The conduct of Ethereum (ETH) holders offers essential insights into market sentiment and potential future price actions.

This analysis delves into the current tendencies amongst Ethereum addresses holding 1,000 ETH or extra, alongside the actions of the most important whales holding 10,000 ETH or extra.

Ethereum Worth Evaluation: Bearish Momentum as Key Helps Break

The price of Ethereum (ETH) continues to fall, influenced by current market dynamics and a notable Bitcoin price prediction from BeInCrypto, which noticed Bitcoin reaching $67,500.

After hitting the 100 EMA on the 4-hour chart as a mid-term resistance stage, ETH dropped to a low of $3,500.

ETH broke by the EMA 200 on the 4-hour chart. The essential help stage was $3,577, which was marked by a big baseline plateau, as proven by the black traces on the chart.

Learn Extra: Who Is Vitalik Buterin? An In-Depth Have a look at Ethereum’s Co-Founder

Moreover, ETH has moved out of the vital quantity profile vary between $3,640 and $3,880. Suggesting potential for top volatility and additional declines.

The chart outlook is at present bearish, with the one doable bullish situation being a transfer again above the EMA 200 and discovering help at that stage.

Learn Extra: Ethereum (ETH) Set for Progress: Key Technical Indicators and On-Chain Insights

Ethereum: Giant Holder Exercise and Market Sentiment

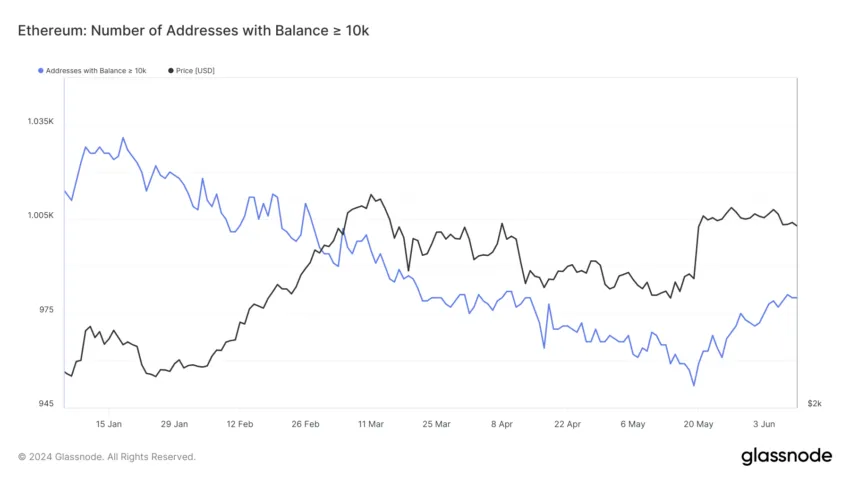

The chart from Glassnode illustrates the variety of Ethereum addresses holding a stability of 10,000 ETH or extra (blue line).

This indicator is essential for understanding the conduct of enormous holders, sometimes called “whales,” who can considerably affect ETH market dynamics.

From January to June, we observe a declining pattern within the variety of addresses with balances exceeding 10,000 ETH. This means that some giant holders would possibly distribute their holdings, probably signaling a bearish sentiment or profit-taking.

Evaluation of Ethereum Addresses with 10,000+ ETH (Might 1 – June 10)

The imply variety of addresses throughout this era was roughly 967.73, with a normal deviation of seven.17, indicating average variability. The minimal variety of addresses recorded was 952 (on Might 19), and the utmost was 981 (on June 8).

The rise within the variety of giant holder addresses throughout the price correction to $3,500 means that these holders have sturdy conviction, as they preserve balances of over 10,000 ETH of their wallets at precise costs.

Ethereum: Mid-Stage Holder Exercise and Market Sentiment

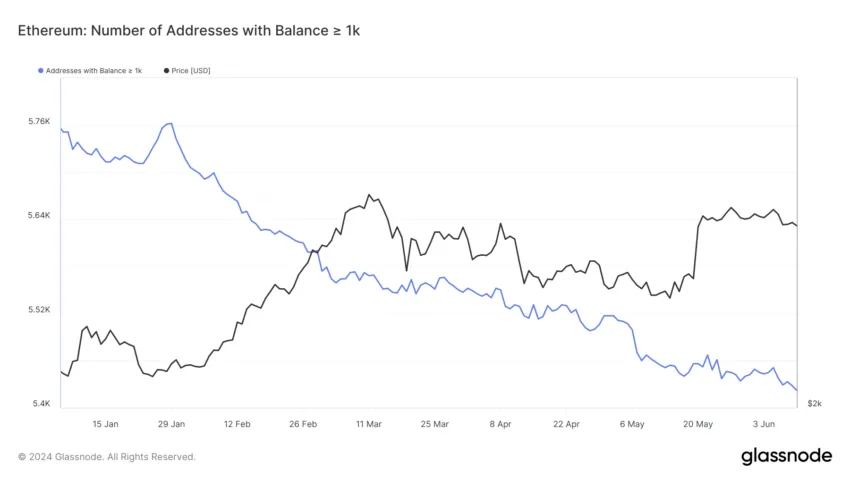

The chart from Glassnode illustrates the variety of Ethereum addresses holding a stability of 1,000 ETH. This indicator offers insights into the conduct of mid-level holders.

Evaluation of Ethereum Addresses With 1,000+ ETH (Might 1 – June 10)

The imply variety of addresses throughout this era was roughly 5,456.78.

With a normal deviation of 24.85, indicating average variability. The minimal variety of addresses recorded was 5,422 (on June 10), and the utmost was 5,517 (on Might 1 and Might 2).

The variety of giant Ethereum addresses clearly dropped, hitting a low level on June 10. This pattern would possibly recommend that mid-level holders had been taking income or feeling much less assured available in the market.

There was a transparent drop within the variety of giant Ethereum addresses, hitting a low level on June 10.

This pattern would possibly recommend that mid-level holders had been taking income or feeling much less assured available in the market. This low stage was final noticed in September 2016.

Strategic Suggestions:

Key Bearish Indicators

Break of EMA 200 on the 4H Chart: ETH has damaged beneath the EMA 200 on the 4-hour chart, a big dynamic help line. This means a possible for additional draw back.

Decline in Mid-Stage Addresses: The variety of ETH addresses holding balances of 1,000 or extra has steadily decreased, hitting a low level final seen in September 2016. This means that mid-level holders are possible taking income and displaying diminished market confidence.

Learn Extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Exit from Key Quantity Profile Vary: ETH has exited the vital quantity profile vary between $3,640 and $3,880. This exit might result in elevated volatility and additional declines.

Key Assist Ranges to Watch

$3,577: Lately damaged, this stage was an vital baseline plateau and signifies a bearish outlook.

$3,500: A psychological help stage the place ETH discovered some stability.

$3,420: One other essential help stage to observe for potential bearish continuation.

As famous in a earlier analysis by BeInCrypto, set purchase orders close to key help ranges at $3,575 and $3,400. Contemplate taking income at resistance ranges round $4,134 and $4,390, or choose to HODL.

Disclaimer

In step with the Belief Challenge pointers, this price analysis article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal research and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.