Picture supply: Getty Photographs

Through the week ended 28 March, Aston Martin Lagonda (LSE:AML) was the worst-performing FTSE 250 inventory. Its share price fell 14% after Donald Trump introduced plans to impose a 25% tariff on all automotive imports into the US.

This new tax is because of take impact from tomorrow (3 April). Admittedly, there’s by no means a great time to should cope with tariffs however the timing for the group is especially unlucky provided that it’s presently loss-making. Since 2 April 2024, its share price has tanked 58%. Over the previous 5 years, it’s down 88%.

A overview of the proof

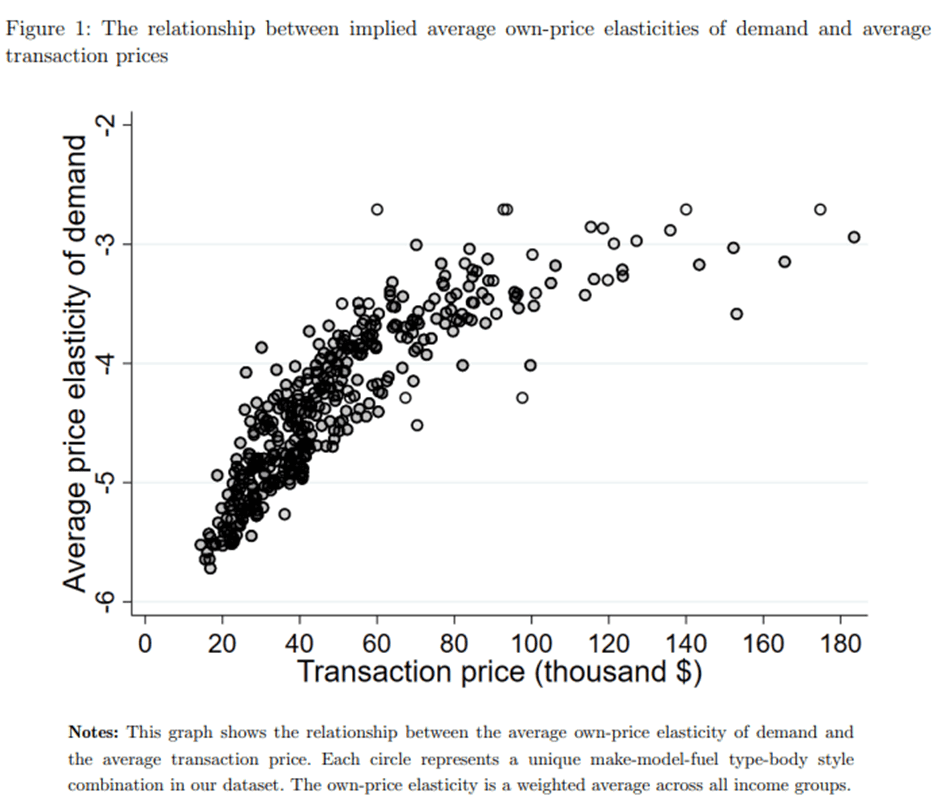

Though price modifications have an effect on the gross sales of luxurious items lower than cheaper alternate options, they’re not immune. Economists measure the affect utilizing the price elasticity of demand (PED). Not surprisingly, for many merchandise, there’s a destructive relationship between the quantity a client has to pay for one thing and the quantity offered.

In August 2023, a tutorial paper particularly appeared on the affect of costs on automotive gross sales. Because the chart under reveals, throughout all car sorts, the PED was destructive, albeit much less pronounced for costlier automobiles.

In 2024, to attempt to scale back its losses, Aston Martin elevated the costs of its automobiles. In comparison with the earlier yr, its common promoting price went up by 5.9% to £245,091. The end result was an 8.9% drop within the quantity offered.

Don’t get me incorrect, I’m not suggesting that the autumn in car gross sales of 590 was totally because of the price enhance. Undoubtedly, international financial uncertainty performed an element. Gross sales in China have been weaker than anticipated and there was additionally some provide chain disruption. However I’m sure charging extra for its automobiles was additionally a contributory issue.

Automotive-mageddon?

That’s why I’m certain shareholders shall be anxious in regards to the affect of Trump’s tariffs. Of concern, the corporate’s largest market is the Americas. In 2024, via its community of 45 sellers, the group offered 1,928 automobiles to the territory, with a worth of £629m. Though this isn’t damaged down by nation, I believe it’s affordable to imagine that the US accounted for a lot of the income.

No one is aware of for certain how the corporate’s high (and backside) line shall be affected however it’s extremely unlikely to be excellent news.

| Area | Vehicles offered 2024 | % |

|---|---|---|

| The Americas | 1,928 | 32.0 |

| Europe, Center East and Africa | 1,796 | 29.8 |

| Asia Pacific | 1,220 | 20.2 |

| UK | 1,086 | 18.0 |

| Whole | 6,030 | 100.0 |

Mitigation

To strengthen its steadiness sheet, the corporate has introduced that its main shareholder, headed by its present chairman, is to take a position one other £52.5m within the firm. This may take the Yew Tree Consortium’s curiosity to 33%. Usually, rising a shareholding above 30% would require a proper takeover bid to be launched. Nevertheless, on this case, a waiver is being sought.

The group’s additionally promoting its minority stake within the Aston Martin Aramco Formulation One racing workforce.

However I think there shall be some troublesome instances forward.

Along with tariffs, the corporate has to navigate its manner via to full electrification of its car vary. And it’s a good distance from being worthwhile at a post-tax degree.

In fact, Trump may rapidly realise {that a} commerce warfare is in no person’s pursuits. And the group nonetheless retains an iconic model with its badge affixed to some lovely sports activities automobiles.

Nevertheless, with all this uncertainty surrounding the group, investing now could be too dangerous for me.