YEREVAN (CoinChapter.com) — ARK 21Shares and Constancy Bitcoin ETFs recorded a $369.7 million internet influx, ending an eight-day outflow streak within the U.S. spot Bitcoin ETF market. The inflows supplied short-term reduction after steady losses.

ARK 21Shares and Constancy Lead Bitcoin ETF Inflows

On Feb. 28, the U.S. spot Bitcoin ETFs recorded a $94.3 million internet influx, marking the primary constructive motion since Feb. 14. ARK 21Shares Bitcoin ETF (ARKB) noticed the most important achieve with $193.7 million, adopted by Constancy Smart Origin Bitcoin Fund (FBTC) with $176 million, based mostly on Farside Buyers knowledge.

The mixed $369.7 million influx from ARKB and FBTC lined some losses, balancing the $244.6 million outflow from BlackRock’s iShares Bitcoin Belief ETF (IBIT). In the meantime, the Bitwise Bitcoin ETF (BITB) gained $4.6 million, and Grayscale Bitcoin Mini Belief ETF (BTC) added $5.6 million.

BlackRock and Grayscale Face Additional Bitcoin ETF Outflows

Regardless of inflows into ARKB and FBTC, BlackRock’s IBIT and Grayscale’s Bitcoin Belief ETF (GBTC) continued to report outflows. VanEck Bitcoin ETF additionally recorded capital losses, whereas Invesco, Franklin, Valkyrie, and WisdomTree Bitcoin ETFs noticed no inflows.

The U.S. Bitcoin ETF market has skilled $3.26 billion in internet outflows since Feb. 18, with Feb. 25 marking the worst day when $1.13 billion exited the market.

Bitcoin Value Drops Earlier than Partial Restoration

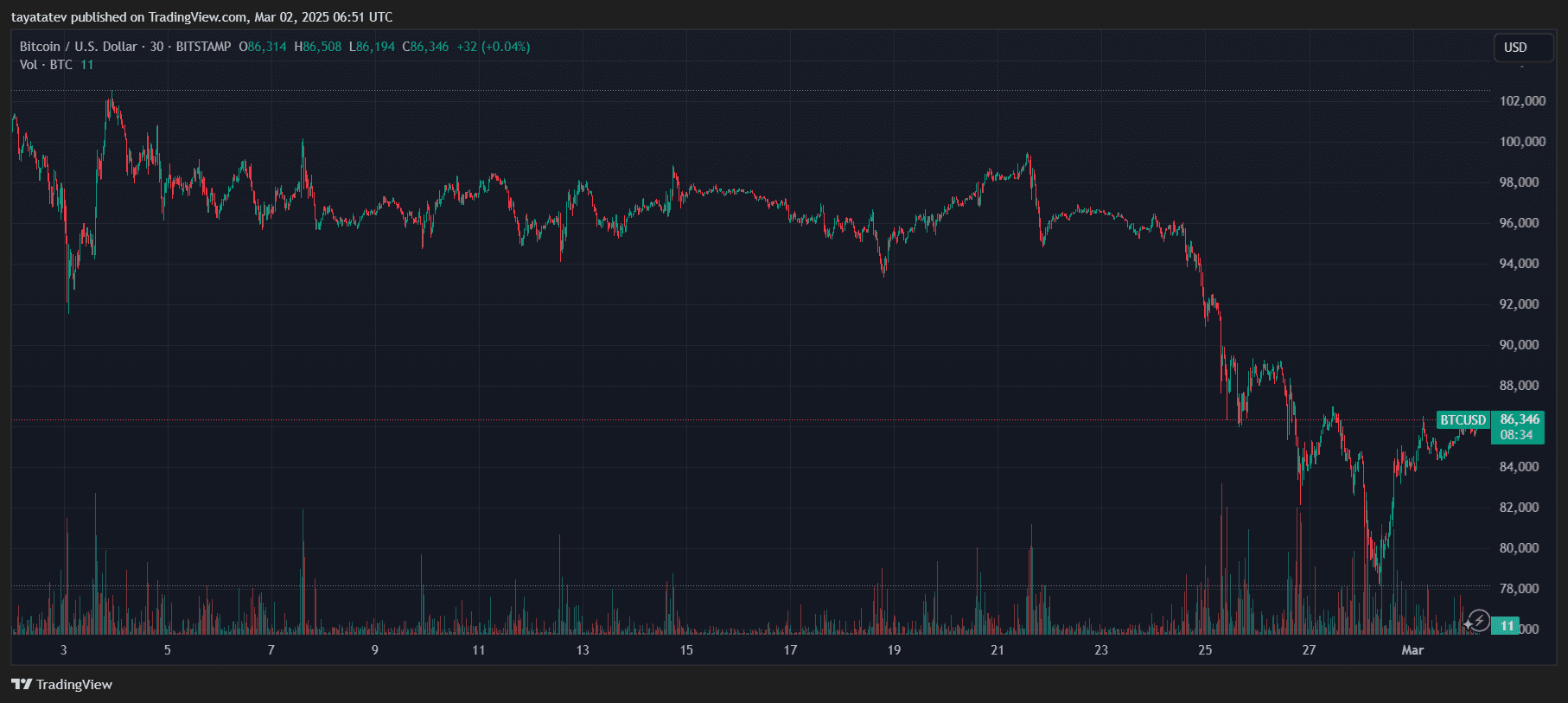

The Bitcoin ETF outflows coincided with a 17.6% price drop between Feb. 18 and Feb. 28, with Bitcoin falling to $78,940, its lowest stage in practically 4 months. Nevertheless, Bitcoin has since rebounded to $86,346, as proven within the TradingView chart from March 2, 2025.

The chart displays vital volatility all through February, with Bitcoin initially buying and selling close to $102,000 earlier than dealing with a number of sharp declines. Essentially the most notable downturn occurred between Feb. 21 and Feb. 27, aligning with the file $1.13 billion outflow from U.S. spot Bitcoin ETFs on Feb. 25.

Following the late-February low, Bitcoin has proven indicators of restoration, climbing again above $86,000. The price motion suggests renewed market curiosity, however buying and selling volumes stay comparatively secure, indicating cautious investor sentiment after the latest downturn.

Spot Bitcoin ETF Market Exhibits Unstable Traits

Since Jan. 10, 2025, the spot Bitcoin ETFs have recorded a internet outflow of $300 million. The latest inflows on Feb. 28 supplied some stability, however general market tendencies stay combined.