Listed below are the newest updates on the U.S. President Donald Trump’s ongoing tariffs coverage.

April 9, 2025: U.S. Hits China with 104% Tariff

The USA formally imposed an enormous 104% tariff on Chinese language imports on April 9. The transfer follows President Donald Trump’s ultimatum to China earlier this week, the place he warned of steep new duties if Beijing refused to roll again its 34% counter-tariff on American items. China didn’t comply, prompting the White Home to proceed with its tariff escalation.

The brand new 104% tariff is the results of three cumulative will increase:

- A 20% tariff introduced in March.

- A 34% tariff carried out as a part of the “Liberation Day” coverage.

- A further 50% penalty was confirmed this week.

Following the announcement, the Asian inventory market tumbled. On April 9, Japan’s Nikkei 225 index dropped almost 4%. Markets in South Korea, New Zealand, and Australia additionally posted losses over the deepening U.S.-China commerce struggle.

China’s main inventory indexes fell in response. The CSI 300, which tracks China’s prime blue-chip shares, slipped 1.2%, whereas Hong Kong’s Grasp Seng index plunged 3.1%.

April 8, 2025: Trump Threatens China with 50% Tariff; Markets Swing Wildly

Tensions between america and China escalated additional on April 8 after President Donald Trump threatened to impose an extra 50% tariff on Chinese language items. The warning got here in response to China’s determination to retaliate towards Trump’s earlier 34% tariff by putting an identical counter-tariff on American imports.

President Trump gave China a 24-hour deadline to take away its 34% countermeasure. He stated that if China refused to again down, america would reply with a 50% import tariff on all Chinese language items. The Chinese language embassy in Washington shortly responded by accusing the U.S. of “economic bullying.” It additionally said that Beijing would “firmly safeguard its legitimate rights and interests.”

The rising uncertainty over commerce coverage led to risky actions throughout monetary markets all through the day. Inventory futures initially rose in after-hours buying and selling late Monday. Contracts tied to the Dow Jones Industrial Common, the S&P 500, and the Nasdaq-100 all gained greater than 1%.

April 7, 2025: China Plans Stimulus as World Markets Battle; Trump Dismisses Recession Fears

Chinese language leaders held emergency conferences over the weekend to debate how to reply to President Trump’s rising record of tariffs. In accordance with individuals acquainted with the matter, prime Chinese language policymakers and monetary regulators thought-about fast-tracking stimulus plans to assist stabilize the economic system and increase home consumption.

A few of these stimulus measures have been already in improvement earlier than the U.S. tariffs however might now be accelerated to counter the financial shock. No ultimate choices have been introduced publicly.

Trump Dismisses Market Considerations, Calls for Commerce Deficit Elimination

President Trump, talking aboard Air Pressure One on Sunday, pushed again towards fears that the tariffs would result in inflation or a recession. He insisted that the market volatility was solely short-term and claimed the U.S. would enter a brand new financial “boom.”

Trump additionally made it clear that he wouldn’t decrease the very best tariffs except the U.S. utterly eradicated its commerce deficit with particular international locations.

