Bitcoin-Gold Ratio Holds as Shares Crash

The Bitcoin-to-gold cross presently trades at 25.6, a stage that traditionally triggered main volatility in crypto markets. Since 2020, the ratio has fluctuated between 16 and 37, indicating a key inflection zone. Merchants now monitor this metric as a sign for both continuation or reversal of Bitcoin’s current power.

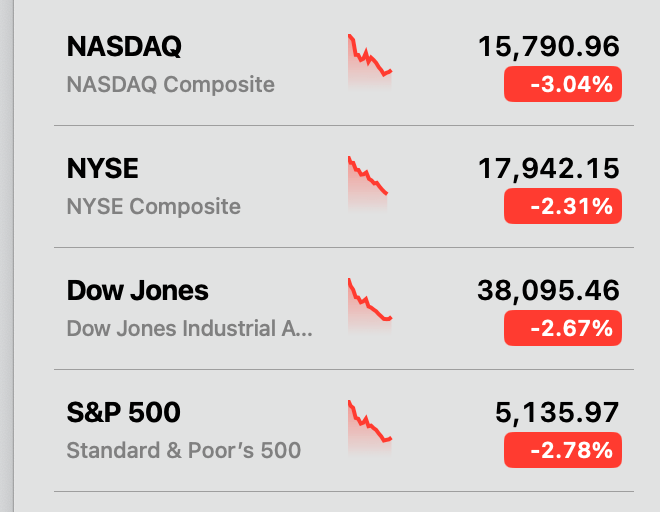

Based on Bloomberg Intelligence’s Mike McGlone, U.S. shares have shed $13 trillion in market worth from their peak, pushing the market cap-to-GDP ratio under 1.85. This shift displays the growing divergence between conventional threat property and various shops of worth. Bitcoin and gold have each outperformed equities throughout this downturn, solidifying their enchantment during times of macro instability.

China Buys Gold, Bitcoin Holds Above $87K

China’s central financial institution added 5 tonnes of gold to its reserves in March, marking its fifth consecutive month of accumulation. This brings the nation’s official gold holdings to 2,292 tonnes, accounting for six.5% of its whole reserves. The transfer indicators a broader pivot away from U.S. dollar-denominated property amid rising skepticism over U.S. coverage stability.

The Kobeissi Letter confirmed the development, suggesting China seeks asset safety from growing geopolitical and financial dangers. In the meantime, Bitcoin maintained its place above $87,000 regardless of a $5 billion outflow from U.S.-based Bitcoin ETFs, showcasing resilience.

Bitcoin’s stability comes because the digital-asset market cap rose 3% to $2.75 trillion. BTC briefly touched $88,527 earlier than retreating to $87,200. Analysts on social media count on the present bullish consolidation to proceed if macro situations stay tense.

Gold Hits Report as Secure Haven Demand Surges

Gold surged previous $3,400 per ounce on Apr. 21, hitting a brand new all-time excessive. The steel’s rise displays broad market concern triggered by ongoing U.S.-China commerce hostilities and greenback depreciation. The ICE U.S. Greenback Index fell to a three-year low of 97.92, prompting a rush into non-dollar shops of worth.

With the 10-year Treasury yield rising to 4.40% and fairness markets posting back-to-back losses, the enchantment of safe-haven property has grown. Gold’s fast ascent underscores the shift in investor priorities, whereas Bitcoin’s relative calm hints at broader institutional positioning.

Whale Exercise Indicators Confidence

Glassnode knowledge reveals a pointy enhance in Bitcoin whale wallets. Greater than 60 new addresses holding over 1,000 BTC appeared since early March, lifting the whole above 2,100. This marks the very best focus of enormous wallets in 4 months, suggesting rising curiosity from high-net-worth buyers.

The divergence between ETF flows and whale accumulation raises questions on institutional sentiment. Whereas ETF merchandise noticed capital outflows, direct accumulation suggests long-term conviction amongst market individuals. The dynamic helps a situation the place Bitcoin continues to observe gold as a hedge towards systemic uncertainty.

BTC-Gold Hyperlink Grows Amid Coverage Doubts

Merchants now interpret the Bitcoin/gold ratio as a barometer for macro threat. As each property maintain agency towards mounting geopolitical and financial threats, their efficiency mirrors buyers’ retreat from shares and bonds.

Michael van de Poppe famous each BTC and gold carried out nicely over the weekend however cautioned towards short-term euphoria. “Probably it will give it back,” he mentioned on X, hinting at attainable corrections forward. Nonetheless, many see the digital-gold thesis gaining momentum as international confidence in U.S. financial management continues to erode.

Bitcoin’s gravity stays tethered to gold’s trajectory. Because the greenback weakens and yields rise, the crypto market might discover its subsequent catalyst in a renewed surge of flight-to-safety demand.