- The rise in problem propelled a hike in every day miners’ income

- Quite a lot of miners cashed out their BTC, suggesting the coin’s price would possibly fall

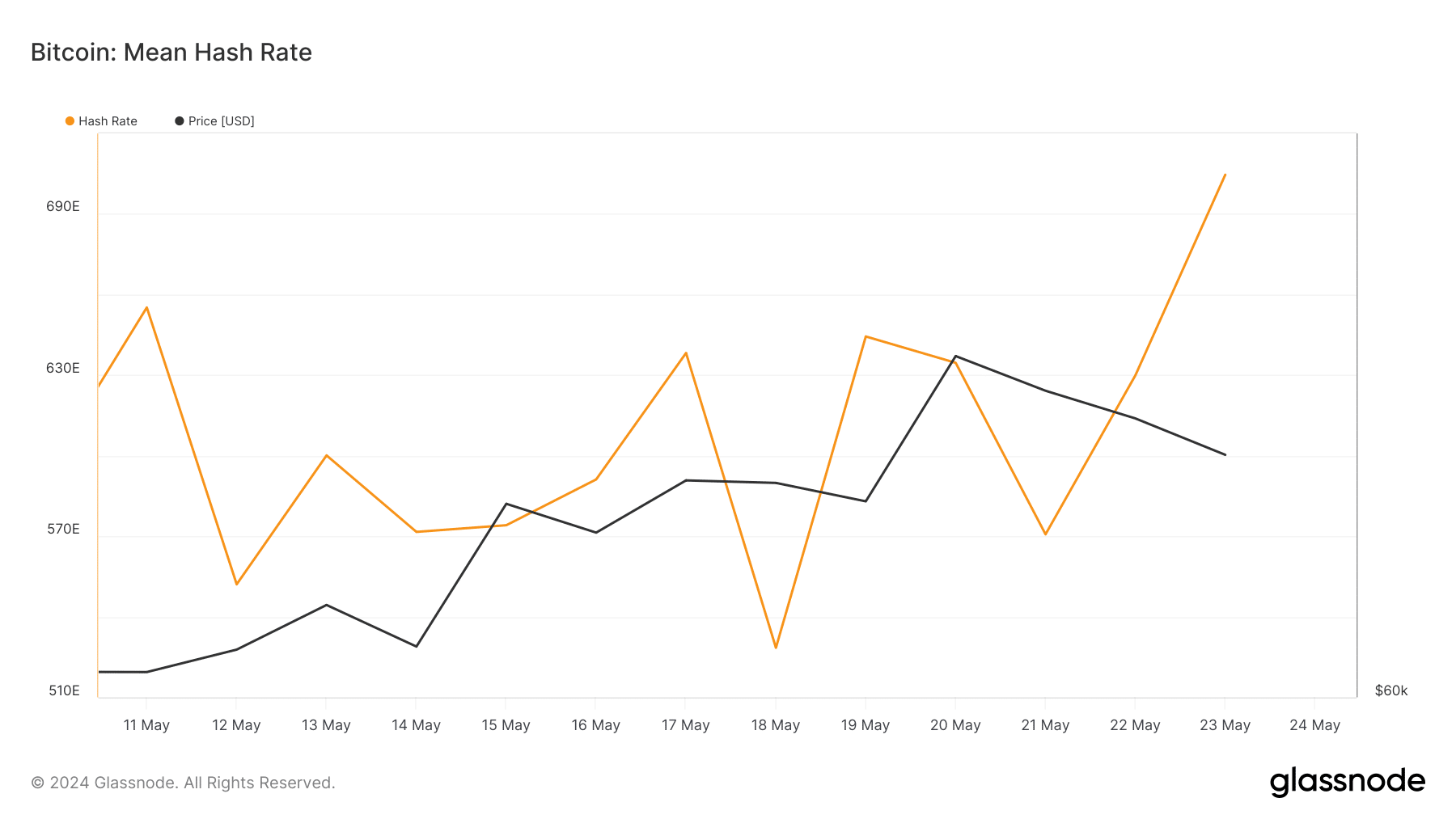

In accordance with on-chain knowledge from Glassnode, Bitcoin’s [BTC] mining problem spiked to a major excessive from its lows of twenty-two Could. Bitcoin mining problem measures how difficult and time-consuming it’s to search out the best hash for every block.

Mining problem doesn’t at all times have an effect on the worth of BTC. Nonetheless, it impacts its perceived worth and shortage. A rise in problem implies a surge in hash energy. In flip, blocks won’t be solved sooner and the block time might be as excessive as 10 minutes.

By way of the price, a rise on this metric might be bullish. This, as a result of miners may be interested in validate extra transactions on the community.

Supply: Glassnode

Nonetheless, mining problem was not the one metric to skyrocket on the community. Actually, one other metric that adopted swimsuit was Bitcoin’s hash price.

