Crypto exchanges play a significant position in right now’s market, and Binance and Binance.US are the 2 greatest platforms price exploring. Binance is a number one international change greatest for its wide selection of options and companies accessible internationally. Binance.US is its U.S.-based model, designed to comply with American laws and supply a a lot easier expertise.

On this information, we are going to examine Binance vs Binance US based mostly on charges, buying and selling options, merchandise, and eligibility that will help you choose the most effective platform on your wants.

What’s Binance?

Binance is a world firm that operates the largest cryptocurrency change by every day buying and selling quantity. It was based in 2017 by Changpeng Zhao. The change began in China however moved to Japan resulting from China’s cryptocurrency restrictions. It later relocated to Malta and now has no official headquarters.

The platform helps over 350 cryptocurrencies and its personal token, Binance Coin (BNB). Binance provides numerous companies past buying and selling. It supplies spot buying and selling with charges as little as 0.1%, reducible to 0.075% utilizing BNB. The change additionally helps futures buying and selling with up to 125x leverage, staking through Binance Earn, and a Visa card for spending crypto. Binance Pay permits prompt international funds with zero charges.

Binance is understood for its safety measures. It makes use of two-factor authentication, chilly storage for many belongings, and the Safe Asset Fund for Customers (SAFU) to guard customers. Binance faces regulatory challenges. The U.S. SEC sued it in 2023 for unregistered operations, and it pleaded responsible to cash laundering costs, paying $4.3 billion in penalties. Changpeng Zhao stepped down as CEO and was changed by Richard Teng. Learn our in-depth Binance overview right here.

What’s Binance US?

Binance.US is a separate platform and the greatest cryptocurrency change for customers in america. It was launched in September 2019 as a separate entity from Binance to adjust to U.S. laws.

The platform is operated by BAM Trading Providers, based mostly in San Francisco, California, and partnered with Binance for know-how and branding. Binance.US serves clients in 34 states, excluding Washington, New York, Texas, and Vermont.

The change provides buying and selling for over 160 cryptocurrencies. Binance.US costs a 0.4% maker and 0.6% taker spot buying and selling payment for normal customers. It additionally provides free Bitcoin buying and selling. The platform helps staking, permitting customers to earn rewards on belongings like Cardano (ADA) and Solana (SOL), with annual yields up to 12%.

Binance vs Binance US: Comparability Desk

| Binance | Binance.US | |

| Availability | International (180+ international locations) | U.S. solely (34 states) |

| Regulation | A number of jurisdictions (22 Licenses) | U.S. (SEC, FinCEN) |

| Supported Cryptos | 350+ | 160+ |

| Spot Trading Charges | 0.1% maker/taker | 0.4% maker and 0.6% taker |

| Cost Strategies | Crypto, card, financial institution, P2P, 100+ different | Crypto, ACH, wire, debit card, and extra |

| Trading Quantity | Very Excessive | Low |

| Liquidity | Excessive | Average |

| Person Base | 250M+ international | U.S.-focused |

| Instantaneous Purchase/Promote | Sure | Sure |

| Futures Trading | Sure (125x leverage) | No |

| Choices Trading | Sure (European Type) | No |

| Margin Trading | Sure (10x leverage) | No |

| P2P Trading | Sure | No |

Binance vs Binance US: Trading Options

Binance supplies a complete buying and selling ecosystem for all ranges. It helps spot buying and selling with over 350 cryptocurrencies and 1,400+ pairs, that includes restrict, market, stop-limit, and OCO (one-cancels-the-other) orders.

You may commerce perpetual futures contracts with up to 125x leverage and use margin buying and selling with borrowed funds at 0.01% every day curiosity. Choices buying and selling provides European-style contracts for BTC and ETH, whereas superior charting through TradingView contains transferring averages and real-time information. Binance additionally supplies P2P buying and selling for direct user-to-user trades and an OTC desk for giant orders.

Binance.US focuses on simplicity and compliance for U.S. customers. It provides spot buying and selling with primary purchase/promote options. Superior charting mirrors Binance’s TradingView integration, however futures, margin, and choices buying and selling are absent resulting from U.S. laws.

Winner: Binance, for its intensive, superior buying and selling options like futures buying and selling, margin buying and selling, and choices buying and selling.

