Bitcoin miners are feeling the warmth after Bitcoin Halving. Nevertheless, is BTC able to surge above $74,000 with the provision shock?

Bitcoin is cyclic, regardless of whether or not you’re a dealer, HODLer, or miner. After the highs of 2021, costs crashed in 2022, solely to bounce again strongly within the second half of 2023.

Those that bailed out, taking a success, meant they missed the experience to all-time highs.

Although Bitcoin is weaving horizontally just under $70,000, which is at 2021 highs, the uptrend stays, and there could possibly be extra room for progress.

This is applicable in case you are a dealer or HODLer.

It is vitally completely different for Bitcoin miners and related buyers.

Roughly two months after celebrating file income when BTC broke $73,500 to register new all-time highs, miners are going through a harsh actuality.

(BTCUSDT)

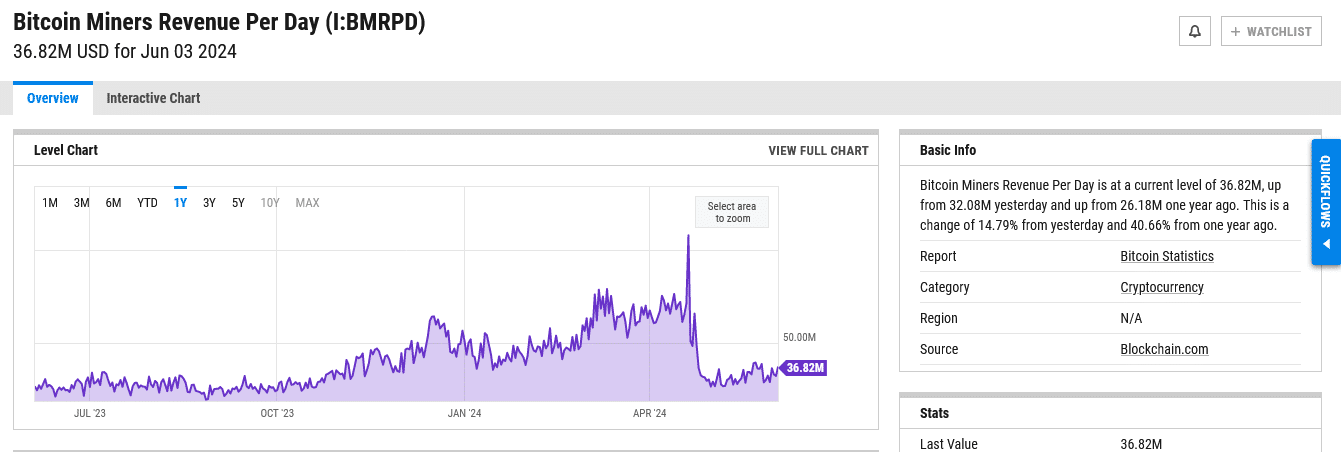

The contraction of costs in Might, coupled with the Halving occasion on April 20, has seen their earnings plummet to the bottom stage since October 2023. However tright here is hope.

Like prior to now, analysts count on costs to pierce above $74,000 in a post-Halving rally.

Nonetheless, a crucial query stays: Is that this income hunch a short lived bump or an indication of a coming crypto winter?

The Bitcoin Halving Impression on BTC Worth

Presently, on-chain mining knowledge paints a sobering image. In line with YCharts, day by day Bitcoin mining income plummeted from a mean of $70 million in April to round $30 million in Might.

(yChart)

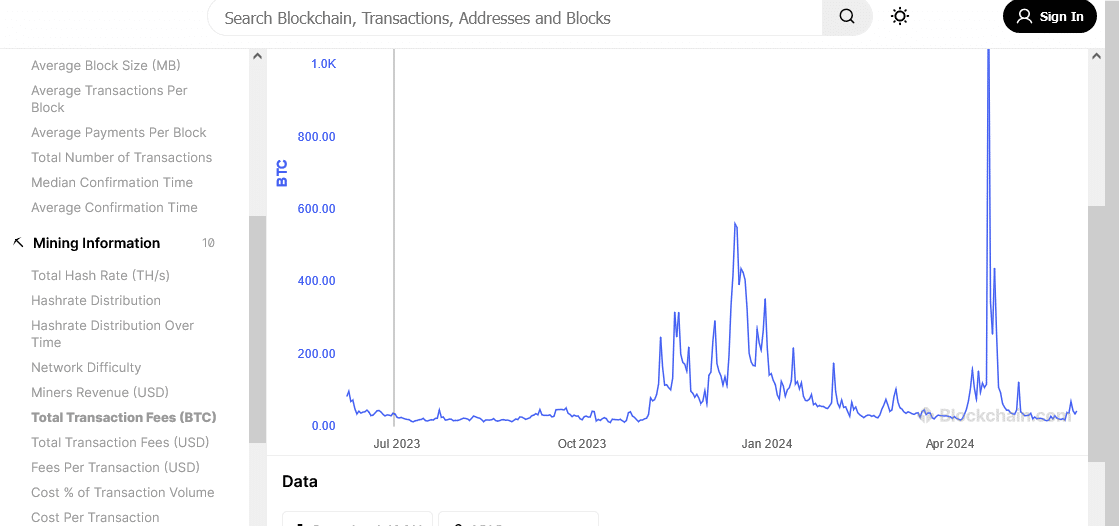

Worryingly, this decline is not only about block rewards—which had been chopped on Halving Day—but in addition in transaction charges.

Whereas block rewards are at 3.125 BTC, transaction charges barely fell in April, based on blockchain.com knowledge.

(Blockchain.com)

The drop was due primarily to Halving, a pre-programmed occasion that slashes mining rewards roughly each 4 years.

