Picture supply: Getty Pictures

One fascinating share I discover within the inventory market at the moment is Joby Aviation (NYSE: JOBY). It’s at $6.60 after rising 24% over the previous 12 months, however has fallen 35% since hitting $10 in January.

Right here’s why I feel it has the potential to supply huge returns over the following few years.

eVTOLs

Joby Aviation is main the race to commercialise electrical vertical take-off and touchdown (eVTOL) plane. Extra generally referred to as flying electrical taxis, they’ll take off vertically like a helicopter, which implies no want for prolonged runways. In contrast to helicopters, they fly quietly like a drone.

Joby’s plane presently has a 100-mile battery vary and carries 4 passengers and a pilot, reaching speeds of up to 200mph. They provide an emission-free various for regional transport.

For instance, an eVTOL can fly from JFK Airport to Manhattan in about 7 minutes, in comparison with 60–90 minutes by automobile, saving passengers up to 80 minutes of journey time. The corporate is constructing vertiports for airport routes first to focus on this low-hanging fruit.

Final 12 months, the agency signed a six-year unique deal to launch air taxi providers in Dubai, beginning in 2026. A flight from Dubai Worldwide Airport to Palm Jumeirah might take simply 10 minutes, in comparison with 45 minutes by automobile. Its companions have damaged floor on the primary vertiport in its Dubai community.

To start out with, Joby will provide Uber Black pricing at a per-seat-mile foundation. Then it plans to finally drive costs down to the extent of UberX, which is the budget-friendly service. Given the quantity of wealth in Dubai, I doubt demand can be an issue!

Blue-chip backing

Talking of Uber, Joby purchased the ride-hailing big’s eVTOL enterprise in 2021. As a part of the deal, Uber took a stake and agreed to combine their providers, that means Joby’s air taxis can be accessible by way of Uber’s app.

One other accomplice is Delta Airways, which plans to combine the service into its app to ferry passengers between airports and concrete centres.

Lastly, there’s Toyota. The automaker not too long ago made one other $500m capital dedication, bringing its whole funding in Joby to nearly $1bn. It’s working intently with the agency on manufacturing and certification.

One other factor to notice is that Joby not too long ago delivered its second plane to the US navy. eVTOLs have defence purposes.

Certification

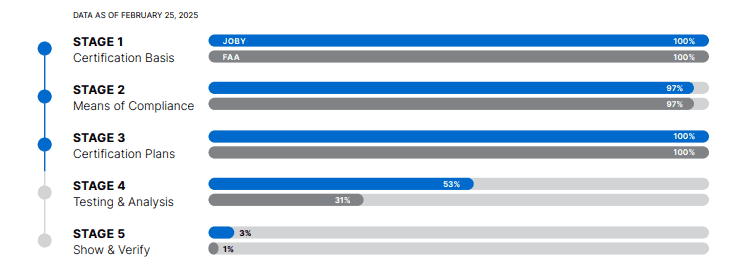

Joby is presently progressing by means of the fourth of 5 phases to get the plane licensed. It expects this to be accomplished by late 2025 or early 2026. So a delay (or worse) might be the largest threat right here proper now.

One other problem could be weak client demand, although a current Honeywell survey discovered that 98% of US airline passengers would contemplate taking an eVTOL.

A optimistic right here is the stability sheet. On the finish of 2024, it had $933m in money, no debt, plus the extra $500m dedication from Toyota. On the present money burn fee, this $1.4bn ought to simply see it by means of to industrial operations.

Additional cash will then be wanted, although I doubt Toyota will abandon its $900m funding. Funding due to this fact shouldn’t be a difficulty, although shareholder dilution might be.

Silly takeaway

Joby is pioneering flying taxis and so they have huge disruptive potential. However it’s pre-revenue, making the inventory extremely speculative. This implies it’s solely appropriate for risk-tolerant buyers with a long-term horizon to contemplate.