YEREVAN (CoinChapter.com) — Analysts are pointing to Q2 2025 as a key interval for altcoin accumulation. The altcoin market capitalization has dropped by 40% from its all-time excessive. It at the moment stands beneath the $1 trillion mark. Many traders are going through losses after months of decline.

Bitcoin’s dominance out there continues to develop. Based on analysts, this may very well be an early sign for an altcoin restoration part. The pattern displays historic cycles the place Bitcoin peaks first, adopted by capital rotation into altcoins.

Bitcoin Dominance at 60% Alerts Shift Towards Altcoins

Bitcoin Dominance (BTC.D), which measures Bitcoin’s share of complete crypto market worth, has remained above 60% in latest weeks. If BTC.D reaches 70%, analysts say it might mark Bitcoin’s peak. After that, funds sometimes stream into smaller-cap cash.

Ash Crypto, a market analyst, shared a chart on X that reveals this sample. He mentioned that Bitcoin’s 70% dominance has traditionally preceded sturdy altcoin efficiency. The chart he posted reveals BTC.D holding above 60% with no indicators of weak spot thus far.

Ash Crypto’s outlook suggests Q2 and Q3 might align with this rotation cycle. He helps this by referencing earlier altcoin seasons that started after Bitcoin dominance peaked.

Altcoins Again to Launch Costs, Analyst Highlights Purchase Zone

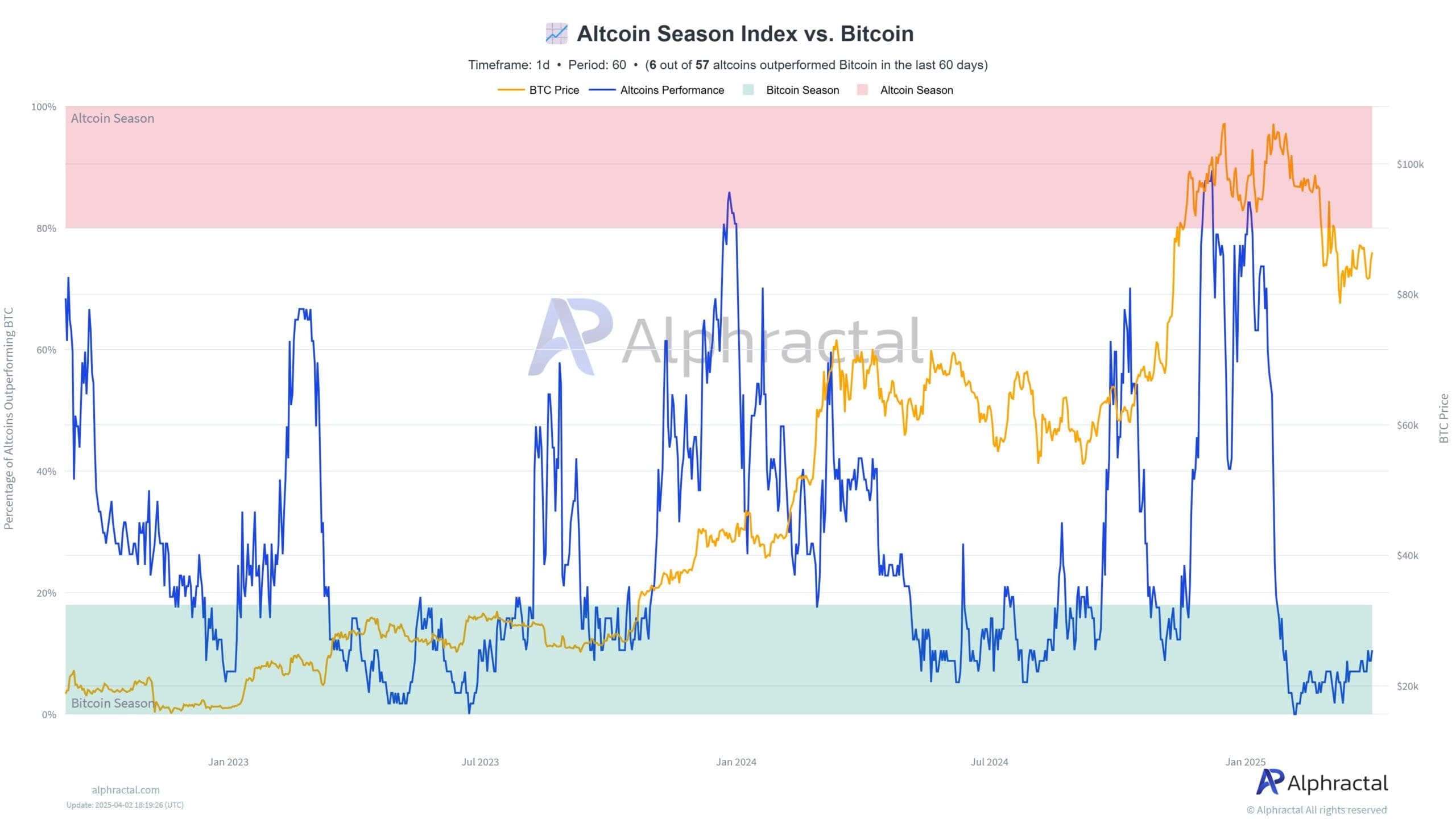

Joao Wedson, founding father of Alphractal, famous that many altcoins have returned to their launch costs. He posted on X that a number of cash that had been as soon as hyped in previous cycles have now erased good points.

“Since December 2024, we’ve been in a bear market (actually, the sentiment was already bearish since October). But I still believe that between April and May, the market will heat up for cryptos—even if BTC drops further, as we still have lower targets,”