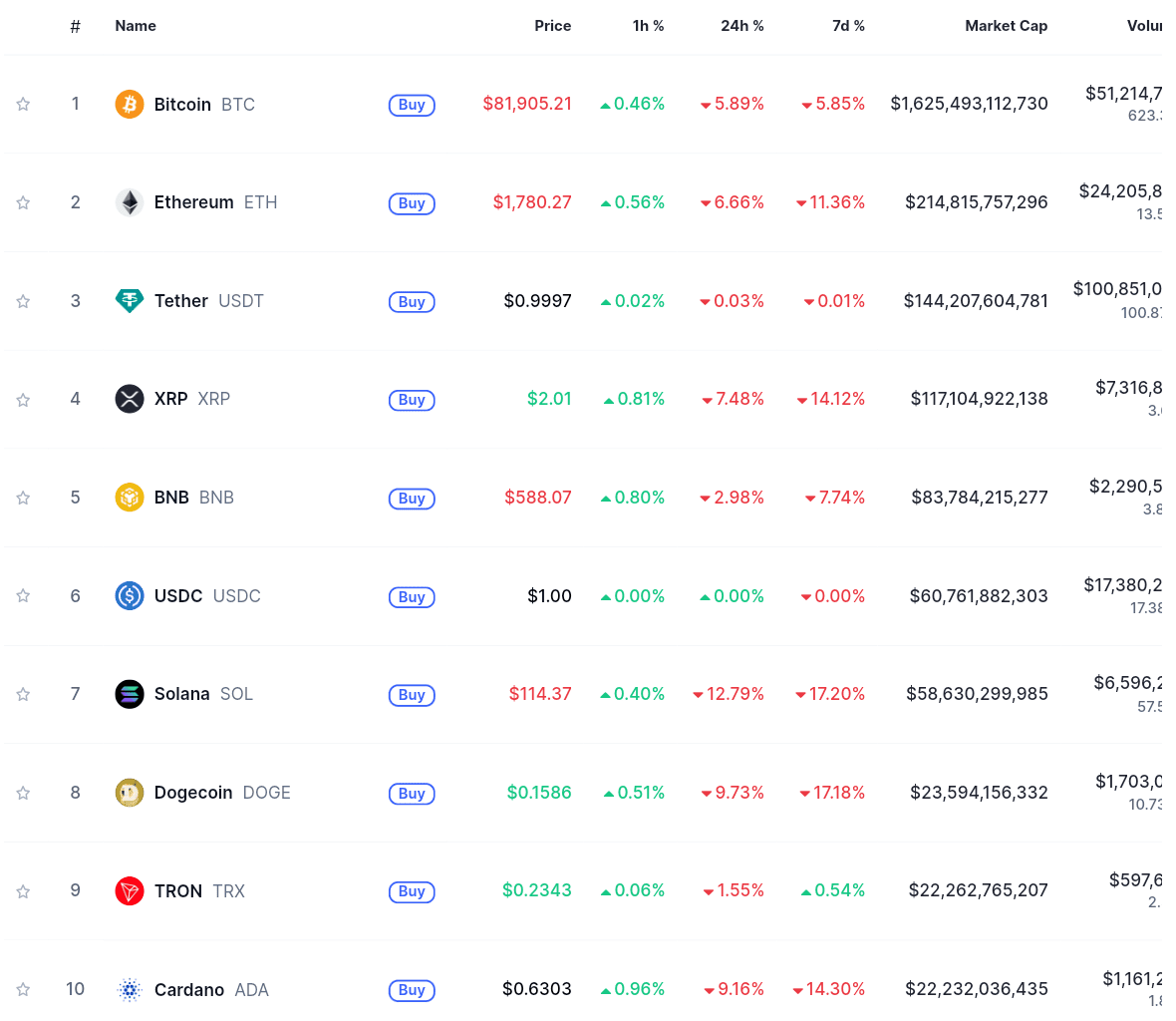

Crypto and Inventory Futures Drop Once more

The worldwide monetary fallout continued as U.S. inventory futures opened decrease and cryptocurrencies noticed one other sharp drop. At present, all prime 10 Cryptocurrencies by market cap are down. Bitcoin misplaced over 8% of its worth, falling to round $76,210. Ether declined greater than 16%, buying and selling at $1,518. The overall crypto market capitalization dropped over 8%, hitting $2.5 trillion.

April 4, 2025: Trump Revises Tariffs, India Focused; Pharma Shares Crash

A brand new White Home doc launched on April 4 exhibits that Trump’s tariff charges have been revised for no less than 14 international locations, together with India. India’s tariff fee was first talked about by Trump as 26%, however the brand new annex initially listed it at 27%. The ultimate doc confirms it has been revised again down to 26%.

Trump’s administration additionally introduced that prescription drugs and semiconductors at the moment are below assessment for attainable new tariffs below Part 232 of the Commerce Enlargement Act of 1962. This part permits the U.S. President to impose tariffs if imports are seen as a risk to nationwide safety.

