17h00 ▪

7

min of studying ▪ by

There was plenty of volatility in rates of interest over the previous two years. How can a change within the yield charge have an effect on an asset like bitcoin? That is the place we’ll take a look at the various factors surrounding rate of interest modifications and the implications for bitcoin.

Why is the 10-year yield charge vital?

The ten-year US yield charge is likely one of the most watched rates of interest on the earth. There are a number of elements that specify this. Firstly, it’s used because the least dangerous funding as a result of the US Treasury is anticipated to repay the invested capital on the maturity date. The danger lies within the nation’s solvency. Subsequently, as it’s thought of low-risk, it would usually be in comparison with different asset lessons. That is to find out whether or not the compensation can be price it. So, the target is to hunt a better return than the “free risk” if we take an asset with extra danger. Secondly, the 10-year yield charge will even play a job in relation to different money owed. For instance, it would have an effect on the charges used for mortgages or loans.

Components influencing the 10-year yield charge

The variation within the 10-year yield charge (rate of interest) can come from a number of causes corresponding to development evolution, inflation, central financial institution selections, provide and demand… Because it evolves in response to a number of elements, the influence on property can generally differ. That’s why it’s vital to know the underlying cause for the motion and the surroundings.

For instance, the 10-year yield charge would possibly rise as a result of we’re in a development acceleration section. After which, it might proceed to rise as a result of there may be inflationary strain ensuing from the expansion acceleration. In each instances, the rate of interest rises, however the influence on curiosity rate-sensitive property can be totally different. It’s all about steadiness regarding the goal inflation charge.

Given the financial local weather (inflation, development), central banks’ selections on the important thing rate of interest will even affect yield charges and provide and demand. For instance, when the central financial institution raises its charges to sluggish down inflation, there comes a stage the place short-term charges exceed long-term charges. That is when it turns into restrictive. It will then immediate buyers to favor short-term treasury bonds over long-term bonds as a result of the remuneration charge is healthier. Conversely, when the central financial institution decides to decrease its charges, this will likely encourage buyers to favor bonds because the yield curve is anticipated to normalize (short-term charges decrease than long-term charges).

How will the 10-year yield charge influence bitcoin?

Bitcoin is kind of delicate to rate of interest fluctuations like many different property. Prior to now, there have been situations the place the yield charge rose and bitcoin additionally rose, simply as there have been occasions when the speed fell and bitcoin rose. And extra hardly ever, there have been occasions when charges fell and bitcoin additionally fell. This may be complicated, however that is the place we have to decide the rationale for the yield charge motion. We’ll take some examples to facilitate understanding.

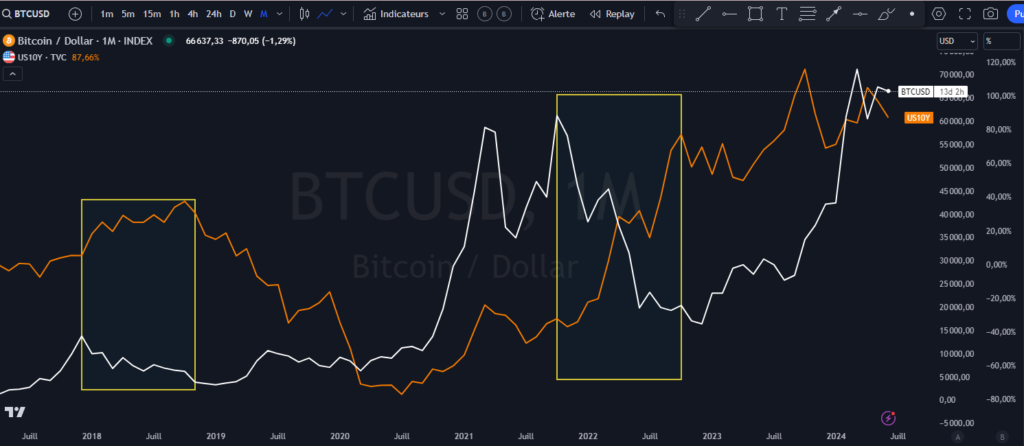

For instance, if the 10-year yield charge rises as a result of development accelerates, the variation in bitcoin ought to be constructive since investor confidence to take a position is again. This may be seen within the chart beneath after the trough of the Covid disaster. Yields rose with bitcoin.