Binance vs Binance US: Charges

Trading Charges

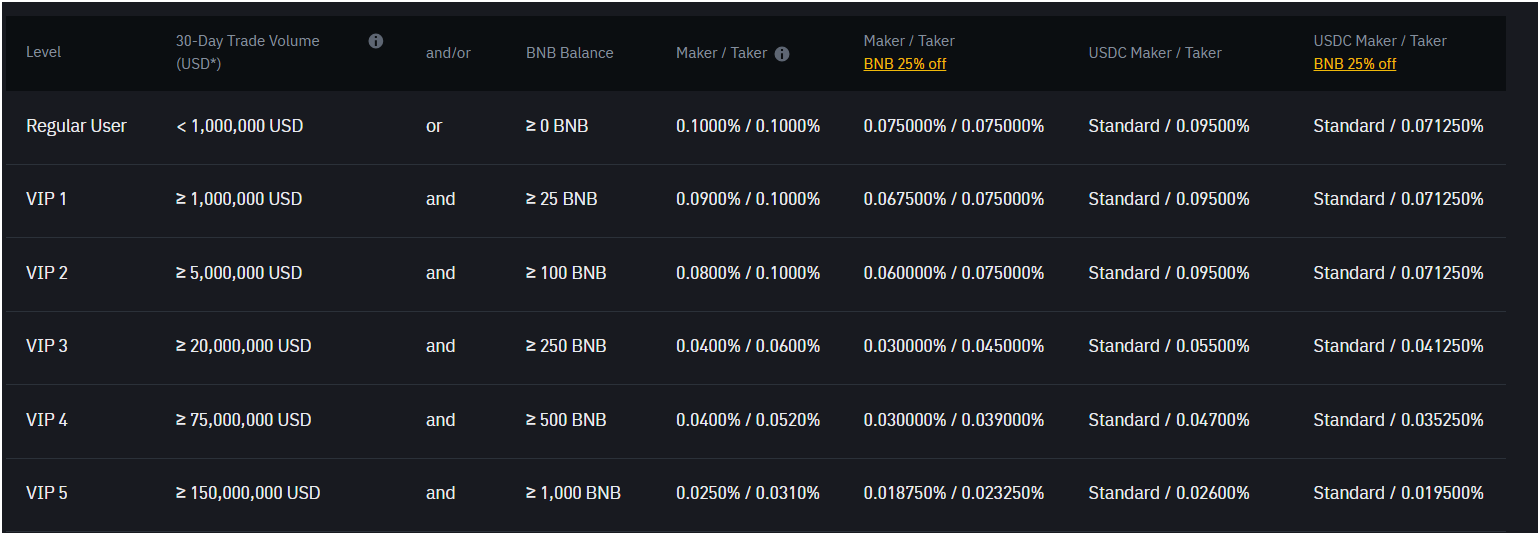

Binance provides a few of the lowest buying and selling charges within the trade. It costs an ordinary 0.1% maker and taker payment for spot buying and selling for customers with a 30-day buying and selling quantity beneath $1M.

You may cut back this by 25% (to 0.075%) by paying with Binance Coin (BNB). Greater-volume merchants unlock VIP tiers – e.g., VIP 1 (over $1M quantity) drops charges to 0.09% maker and 0.1% taker, down to 0.011% maker and 0.023% taker at VIP 9 ($4B+ quantity).

Binance futures buying and selling charges begin at 0.02% maker and 0.05% taker, additionally tiered by quantity. This construction advantages energetic international merchants with flexibility and reductions.

Binance.US charges are greater and fewer forgiving. For 30-day volumes beneath $10,000 (VIP 1), Tier 1 pairs cost 0.4% maker and 0.6% taker – 4 to 6 instances Binance’s base fee.

Tier 0 pairs (BTC/USD, BTC/USDT, BTC/USDC, BTC/BUSD) are free, however most trades fall beneath Tier 1. Above $10,000, charges drop – e.g., VIP 2 ($10,000-$50,000) is 0.25% maker and 0.4% taker, down to 0.08% maker and 0.18% taker at VIP 5 ($1M-$20M).

A 5% BNB low cost applies, which is much much less beneficiant than Binance’s 25%. No futures buying and selling exists resulting from U.S. guidelines.

Winner: Binance’s charges are constantly decrease and extra scalable, whereas Binance.US’s excessive Tier 1 charges overshadow its zero-fee BTC pairs. Binance wins for price effectivity.

Deposits and Withdrawals Charges

Binance provides free crypto deposits for all 350+ belongings. Withdrawal charges fluctuate based mostly on community congestion. Fiat deposits (e.g., USD through financial institution switch) are sometimes free through companions, however card purchases hit 3.75%. Fiat withdrawals like USD fluctuate by area. You profit from low crypto charges and P2P buying and selling with zero prices in some instances.

