Picture supply: Getty Photographs

If anybody had any doubts in regards to the power of the connection between the price of oil and the BP (LSE:BP.) share price, then the occasions of the previous few days ought to assist make clear issues.

Since shut of enterprise on 2 April — simply earlier than President Trump’s ‘Liberation Day’ speech — a barrel of Brent crude was promoting for $74.95. Every week later, after 5 successive days of falls, it’s down to $59.15. That’s a drop of 21.1%.

| Date | Brent crude ($ per barrel) | Change (%) |

|---|---|---|

| 3 April | 70.14 | -6.4 |

| 4 April | 65.58 | -6.5 |

| 7 April | 64.21 | -2.1 |

| 8 April | 62.82 | -2.2 |

| 9 April (lunchtime) | 59.15 | -5.8 |

Over the identical interval, BP’s inventory has fallen 23%. This isn’t a shock to me provided that round 65% of the group’s revenues are derived from the sale of oil-based merchandise.

However I worry there could also be additional falls forward. The final time oil costs had been at this degree was in February 2021. On the time, BP’s shares had been altering fingers for lower than £3. And the present uncertainty on the impression of tariffs on the worldwide financial system may make issues even worse.

Taking a long-term view

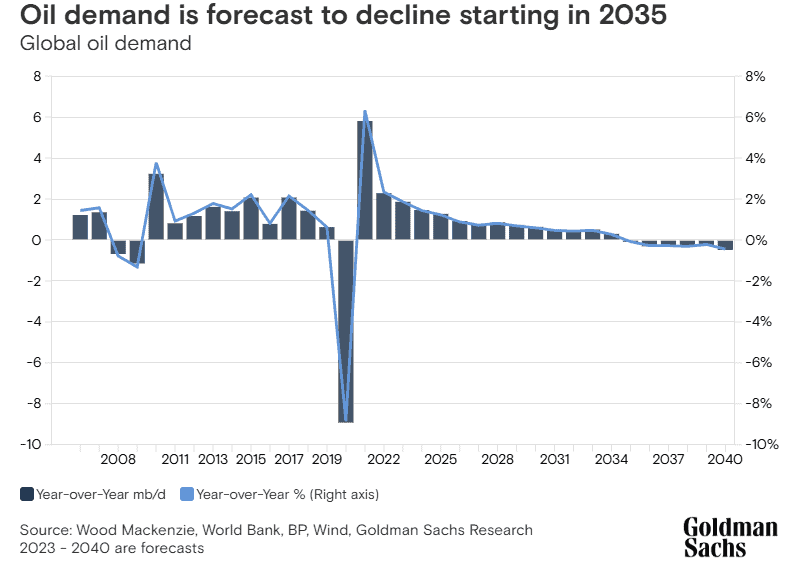

Nevertheless, most economists predict the demand for oil to proceed to rise over the subsequent few years. For instance, Goldman Sachs is forecasting ‘peak oil’ to happen in 2034. And because the chart under exhibits, there’ll solely be a small discount in demand thereafter.

The funding financial institution’s additionally produced another state of affairs during which the adoption of electrical automobiles (EVs) is slower than at the moment anticipated. This mannequin exhibits oil demand persevering with to rise till 2040.

And this may very well be the trail we’re on. The UK authorities’s just lately introduced plans to permit smaller quantity automobile producers to proceed to supply petrol vehicles past the present deadline of 2035.

The current fall in BP’s share price has additionally created a chance for revenue traders.

Based mostly on its final 4 quarterly dividends, the inventory’s now yielding a powerful 7.3%. In April 2024, the return was a much less beneficiant 4.2%. After all, a lot of this has been brought on by the autumn in its share price — it’s down 34% over the previous 12 months — however except the oil price stays depressed for a sustained interval, I feel the power big’s dividend is secure for now.

What I’m considering

Regardless of these positives, I’m conscious of the dangers of investing within the power sector. Unstable oil and fuel costs imply it’s not possible to precisely predict BP’s earnings from one yr to the subsequent. And a fall in revenue may have an effect on the dividend.

Additionally, the Deepwater Horizon catastrophe exhibits how harmful the trade may be. The tragedy resulted in 11 deaths and value the group over $65bn in clean-up prices, fines and compensation.

However after weighing up the professionals and cons, I’m severely contemplating placing the inventory into my Self-Invested Private Pension (SIPP).

Nevertheless, though investing for retirement requires taking a long-term view, I’m going to attend a little bit longer earlier than making a last resolution. I don’t suppose the present market volatility will finish quickly, which makes me reluctant to speculate proper now. In the intervening time, I’m going to maintain BP on my watchlist.