinShares examine highlights that the concern of an enormous BTC sell-off by the compensation of Mt. Gox collectors could be exaggerated. The worst-case situation shared within the examine reveals a single 19% every day drop in price, though CoinShares analysts discover this final result to be unlikely.

Furthermore, the speech by the Chairman of the Federal Reserve yesterday, in Portugal, raised some considerations amongst buyers. Highlights from Powell’s remarks are the finances deficit being “very large and unsustainable,” the unemployment price at 4% remains to be very low, and the Fed is just not assured sufficient to chop rates of interest.

This paints an image of steady financial instability within the US and leaves the market questioning how lengthy it should take for the primary rate of interest minimize. Due to this fact, this impacts crypto straight, as danger belongings want each smaller rates of interest and an optimistic panorama to grow to be extra engaging.

Share this text

![]()