Gold costs proceed to soar on the finish of the summer time. As I kind, the yellow steel’s within the strategy of hitting new report peaks above $2,500 an oz. I’m seeking to purchase an inexpensive share or two to capitalise on this price growth after I subsequent have money to speculate.

There are a number of components driving the gold rush, such because the expectation that inflation will rise as rates of interest are decreased by central banks. Charge cuts by the Federal Reserve particularly are serving to the yellow steel by weakening the US greenback. This makes it cheaper to purchase buck-denominated belongings like gold.

Secure-haven gold shopping for can be accelerating following Ukraine’s invasion of Russia and recent violence in Gaza and Israel. These latest actions are fuelling fears of widening conflicts in Europe and the Center East, respectively.

A high ETF

Traders can faucet into gold’s bull run in some ways. A technique that I believe is price critical consideration is shopping for an exchange-traded fund (ETF) just like the iShares Gold Producers UCITS ETF (LSE:SPGP).

Because the title implies, this offers publicity to corporations that supply most of their revenues from gold mining. And over the previous yr it’s supplied a powerful 21.4% return.

There are drawbacks to proudly owning a fund that focuses on gold miners, in comparison with one which merely tracks the gold price. Operational issues are widespread within the mining sector, and will be vastly costly as soon as misplaced revenues and massive prices are taken into consideration.

Nevertheless, this iShares product enormously reduces this danger by investing in a large raft of corporations. In truth it owns stakes in 62 corporations at this time, together with many heavyweight names with nice monitor information reminiscent of Newmont, Agnico Eagle and Barrick Gold.

With an expense ratio of 0.55%, it has one of many lowest charges attributable to this type of ETF too.

An amazing gold inventory

Investing in a single mining inventory will be extra dangerous, for the explanations outlined above. However there’s additionally the chance to make spectacular, sector-beating returns.

That is one thing that consumers of Centamin (LSE:CEY) shares have skilled over the previous yr. The FTSE 250 miner’s share price has rocketed 54% in the course of the previous 12 months.

This displays, partially, ongoing manufacturing on the flagship Sukari mine in Egypt, with 2024 output heading in the right direction to rise to 470,000-500,000 ounces in 2024.

It’s additionally as a result of promising drilling work at its Doropo exploration undertaking, an enormous undertaking within the Côte d’Ivoire. Centamin is anticipating to obtain a mining licence right here by the tip of the yr, though this isn’t assured and issues on this entrance might hurt the share price.

Lastly, Centamin’s share price surge displays an explosion of curiosity from worth seekers seeking to get in on the gold rush.

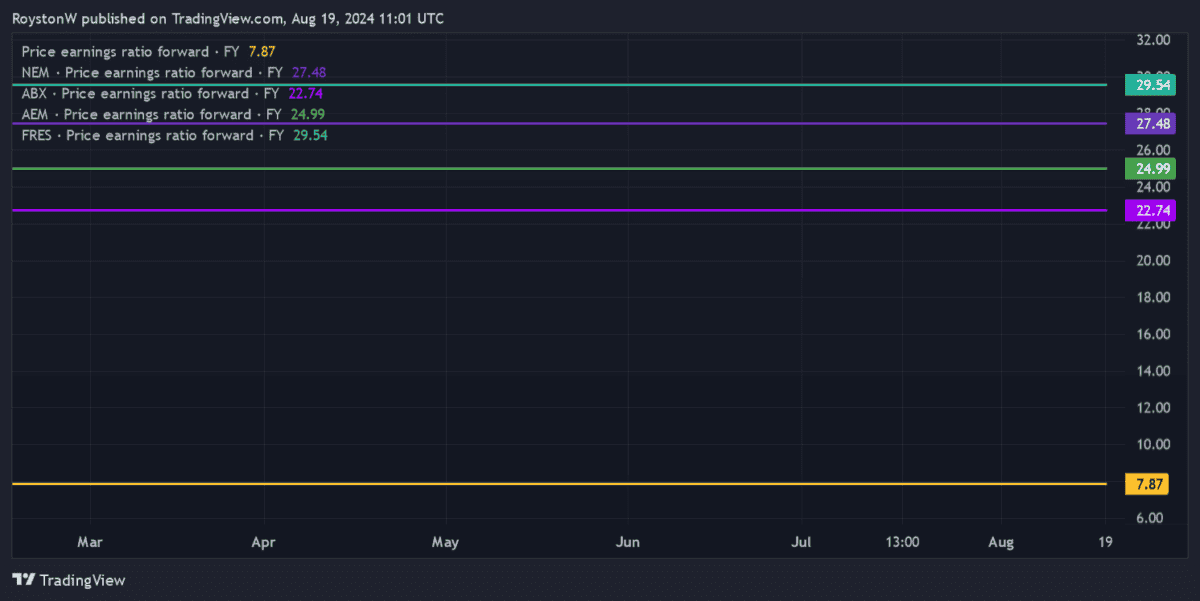

Because the chart beneath exhibits, the FTSE 250 firm nonetheless trades at a big low cost to the broader gold mining sector, primarily based on the ahead price-to-earnings (P/E) ratio). This might present the bottom for much more industry-beating share price good points trying forward.