Picture supply: Getty Pictures

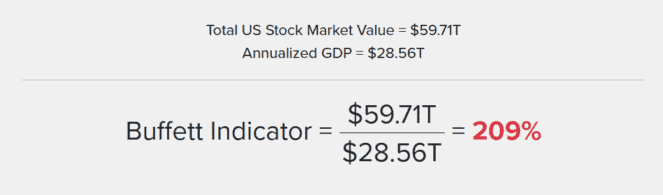

Named after billionaire investor Warren Buffett, the ‘Buffett Indicator’ is a market valuation metric that divides the overall market-cap of US shares by the nation’s GDP. Typically seen as top-of-the-line single market valuation indicators, the metric historically flashes warning indicators when it surpasses 100%.

Just lately, it’s climbed to a staggering 209%. This determine is nicely above the historic common, indicating that shares are extremely overvalued relative to the economic system.

The present stage has spurred hypothesis that the inventory market is coming into bubble territory. When valuations are this excessive, it typically indicators future downturns because the hole between inventory costs and financial fundamentals grows.

The final time the Buffett Indicator reached such highs was within the lead up to the dot-com crash in 2000 and, extra just lately, earlier than the pandemic-driven downturn in 2020.

Including to this, Buffett’s Berkshire Hathaway fund has just lately offered giant parts of its portfolio. The corporate reportedly holds $325bn in money — an unusually excessive quantity even by its requirements. This transfer suggests it might be getting ready for a possible correction, as Buffett has famously suggested towards overvalued markets.

The choice to promote quite than purchase displays his cautious method, significantly given ongoing considerations about excessive rates of interest and unsure financial development.

What to do in a market downturn

For particular person buyers, the temptation is perhaps to observe Buffett’s lead by trimming overvalued shares or reallocating to much less dangerous property. Whereas a market crash isn’t sure, excessive valuations are a great time to judge a portfolio.

Holding some money or diversifying into defensive sectors might present stability if a downturn hits in 2025. Being attentive to valuation indicators and getting ready for elevated volatility is a prudent method amid present market dynamics.

For UK buyers, a number of defensive FTSE shares have traditionally proven resilience throughout financial downturns. One in every of my favourites is knowledge analytics agency RELX (LSE: REL).

As a worldwide supplier of information-based analytics, it has a robust foothold in authorized, scientific and danger markets. It has a diversified income stream and a recurring subscription-based mannequin, so it’s typically seen as a secure, cash-generative firm.

Over the previous 30 years the share price has elevated at a mean fee of seven.36% a 12 months.

Professionals and cons

It might be defensive, however RELX nonetheless faces dangers tied to financial cycles and regulatory modifications. A slowdown in authorized or monetary companies might influence its enterprise segments.

A current concentrate on synthetic intelligence (AI) and analytics has strengthened its aggressive edge, enhancing its digital supply and knowledge companies. However competitors can be intensifying as digital and AI-driven analytics turn out to be normal within the trade.

Latest inventory efficiency has been constructive however macroeconomic challenges, like inflation and rate of interest hikes, might weigh on future development.

Robust development means it now has a comparatively excessive valuation with a price-to-earnings (P/E) ratio of 36. This makes it vulnerable to a pullback if development slows. Nonetheless, its revenue margin is sweet at round 20% and it has a excessive return on fairness (ROE) of 56%, indicating environment friendly capital utilization.

Though it has a low yield of only one.64%, dividends are dependable and reveal a dedication to shareholder returns. In unstable instances, I feel it’s price contemplating as a inventory that would add stability to a portfolio.