Binance.US additionally supplies free crypto deposits. Withdrawal charges are generally excessive in comparison with international Binance customers. Additionally, Binance.US doesn’t cost charges for USD deposits or withdrawals utilizing financial institution transfers (ACH).

Binance vs Binance US: Out there Cryptocurrencies

Binance provides entry to over 350 cryptocurrencies for buying and selling. It contains standard cash like Bitcoin, Ethereum, and Binance Coin (BNB), in addition to lesser-known altcoins corresponding to Solana, Algorand, and Matic. You may commerce lots of of pairs. Binance continuously updates its listings and infrequently provides cash by way of its Launchpad program.

Binance.US supplies a a lot smaller choice, with about 160 cryptocurrencies accessible. It contains main cash like Bitcoin, Ethereum, and Litecoin however lacks the intensive vary of altcoins discovered on Binance. The platform focuses on standard, established tokens to adjust to strict U.S. guidelines. You received’t discover as many area of interest or new cryptocurrencies right here as a result of it prioritizes regulatory security over selection.

Winner: Binance, as a result of it provides greater than double the cryptocurrency choices (350 vs. 160).

Binance vs Binance US: Regulation & Availability

Binance is a world platform that operates globally however faces some regulatory challenges. The change is banned within the U.S., Iran, North Korea, and Thailand resulting from strict legal guidelines. You can’t use Binance within the U.S. as a result of it doesn’t meet federal necessities. It holds 22 licenses in locations like Bahrain, Dubai, India, and France, but it surely’s beneath scrutiny from regulators just like the U.S. Division of Justice for previous points like cash laundering allegations in 2023.

Binance.US is designed particularly for the U.S. market. The platform is accessible in 34 states however not in Hawaii, New York, Texas, or Vermont resulting from state-specific guidelines. You may commerce legally right here in the event you’re in an allowed state, and it’s registered with the U.S. Monetary Crimes Enforcement Community (FinCEN). It avoids the worldwide bans Binance faces by tailoring its operations to U.S. legal guidelines. About availability, Binance is accessible in 180+ international locations, however Binance.US is particularly designed for U.S. customers solely.

Winner: Binance is regulated in over 22 international locations, whereas Binance.US is constructed for and registered in america solely.

Binance vs Binance US: Safety

The most important safety measures of the Binance international cryptocurrency change platform are:

- Two-factor authentication (2FA) provides an additional step to logging in or withdrawing funds. You enter a code out of your telephone or a tool like a YubiKey on prime of your password, so even when somebody will get your password, they will’t entry your account with out that second code.

- Withdrawal tackle whitelisting helps you to set an inventory of trusted pockets addresses for withdrawals. You may solely ship funds to those pre-approved addresses, which stops hackers from withdrawing your cash to their very own wallets in the event that they break into your account.

- Anti-phishing code is a singular set of letters and numbers you create. Binance contains this code in all actual emails they ship you, so you possibly can inform if an e mail is faux if the code is lacking or flawed. It helps you keep away from scams pretending to be Binance.

- Safe Asset Fund for Customers (SAFU) is an emergency fund that Binance began in July 2018. The change units apart 10% of buying and selling charges to develop this fund, valued at $1 billion.

- Chilly storage means Binance retains most consumer funds offline in safe gadgets. These gadgets aren’t related to the web, so hackers can’t attain them, and the personal keys are encrypted for further security.

Binance Hacking Points:

Binance has skilled a notable safety breach up to now. Essentially the most important incident occurred in 2019 when hackers stole 7,000 Bitcoin (BTC), price about $40 million on the time, from the change’s scorching pockets.

One other main occasion tied to Binance occurred in 2022 when a cross-chain bridge on the Binance Good Chain (now BNB Chain) was hacked. Hackers exploited a flaw, minting 2 million BNB tokens valued at $570 million. Binance paused the chain and, with group assist, froze $7 million of the stolen funds.

Binance.US Safety:

Binance.US matches many of those options for U.S. customers. It additionally makes use of 2FA and chilly storage for 95% of belongings and has its personal insurance coverage fund. The change emphasizes U.S.-based storage amenities for added belief.

You received’t discover a historical past of main breaches right here, in contrast to its mum or dad firm. It ranks excessive on safety evaluations, like CER’s checklist, even above Coinbase. The platform focuses on holding your belongings protected in a regulated surroundings.

Winner: Each exchanges are extremely safe, however Binance.US has by no means confronted a safety breach.

