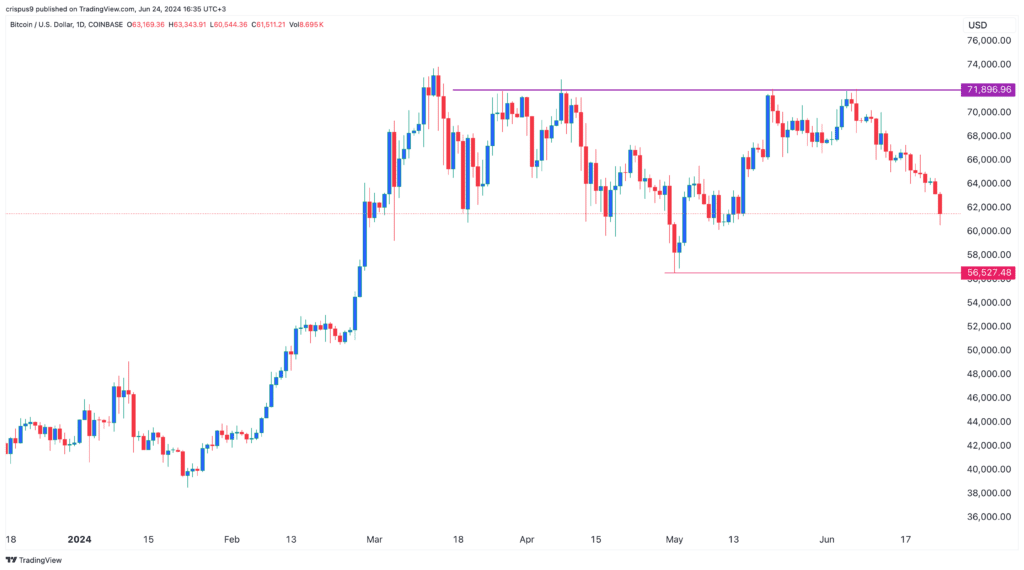

Bitcoin price was below heavy promoting strain on Monday, persevering with a sell-off that began on June seventh when it peaked at $72,000.

BTC examined the $60,000 degree, that means it has now misplaced greater than 15% of its worth over the previous few weeks. Bitcoin’s weak point triggered a serious crash amongst altcoins, with tokens like Turbo, Solana, and Cardano falling greater than 20%.

The bullish case for Bitcoin

A way of pessimism and concern has unfold within the crypto trade because the concern and greed index moved to 49, down from the year-to-date excessive of over 90.

Nevertheless, some analysts are nonetheless optimistic that Bitcoin continues to be in an uptrend. In an X publish, crypto analyst Rekt Fencer defined that BTC will in the end bounce again later this yr.

He cited a number of potential catalysts that can push Bitcoin greater. First, he famous that Bitcoin tends to consolidate after halving. This consolidation doubtless occurs due to the idea often called shopping for the hearsay, and promoting the actual fact.

On this case, Bitcoin halving occurred at a time when the coin was considerably greater following the approval of spot Bitcoin ETFs in January. As such, this consolidation is occurring as buyers look forward to the subsequent catalyst. In 2016, Bitcoin consolidated for 4 months after halving whereas in 2020, it consolidated for 5 months.

Rekt additionally famous three key causes for the present consolidation:the summer season interval is a interval of stagnation, the uncertainty of the Ethereum ETF, and the dearth of a transparent narrative out there. Additionally, the narrative has been fairly detrimental, with headlines like Germany promoting $3 billion in Bitcoins and ETFs recording nearly $1 billion in outflows.

Subsequently, Rekt believes that Bitcoin price will in the end bounce again. A few of the potential catalysts would be the upcoming US election, the place Donald Trump has supported digital currencies, rate of interest cuts by key central banks, and the approval of Ether ETFs.

Altcoins like Ethereum, Solana, IOTA, and Hedera Hashgraph to learn

Rekt believes that different altcoins may even profit from the Bitcoin rebound. Generally, altcoins, together with meme cash like Bonk, Pepe, and Floki are likely to outperform Bitcoin throughout bull runs.

Ethereum price will rise as a result of the SEC has signalled that it’s going to approve most or all ETF functions quickly. Such a transfer will doubtless result in extra inflows as we noticed with Bitcoin a number of months in the past. This accumulation will occur at a time when the quantity of Ethereum balances in exchanges is falling.

Solana price may even profit when the SEC approves Ethereum ETFs. As one of many largest and most liquid altcoin, the expectation is that corporations will file for Solana ETFs. Simply final week, 3iQ Digital Asset Managent filed for North America’s first Solana ETF in Toronto.

If his estimate is right, it implies that different altcoins like IOTA, Hedera Hashgraph, and Zilliqa will resume their rebound.

Bitcoin price chart

Nonetheless, there are dangers to the BTC and altcoins bullish prediction. The important thing one is that Bitcoin has shaped a triple-top chart sample at $72,000. Generally, this sample is likely one of the most bearish ones and a crash under the neckline at $56,520 may level to extra draw back.