Share this text

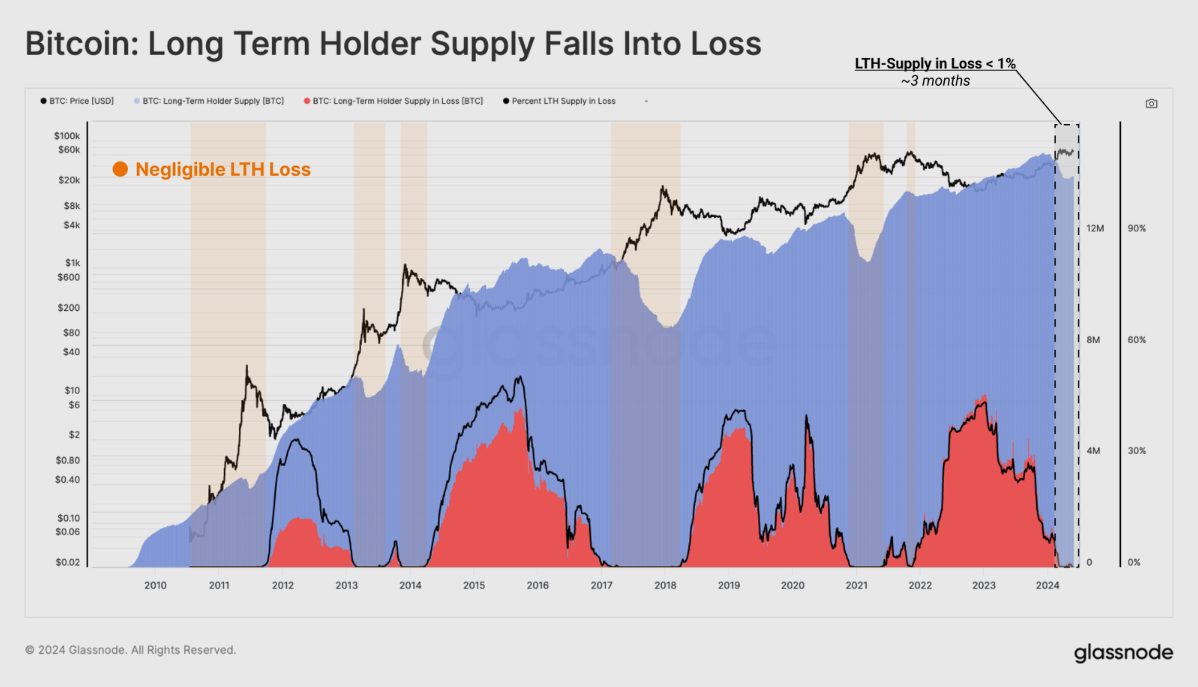

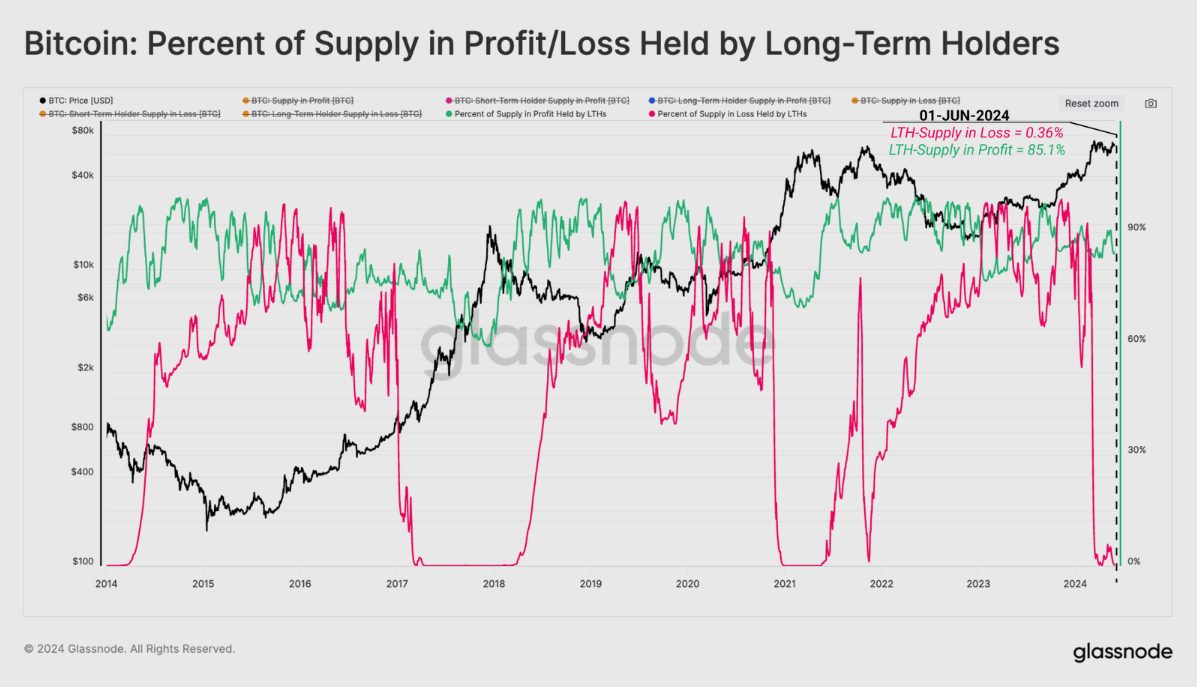

Bitcoin’s market dynamics are exhibiting early indications of renewed hypothesis within the crypto market, as reported by Glassnode. Lengthy-Time period Holders (LTH) are presently sitting on unrealized income, with solely a minuscule 0.03% in losses, signaling the onset of a possible bull market’s euphoric section.

Over the previous two months, the Promote-Aspect Danger Ratio for each Lengthy and Quick-Time period Holders has balanced out, suggesting that the market has absorbed the anticipated revenue and loss inside the present price vary, setting the stage for attainable important volatility forward.

A notable shift has occurred with the spending of long-dormant cash, which has led to spikes in metrics resembling Realized Cap, Spent Output Revenue Ratio (SOPR), and Coindays Destroyed. Nevertheless, by utilizing an entity-adjusted variant of the Realized Cap, Glassnode filtered the precise capital inflows in Bitcoin, which presently stands at an all-time excessive (ATH) valuation of $580 billion.

The “Realized Cap HODL Waves” metric reveals that 41% of community wealth is held by cash youthful than three months, indicating a wealth switch to new demand. This sample is in keeping with earlier cycles, the place new demand ultimately accounts for over 70% of community wealth.

Regardless of a slowdown in liquidity and speculative exercise, the latest reclaiming of the $68,000 degree has introduced most Quick-Time period Holders again into revenue.

Furthermore, the market’s consolidation just under Bitcoin’s all-time excessive has created a big cluster of Quick-Time period Holder cash across the present spot price, highlighting substantial funding on this vary and introducing the chance of heightened investor sensitivity to price fluctuations.

The latest pullback to $58,000 marked a 21% correction, the most important because the FTX collapse, pushing 56% of the Quick-Time period Holder provide right into a loss. But, the magnitude of unrealized loss aligns with typical bull market corrections, suggesting stabilization is on the horizon.

Lengthy-Time period Holders proceed to exhibit confidence, with solely 4.900 BTC held at a loss, representing a mere 0.03% of their provide. This contrasts with the Quick-Time period Holders, who bear the brunt of market losses, particularly close to peak costs.

The market can also be anticipating the Mt.Gox distribution occasion, with the Trustee’s latest pockets consolidation signaling preparations for the return of 141,000 BTC to collectors by October. Mark Karpeles, the previous CEO of Mt.Gox, confirmed the pockets actions have been a part of this course of.

Share this text

![]()