Wedson mentioned.

He emphasised that this price drop suggests a transparent accumulation zone. Wedson advises staying away from tokens that carried out properly in 2024, together with ETH, SOL, and TRX. He focuses on figuring out altcoins with sturdy fundamentals and long-term development potential.

Concern Index Hits 25, But Analysts Stay Centered on Fundamentals

Regardless of optimism from some specialists, the Crypto Concern & Greed Index dropped to 25 factors lately. This marks an “Extreme Fear” zone. Geopolitical tensions and commerce conflict dangers are contributing to the market’s present sentiment.

Nonetheless, some analysts consider the concern metric typically acts as a contrarian sign. The disconnect between costs and venture fundamentals has led some merchants to start positioning early.

Nic Puckrin, founding father of Coin Bureau, has cautioned in opposition to the concept that Bitcoin is coming into a brand new bear market. Nonetheless, he questioned the outlook for a lot of altcoins, pointing to weak efficiency in some sectors.

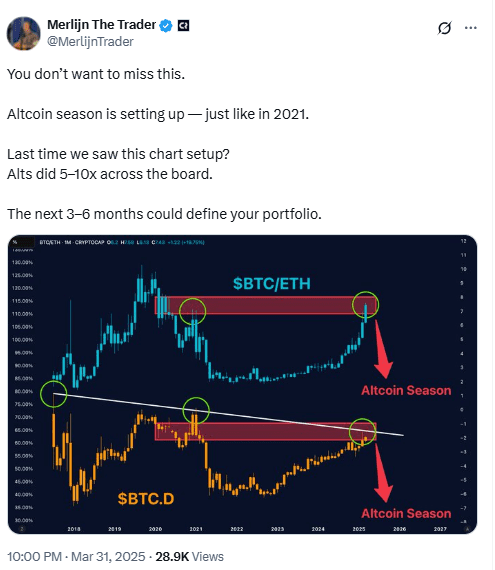

Merlijn Sees Comparable Setup to 2021 Altcoin Season

One other crypto dealer, Merlijn, additionally weighed in on the setup. He posted on X that the subsequent three to 6 months might outline investor portfolios.

“Altcoin season is setting up—just like in 2021… The next 3–6 months could define your portfolio,”

Merlijn mentioned.

His comparability to the 2021 altcoin cycle helps the concept of a repeating sample. That 12 months, altcoins rallied after Bitcoin dominance peaked. This view aligns with each Ash Crypto and Wedson’s observations.

Merchants are waiting for additional developments as Q2 progresses. Whereas sentiment stays low, historic patterns and chart indicators are drawing curiosity from analysts and traders alike.