As the problem rises, so does income

If Bitcoin’s hash price is excessive, it signifies that the community is safe and wholesome. For buyers, this hike serves as a reassurance that purchasing BTC might be worthwhile in the long run. Nonetheless, this situation solely works if the market situation is in a bull part.

However, a serious decline in hash price signifies modifications or dangers to the community. In conditions like these, miners would possibly discover it troublesome to generate earnings from their operations.

Supply: Glassnode

As anticipated, the influence of the hike in mining problem and the hash price was mirrored in miners’ income. Actually, on the time of writing, on-chain knowledge revealed that miners’ income had a determine of 558.057 BTC

This appeared to point that operators have labored in the direction of confirming extra new transactions on the block, in comparison with the way it was on 21 Could.

Not everyone seems to be HODLing

AMBCrypto additionally regarded on the Miner Internet Place Change. At press time, the metric had a studying of -2.748.69 BTC. Miner Internet Place Change tracks the 30-day change of the Bitcoin provide held in miner addresses.

When this metric is optimistic, it implies that miners are accumulating extra cash. Nonetheless, the current lower which has been taking place for the final two weeks implies that miners are cashing out their holdings.

As such, there’s a likelihood that Bitcoin mining would possibly turn out to be tougher. For the price motion, this might power one other decline for the cryptocurrency.

At press time, BTC was valued at $68,291, having appreciated by beneath 1% in 24 hours after lots of sideways motion. The price motion is price keeping track of since Bitcoin holders would possibly search for different alternatives to money out going ahead.

BTC in circulation drops

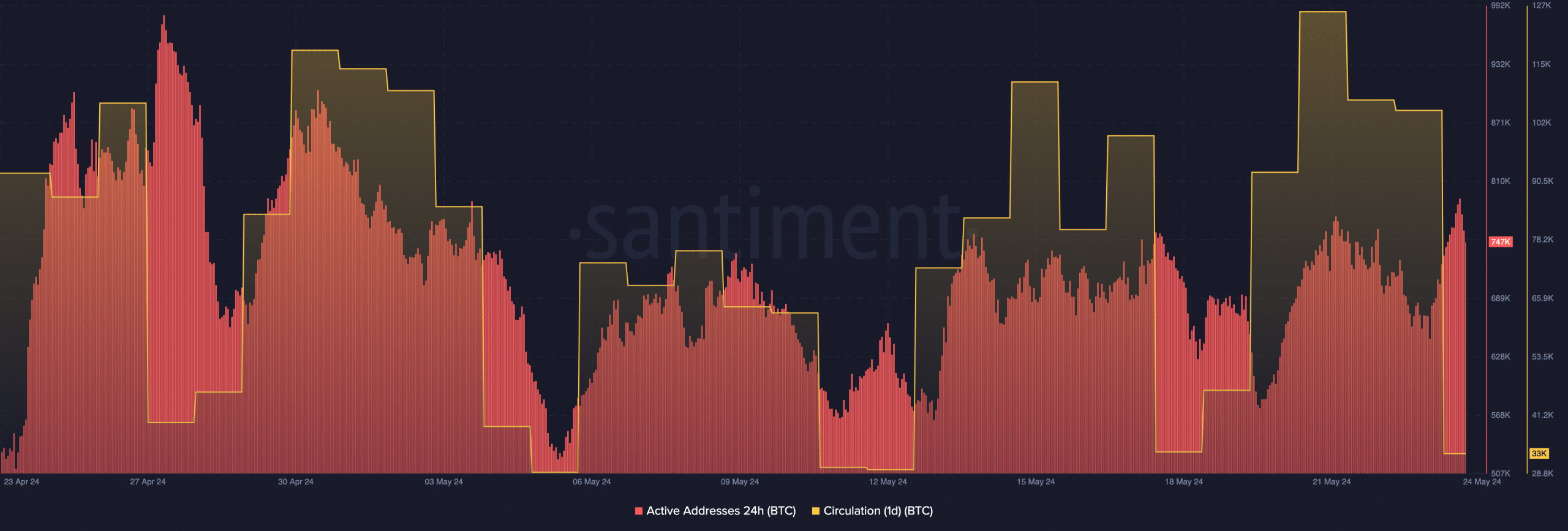

From an on-chain perspective, AMBCrypto additionally regarded on the 24-hour lively addresses. In accordance with Santiment, the 24-hour lively addresses on Bitcoin’s community have been 747,000.

This alluded to a major hike from the place the metric was on 23 Could. Lively addresses measure the every day interplay of customers on a blockchain, that means that the variety of Bitcoin transactions has since risen.

For the price, the hike in exercise may spur price appreciation for the coin. Nonetheless, that metric alone can’t decide BTC’s subsequent path. Therefore, it’s price contemplating the circulation too.

Supply: Santiment

At press time, the one-day circulation was down to 33,000, that means that the variety of cash engaged in transactions had fallen.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Contemplating the hike in Bitcoin mining problem and the exercise on the community, the crypto’s price may be aware a rise within the mid-term. On the targets entrance, the worth may rebound in the direction of $73,000.