KanawatTH

Bitcoin (BTC-USD) is among the most attention-grabbing monetary property in fashionable instances to me. The asset is mired in controversy, with avid supporters who imagine that its price is ready to extend by many multiples sooner or later and robust detractors who oftentimes imagine that Bitcoin is not value something in any respect.

Solely a really small variety of property have such a excessive diploma of deviation in what buyers imagine the asset must be buying and selling for, and it displays an inherent problem in answering the query of Bitcoin’s true worth.

I personally fall into the camp that believes that Bitcoin and most cryptocurrency normally is at present of little to no intrinsic worth. I imagine this for a myriad of causes, reminiscent of Bitcoin being simply copiable (many have simply launched their very own cryptocurrencies with equivalent properties), in addition to it being impractical for transactions with out the usage of a centralized entity. Moreover, Bitcoin being the primary cryptocurrency, just isn’t as technologically superior as its successors, which use ideas reminiscent of proof of stake.

That being mentioned, in case you took this stance at practically any level since Bitcoin’s inception, it might’ve misplaced you cash, so this view will not characteristic in my analysis.

As an alternative, my analysis will concentrate on taking a look at provide/demand dynamics and analyzing the important thing components which affect the availability and demand sides of the Bitcoin market. Wanting again over the historical past of Bitcoin, I imagine that taking this method would’ve, normally, led to extra correct buying and selling selections than focusing solely on attempting to find out an intrinsic worth for Bitcoin, after which making funding selections primarily based on that.

Key Elements Influencing Bitcoin Demand:

The first components which affect the Demand for Bitcoin in my eyes are as follows:

- Media consideration on Bitcoin/crypto: In each 2017 and 2021, media consideration contributed considerably to Bitcoin’s run-up. Adverts for numerous cryptocurrencies may very well be seen in airports, on public buses or in subways globally. This elevated media consideration led to elevated shopping for, inflicting price will increase, once more garnering extra consideration. Throughout these intervals, it was widespread to listen to folks with in any other case little to little interest in finance speaking about cryptocurrency, and superstar promotion of cryptocurrency was widespread.

- Elevated adoption: The current Bitcoin rally comes not less than partially because of the approval of Bitcoin ETFs, that are extremely regulated and thus enable buyers who’re in any other case cautious of placing their cash in Bitcoin to take a position, in addition to encouraging a point of enhance in institutional adoption.

- The integrity and fame of the crypto ecosystem: Curiously, when occasions happen which present that there may be penalties for nefarious actors within the crypto group, Bitcoin tends to rally. In some methods, it is a side of elevated adoption, because the rallies are seemingly primarily based on eradicating fraudsters from the ecosystem being seen pretty much as good for long run funding/adoption. A current instance of that is when Bitcoin rallied in anticipation of the sentencing of Sam Bankman-Fried. This will even have a major influence on provide, with information of fraud, pushing costs down.

- Sooner/sooner than anticipated rate of interest cuts, which have a tendency to profit risk-on property.

Key Elements Influencing Bitcoin Provide:

Bitcoin provide is mostly affected by two vital components:

- Bitcoin’s price relative to its current historical past: A runup in price can result in will increase in buyers trying to promote to lock in good points. Relying on the state of affairs, this impact can nevertheless typically be counteracted by much more demand to purchase, because of seeing a runup and hoping it is going to proceed.

- Bitcoin halving: Each time Bitcoin goes by a halving, the entire quantity of recent Bitcoin awarded to miners decreases. Since miners promote Bitcoin to cowl prices which they should pay in fiat foreign money, much less Bitcoin being awarded to miners restricts Bitcoin provide.

Evaluation of Demand Elements:

Beginning on the Demand aspect; it is clear immediately that the quantity of media consideration surrounding Bitcoin and crypto as a complete is pretty minimal in comparison with the eye it garnered prior to now, close to the peaks of bull runs. In 2021, you could not keep away from listening to about or seeing advertisements for crypto in case you tried. Immediately, that promotion is way extra subdued.

In my evaluation this will imply certainly one of two issues: Firstly, that we’re not but on the prime of a bull run, or secondly that after the immense hype surrounding cryptocurrency in 2021 and the variety of people who misplaced cash investing in it on the time, the broader public are apathetic in the direction of crypto and Bitcoin, resulting in the decrease media consideration we see immediately. My evaluation is that the latter case is extra seemingly.