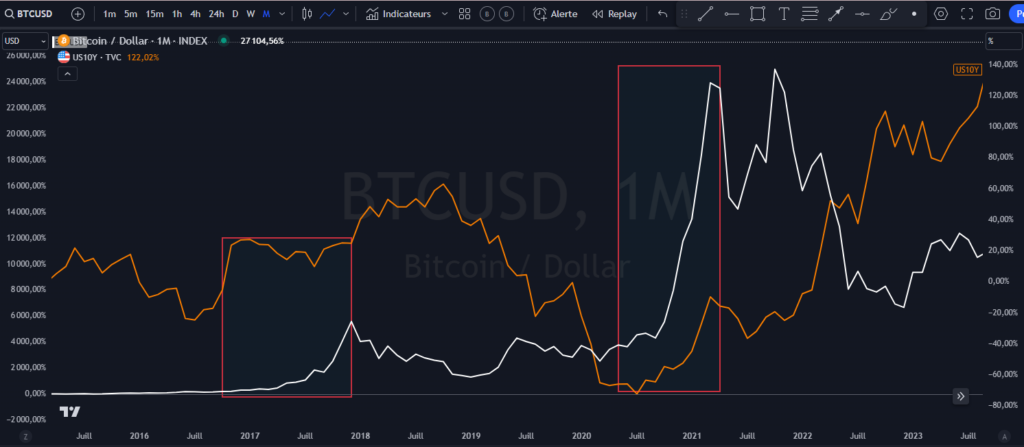

The opposite instance beneath highlights the rise within the yield charge following an inflation rise. A price improve generally is a late consequence of development acceleration. In this type of scenario, a number of danger property, together with bitcoin, face extra difficulties as a result of the speed rises to sluggish inflation whereas development slows. In such a local weather, bitcoin is extra weak. Right here is the graph exhibiting bitcoin and the yield charge in such an surroundings.

There are a number of causes that may clarify this, notably the weakened buying energy. Buyers are extra skeptical about investing capital. Moreover, because the borrowing value is increased, it limits the potential leverage utilized in firms for improvement. That is additionally true for households that may borrow much less to eat. This may have fast repercussions on extra risk-sensitive property like small companies or speculative property. The investor will favor safer placements by favoring low-risk merchandise like treasury bonds.

Bitcoin, inflation, and the yield charge

Bitcoin was strategically designed to deal with inflation by means of financial provide enlargement. The halving course of will cut back its inflation charge each 4 years. This dynamic permits bitcoin to be bullish in the long run so long as we proceed to have financial provide development.

Regardless of its inflation charge being decreased each 4 years, it has not served as a hedge in opposition to the robust inflation surge that accompanied an increase within the yield charge in 2022. That is primarily as a result of bitcoin is a performing asset when monetary situations are favorable. As central banks applied a restrictive program by means of charge hikes, monetary situations grew to become harder. The US greenback strengthened, yields rose, and the expansion of the cash provide decreased. Consequently, bitcoin fell.

Bitcoin tends to carry out higher when monetary situations are extra accommodating. Despite the fact that the Fed maintained excessive charges in 2023 (implying excessive yield charges), the disinflation course of, the Fed’s pause, and the greenback’s decline supplied extra versatile monetary situations. This additionally explains the financial restoration and bitcoin’s rebound regardless of nonetheless excessive charges. Therefore, understanding the financial surroundings is essential to figuring out the variation of property like bitcoin.

The rate of interest or yield charge has a major affect on many property together with bitcoin. Typically, the decrease the charges, the extra it encourages consumption and funding, leading to price will increase, which is constructive for bitcoin in the long term.

Maximize your Cointribune expertise with our ‘Learn to Earn’ program! Earn factors for every article you learn and achieve entry to unique rewards. Signal up now and begin accruing advantages.

Click on right here to hitch ‘Learn to Earn’ and switch your ardour for crypto into rewards!

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers.

Mon however ici, est de démocratiser l’data des marchés financiers auprès de l’viewers Cointribune sur différents facets, notamment l’analyse macro, l’analyse approach, l’analyse intermarchés…

DISCLAIMER

The views, ideas, and opinions expressed on this article belong solely to the creator, and shouldn’t be taken as funding recommendation. Do your individual research earlier than taking any funding selections.