Each halving is predicted to place a monetary pressure on Bitcoin miners since most depend on block rewards for income. There’s proof to spotlight this.

Bitfarms, a public Bitcoin mining firm, aptly exemplifies these challenges. Mining income fell 42% in Might as they solely mined 156 BTC, down from 263 BTC in April.

Bitfarms attributes this decline to a mixture of things.

Submit-halving economics undoubtedly performed a task. Even so, Bitfarms stated frigid climate at its Argentinian facility pressured them to cease operations for eight days.

Bitcoin Miners Replace: Is There a Bitcoin Provide Shock?

Regardless of the present downturn, there are some optimistic indicators for miners. The hash price, a metric reflecting the profitability of mining Bitcoin, improved in Might, rising from $47 per PH/s to $58 per PH/s.

(Hash Charge)

It’s a lot decrease than the $170 per PH/s registered on April 21. On the similar time, costs have stabilized, rising from the $56,500 stage registered in Might.

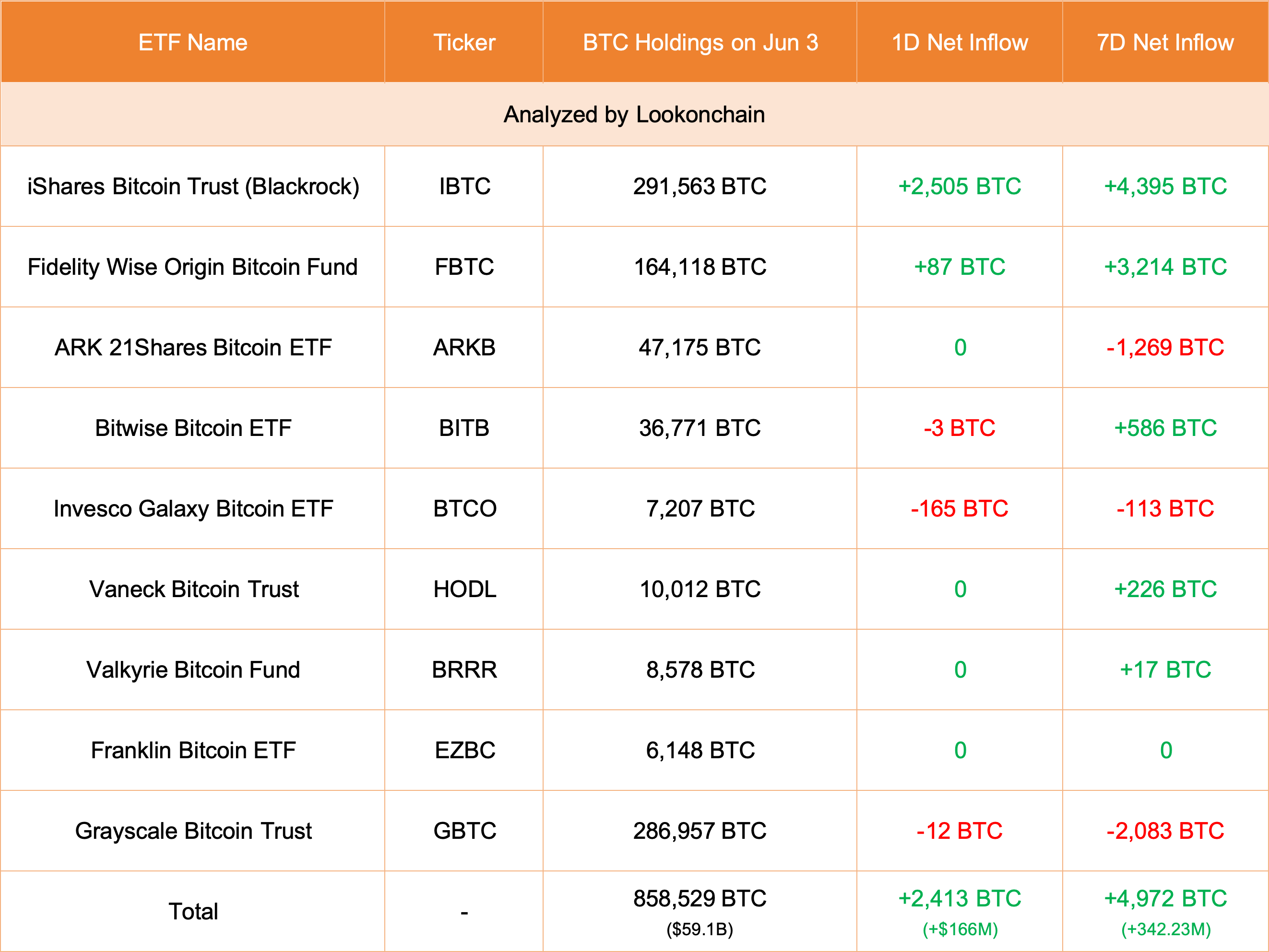

There could possibly be extra room for progress within the coming classes, however demand will play a key function. Encouragingly, inflows to identify Bitcoin ETFs are rising. Within the final week of Might, issuers have been shopping for much more BTC than mined.

DISCOVER: Find out how to Purchase Bitcoin Spot ETF in June 2024

Yesterday, Lookonchain knowledge reveals that issuers purchased 2,413 BTC value over $166 million. Solely 450 BTC are mined every single day within the present epoch.

If that is sustained, the day by day provide of cash can be far lower than demand, making a provide shock that can solely profit bulls.

EXPLORE: Bitcoin “Going” To Cardano Forward of The Chang Arduous Fork

Disclaimer: Crypto is a high-risk asset class. This text is offered for informational functions and doesn’t represent funding recommendation. You possibly can lose all your capital.