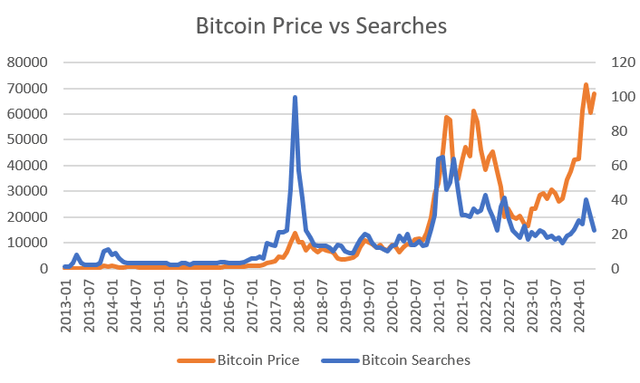

Bitcoin Worth vs Searches Chart (Excel)

The above chart plotting Bitcoin price vs. Bitcoin Google searches (expressed as a share of their all time excessive determine achieved in 2017), lends proof to the commentary that Bitcoin is not gaining practically as a lot consideration as prior to now. Moreover, curiosity in Bitcoin has begun trending down sharply, while costs aren’t budging. Within the absence of price appreciation, it is troublesome to determine a serious driver of development in media consideration for Bitcoin.

Moreover, it is evident from the chart that earlier intervals of development within the price of Bitcoin have occurred solely along side rising curiosity, and when price stagnated, alongside searches, that marked the tip of the bull run.

In my opinion, this lends proof to the case that Bitcoin has reached a close to time period peak and can start to development downwards.

Moreover, within the close to time period, there are not vital occasions on the horizon which might enhance adoption. The Bitcoin ETFs clearly did lend themselves to this, however that is already contributed to a big runup in price.

The approval and impending launch of Ethereum ETFs might assist enhance funding in Bitcoin ETFs, in the event that they draw ample media consideration to crypto ETFs as a complete. Nevertheless, Ethereum (ETH-USD) does compete with Bitcoin as an funding and thus, the launch of Ethereum ETFs might additionally result in a lower in demand for Bitcoin ETFs, as buyers use the Ethereum ETFs instead as a substitute. Therefore, the web impact of the launch of those ETFs on demand for Bitcoin is blurry, however probably impartial or reasonably optimistic within the quick time period, however destructive over the long run, because the impact of media consideration because of their launch dies down, leaving solely a competitor for funding.

From an integrity standpoint, I imagine that there are unlikely to be any main scandals within the cryptocurrency group within the subsequent few months. The FTX and Binance circumstances are previous information and basically resolved. The remaining exchanges are usually of upper integrity. Coinbase is even listed on the inventory alternate, and thus has much more incentive to function conservatively and keep away from pushing the boundaries of the regulation. This could have a touch optimistic impact on shopping for and suppress promoting.

Barring any anomalies, the present trajectory of charges anticipated by the market seems to be affordable, and so I am comfy to imagine that the impact of future fluctuations of rates of interest is impartial in expectation.

Evaluation of Provide Elements:

Bitcoin’s price is excessive relative to its current historical past. Moreover, the price is now not rallying, which is prone to suppress shopping for from buyers hoping to get in on a runup. The impact of this must be easy. This could enhance promoting strain, as buyers look to lock in good points and trim allocations to a risky asset.

Moreover, while the Bitcoin halving sometimes precedes a rally within the price of Bitcoin. This time, the price rallied previous to halving and has remained regular since then. I view this as a consequence of extra subtle organizations reminiscent of hedge funds buying and selling Bitcoin immediately, whereas prior to now, Bitcoin buying and selling was comprised largely of retail merchants.

If the expectation is for the price to understand upon halving resulting from a discount in provide because of miners promoting, then the rational resolution is to purchase, previous to halving. If sufficient subtle buyers come to the identical conclusion, this might result in a rally previous to halving, somewhat than after it, which is per what we have seen out there this time.

This leads me to imagine that the halving is already priced in by buyers, and Bitcoin merchants cannot count on the previous technique of shopping for after halving to get in on a rally to work.

Bringing it Collectively:

While there are some occasions on the horizon which can be prone to trigger marginal demand development, the lackluster and declining media consideration and curiosity in Bitcoin far outweighs the consequences of those occasions in my eyes. Moreover, the correlation between searches and price rallies has held sturdy prior to now and vital rallies have solely taken place along side climbing consideration and curiosity, one thing which is not current at present.

The provision image is not wanting nice for Bitcoin’s price both, with the restriction in provide resulting from halving seeming to be already accounted for, as evidenced by the pre-halving rally. Bitcoin’s comparatively excessive price and stagnant rally additionally offers buyers within the inexperienced a superb probability to trim Bitcoin allocations, which I count on so as to add to promoting strain.

Combining either side of the market, it appears to be like as if the probably consequence is that demand lags behind provide, which ought to end in a declining price. Because of this, I am initiating protection on Bitcoin with a promote ranking.