Binance vs Binance US: Trading Quantity and Liquidity

Binance leads the world in buying and selling quantity, with $50 billion+ every day spot buying and selling quantity. It serves 250 million customers throughout 180+ international locations, making it probably the most liquid change globally. You may execute trades quick with minimal price slippage due to its large consumer base and deep order books. The platform handles hundreds of buying and selling pairs, guaranteeing excessive liquidity even for obscure cash.

Binance.US trails far behind, with a buying and selling quantity of round $30 million per day. It caters to a smaller U.S. viewers, and also you would possibly discover slower trades or wider spreads on much less standard pairs resulting from decrease liquidity. The change helps fewer belongings, so it will possibly’t match the depth of its international counterpart.

Winner: Binance, for its unmatched buying and selling quantity and liquidity.

Binance vs Binance US: Merchandise & Providers

Listed here are the highest Binance Merchandise & Providers

- Spot Trading: Binance helps over 350 cryptocurrencies and 1,400+ buying and selling pairs, together with BTC, ETH, and altcoins like Solana.

- Futures Trading: It provides perpetual and quarterly futures with up to 125x leverage on belongings like BTC and ETH.

- Margin Trading: Binance helps you to borrow funds with rates of interest beginning at 0.01% every day. You may entry this for over 100 cash.

- Choices Trading: It supplies European-style choices for BTC and ETH with versatile expiration dates.

- Crypto Staking: You may lock cash like ETH or BNB to earn 5-20% APR, relying on phrases (30-120 days). It’s a passive revenue instrument with over 300 supported belongings.

- Financial savings Accounts: The Binance change platform provides versatile (withdraw anytime) or mounted (greater yield) financial savings for 50+ cash. You earn up to 10% APR, balancing liquidity and returns.

- P2P Market: It allows direct crypto trades with customers globally, supporting 50+ fiat currencies. It costs 0% charges for P2P trades.

- NFT Market: Binance hosts NFT buying and selling, minting, and auctions for digital belongings. You have interaction with distinctive collectibles, a rising crypto area of interest.

- Crypto Loans: You may borrow in opposition to crypto collateral for 7-180 days, with charges from 2-10%. It’s a fast liquidity choice with out promoting belongings.

- Binance Visa Card: It converts crypto to fiat for spending at 60 million+ retailers worldwide. You get up to eight% cashback in BNB, mixing crypto with every day use.

- Launchpad: Binance helps you to spend money on new token initiatives earlier than public itemizing. You commit BNB for allocations, concentrating on early-stage beneficial properties.

- Good Pool: It optimizes mining energy throughout BTC, ETH, and different cash for greater returns. You be a part of with minimal setup, geared toward miners.

Binance.US Merchandise & Providers

- Spot Trading: Binance.US provides 160+ cryptocurrencies and 324 buying and selling pairs, like BTC/USD and ETH/USDT. You commerce with greater charges (0.4% maker, 0.6% taker) until on free Tier 0 pairs (BTC/USD).

- Staking: It helps staking for cash like ETH and ADA, yielding 2-10% APR with fewer choices.

- Crypto Swaps: Binance.US supplies prompt conversions between supported cash, like BTC to ETH. You may simply swap with out order books.

- OTC Trading: It provides over-the-counter trades for giant volumes (e.g., $10,000+). You get customized pricing, fitted to institutional or high-net-worth customers.

Winner: Binance has a complete suite – spot, futures, margin, choices, staking, financial savings, P2P, NFTs, loans, a card, Launchpad, and mining. Binance.US limits itself to identify buying and selling, staking, swaps, and OTC.

Binance vs Binance US: Buyer Help

Binance provides sturdy buyer help for its international customers. It supplies 24/7 stay chat, e mail help, and an in depth assist heart with guides. You may attain out in a number of languages, reflecting its 250 million customers throughout 180+ international locations. Response instances are usually fast, usually inside hours, although peak instances can gradual issues down. The platform has improved since early complaints, incomes reward for responsiveness by 2025.

Binance.US supplies related choices however with combined outcomes. It provides 24/7 stay chat, e mail, and a help ticket system tailor-made to U.S. customers. You would possibly wait longer, generally for days, particularly throughout verification delays. The change serves fewer folks but struggles with consistency. It lacks telephone help, in contrast to some U.S. rivals like Kraken.

Winner: Binance, for quicker and extra dependable buyer help in comparison with Binance.US.