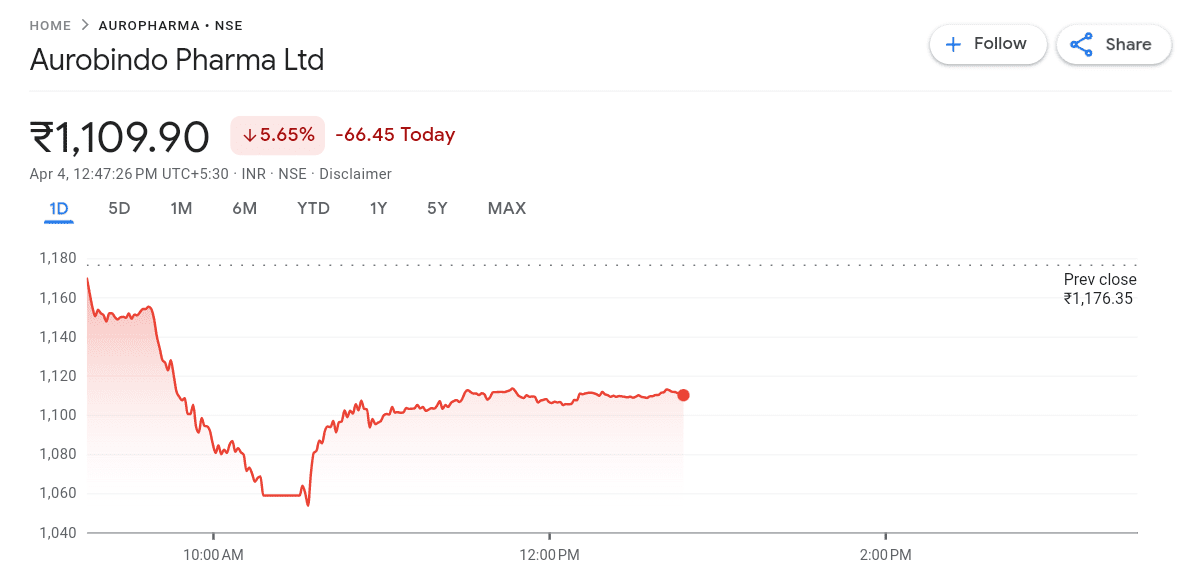

Following this information, Indian pharmaceutical shares took a tough hit:

April 3, 2025: U.S. and Crypto Markets Dump After Tariff Shock

World monetary markets reacted negatively to Trump’s newly introduced tariffs. Key monetary indexes noticed steep declines:

- The Dow Jones Industrial Common fell by over 1,500 factors (3.6%).

- The S&P 500 declined round 4%.

- The Nasdaq Composite dropped almost 5%.

Bitcoin and different main cryptocurrencies skilled notable declines. Bitcoin fell as a lot as 4%, reaching roughly $82,000 on Thursday morning in Singapore. Different cryptocurrencies, together with Ether and XRP, additionally noticed declines, with Solana dropping over 9% at one level.

April 2, 2025: Trump Formally Launches “Liberation Day” Tariffs

President Trump formally introduced the “Liberation Day” tariffs on this date. He referred to as it a nationwide emergency to guard American trade.

The main points of the brand new tariffs have been:

- A 10% baseline tariff on all imports.

- A 34% tariff on items from China.

- A 46% tariff on items from Vietnam.

- A 20% tariff on items from the European Union.

- A 10% tariff on imports from the UK, Australia, and different allied international locations.

Trump stated these tariffs would rebuild the American economic system, deliver again jobs, and decrease taxes. However many international locations criticized the transfer. The European Union and Australia expressed sturdy issues, saying the tariffs would damage world commerce.

Trump’s Commerce Battle 2.0: The Background of Imposed Tariffs Defined

After successful the U.S. presidential election in November 2024, Donald Trump returned to the White Home with a transparent message: he wished to repair America’s commerce deficit and scale back dependency on international items. Moreover, he promised to deliver again American manufacturing jobs and make the nation much less reliant on international locations like China.

On February 1, 2025, just some weeks after taking workplace for his second time period, Trump signed his first main commerce motion. He imposed new tariffs on imports from China, Canada, and Mexico. The tariffs included:

- A 25% tariff on items from Canada and Mexico,

- A ten% tariff on items imported from China.

These tariffs formally took impact on Feb. 4. Trump stated that these tariffs would shield U.S. industries, safe jobs, and stability commerce. Nevertheless, this determination instantly created stress with America’s prime buying and selling companions. Canada, Mexico, and China all expressed issues and warned that they could retaliate.

Notably, all through February and March 2025, the state of affairs worsened. Extra tariffs adopted, concentrating on particular international locations. Particularly, China and Vietnam have been accused of manipulating their currencies and giving unfair subsidies to their exporters. Trump and his staff used this to justify even larger tariffs on these international locations.

Because the tariff struggle heated up, monetary markets additionally started to react. Specifically, companies, particularly people who depend on imports or promote to worldwide markets, began to endure. Above all, buyers are involved that the tariff battle may result in a commerce struggle or perhaps a recession.