Binance vs Binance US: Person Interface

The worldwide Binance platform delivers a flexible consumer interface for all ranges. It provides a primary mode for newbies and a sophisticated mode with charting instruments, like TradingView integration, for execs. You may commerce over 350 cash throughout spot, margin, and futures markets, all on a clear, customizable dashboard. The cellular app mirrors this flexibility. It’s intuitive but filled with options.

Binance.US simplifies issues for U.S. customers. It supplies a streamlined interface with primary and superior views, supporting 160 cash on spot buying and selling solely. You get related charting instruments however fewer choices like futures or margin buying and selling resulting from laws.

The platform is user-friendly, with a cellular app rated nicely for ease, although some discover it much less dynamic than Binance’s. It fits newbies however might bore superior merchants.

Winner: Binance has a extra superior consumer interface, whereas Binance.US has a extra primary model with none superior instruments resulting from regulatory compliance.

Conclusion: Which Binance is healthier?

To check Binance vs. Binance.US, the variations are clear throughout key areas. Binance dominates globally with over 350 cryptocurrencies, a $50 billion every day buying and selling quantity, and entry in 180+ international locations, making it excellent for numerous, high-volume merchants. Its consumer interface is strong, its buyer help is environment friendly, and its safety is powerful regardless of a 2022 hack, backed by a $1 billion SAFU fund. Nevertheless, it’s unavailable within the U.S. resulting from regulatory bans.

Binance USA model caters to Individuals in 34 states, providing 160 cryptocurrencies, a $30 million buying and selling quantity, and strict U.S. compliance. It supplies an easier interface and a clear safety file however lags in liquidity and help responsiveness.

The worldwide Binance platform excels in scale and selection, whereas Binance.US prioritizes legality and security for U.S. customers. For international attain and options, Binance wins; for U.S.-based buying and selling, Binance.US is the one choice. Your selection depends upon location and priorities. It’s also possible to try our different comparisons, like Binance vs OKX and Binance vs Bybit.

FAQs

Who can use Binance and Binance US?

Binance can be utilized by international customers in over 180 international locations, together with Europe, Asia, and Africa, and provides buying and selling futures, spot, margin, and choices. Binance.US is just for U.S. merchants in 34 states. The platform focuses on compliance and ease, limiting options like futures or margin buying and selling for its American viewers.

Is Binance.US authorized within the USA?

Sure, Binance.US is authorized within the USA and designed to adjust to U.S. laws. It operates beneath BAM Trading Providers, a U.S.-based entity registered with the Monetary Crimes Enforcement Community (FinCEN). The platform adheres to federal legal guidelines, together with anti-money laundering (AML) and KYC necessities, guaranteeing customers confirm their id with government-issued IDs. You should use it in 34 states.

Which Binance app to make use of within the US?

It’s best to use the Binance.US app in the event you’re in america. It’s tailor-made for U.S. residents, accessible on iOS and Android, and helps buying and selling 160 cryptocurrencies. The app complies with U.S. legal guidelines and requires KYC verification with a U.S. ID. You obtain it from the App Retailer or Google Play, log in with a Binance.US account, and commerce legally in states like California or Florida, however not New York or Texas.

What’s the distinction between USD and USDT on Binance?

USD on Binance refers back to the U.S. greenback, a fiat foreign money issued by the U.S. authorities. It’s utilized in restricted buying and selling pairs, like BTC/USD, the place you commerce cryptocurrencies instantly in opposition to actual {dollars}. You deposit USD through financial institution transfers, however availability is restricted resulting from regulatory hurdles. Binance not often provides USD pairs globally, however Binance.US makes use of USD.

USDT, or Tether, is a stablecoin pegged 1:1 to the USD and issued by Tether Restricted. It’s extensively used on Binance, with over 350 buying and selling pairs like BTC/USDT. You may commerce it freely with out financial institution involvement, because it’s a cryptocurrency saved in wallets. USDT maintains stability, with every token backed by greenback reserves, making it a well-liked proxy for USD on exchanges.

USD entails precise money and stricter guidelines, whereas USDT mimics USD worth throughout the crypto ecosystem. Binance favors USDT for its flexibility and quantity.

Is Binance US shutting down?

No, Binance.US shouldn’t be shutting down; it stays operational, serving tens of millions of customers throughout 34 U.S. states. The platform confronted challenges, like a $4 billion positive tied to its mum or dad firm Binance’s authorized points, and paused USD withdrawals for a while resulting from SEC strain. You may nonetheless commerce crypto-to-crypto pairs, and it’s licensed by FinCEN, displaying dedication to U.S. compliance.