Seasoned crypto buyers perceive that monitoring and protecting a continuing watch available on the market is a vital option to make earnings doubtlessly. Not like different monetary markets, cryptocurrency transaction knowledge is publicly accessible, making it simple to identify good tasks value investing in.

Whereas elementary and technical analyses present perception into traits of assorted cryptocurrencies (btw, our three skilled merchants and analysts share tech analysis in our BeInCrypto Trading Neighborhood on Telegram every single day), the concept of extracting knowledge corresponding to buying and selling exercise from the general public ledger is second to none. This idea, referred to as on-chain analysis, entails leveraging knowledge found on the open-source blockchain to assist merchants make knowledgeable buying and selling choices. This information will present every thing you want to learn about on-chain analysis.

Hottest on-chain analysis instruments

IntoTheBlock

AI-powered price predictions & NFT Analytics

Discover IntoTheBlock

on IntoTheBlock’s official web site

Supported property

900+

Free Trial

Sure

Worth

$10 per thirty days / $100 per yr

Glassnode

10+ years of knowledge, 200+ metrics & customizable dashboards

Discover Glassnode

on Glassnode’s official web site

Supported property

200+

Free Trial

No

Worth

$39 per thirty days / $348 per yr

What’s on-chain knowledge?

Transaction particulars, corresponding to sending and receiving addresses, transferred funds, pockets addresses, transaction charges, and circulating funds for a sure tackle, are all on-chain knowledge.

Since blockchains are immutable, all transactions saved and validated on the blockchain can’t be modified or eliminated. Immutability, safety, and transparency are some options of on-chain knowledge.

On-chain vs. off-chain knowledge

To raised perceive what on-chain knowledge entails, let’s examine it to off-chain. Off-chain knowledge are transactions taking place outdoors the blockchain community. It’s info not recorded on a blockchain community. As an alternative of recording knowledge on the blockchain, off-chain knowledge exists in conventional databases and servers.

Blockchains characteristic decentralization, which means they don’t seem to be ruled by any central physique, which implies there’s little to no danger of a third-party consensus breach. However, a 3rd social gathering handles off-chain knowledge, making transactions extra personal as a result of the information shouldn’t be publicly displayed. Moreover, since transactions are managed by an middleman, info recorded could be altered, which makes the entire community vulnerable to assault or fraudulent transactions.

Anybody can observe on-chain transactions again to the unique pockets tackle and discover its transaction historical past, enhancing transparency and safety. In distinction to on-chain knowledge, off-chain knowledge suffers transparency and safety. You can not leverage transaction particulars since all knowledge are made personal.

Whereas off-chain knowledge provide quick transaction velocity, on-chain knowledge lacks velocity. As soon as a big quantity of knowledge is saved on a blockchain, it turns into congested, making it sluggish and costly. In distinction, off-chain knowledge is validated rapidly whatever the variety of knowledge being recorded. Moreover, off-chain knowledge don’t need to cross via completely different blockchain nodes to get validated, making the storage course of even sooner and cheaper.

What’s on-chain analysis?

Whereas elementary and technical analysis entails using market research and price analysis, the on-chain analysis combines indicators with technical and elementary analysis to have higher buying and selling methods.

On-chain analytics is the method of accumulating knowledge a couple of sure cryptocurrency by taking a look at transaction historical past, hashrates, and different particulars. It may possibly additionally contain analyzing the market sentiment and possession to determine hype and good tasks whereas monitoring large gamers’ actions.

How does on-chain analysis work?

On-chain analysis works primarily based on many metrics, which have been grouped into three lessons that includes a cryptocurrency’s foundation, current, and future state. These bits of information are market capitalization, HODL standing, and the long run potential of a sure cryptocurrency.

Whole market capitalization

The whole market capitalization is the overall asset worth of a cryptocurrency. It’s normally calculated by multiplying an asset’s price and circulating provide.

It’s broadly identified that large-cap cryptocurrencies are secure crypto investments, and mid-cap cryptos are unstable with progress potential. In distinction, small-cap cryptocurrencies are extremely unstable and thought of dangerous to put money into.

Maintain standing

HODL waves are an on-chain indicator that reveals a specific cryptocurrency’s market pattern and age band. With this indicator, you’ll be able to decide the holding interval of a specific asset. For instance, the HOLD wave signifies a yellow coloration inside 6–12 months and purple for a interval of greater than 10 years.

Due to this fact, this indicator lets you realize whether or not merchants are holding the asset for a long-term or a short-term interval. In the end, it displays the conduct of merchants and the long run market transfer of a sure cryptocurrency.

Prospects of a cryptocurrency

Since on-chain analysis displays the rising variety of buyers partaking in a cryptocurrency, you’ll be able to higher predict the longevity of that crypto. Identical to analyzing price volumes, market dimension, and so on., you’ll be able to analyze the long run prospects of crypto. Normally, investing in property which have related price actions to Bitcoin is taken into account safer. This indicator additionally shows the overall inflows and outflows of an asset.

Indicators that on-chain knowledge present

Past the above-mentioned on-chain metrics, on-chain knowledge has a number of indicators for precisely analyzing a blockchain community. Some frequent on-chain indicators, such because the hash charge and circulating provide, are fairly well-known to a mean crypto investor.

Worth motion

On-chain knowledge permits merchants to make commerce choices primarily based on price actions over a interval, as displayed on the chart. Worth motion basically kinds the idea of all on-chain analysis because it makes use of price patterns and traits to foretell future actions. You may make use of price motion and chart analysis to grasp traits in market construction from which you’ll higher strategize and forecast potential price path.

Some price motion instruments you should utilize embrace:

Inventory-to-flow ratio

The stock-to-flow ratio (S/F) is the ratio of the circulating provide of a cryptocurrency to the newly equipped cash. The rule of thumb is the worth of a cryptocurrency will increase with its stock-to-flow ratio. Because of this, you should utilize this ratio software to find out the worth of a specific crypto primarily based on market shortage and new property equipped.

Sometimes, a excessive stock-to-flow ratio of fifty or extra signifies excessive relative shortage, which means that the value of the asset may even rise. This software can have an effect on your buying and selling choice by promoting a sure crypto at a excessive price and shopping for when the ratio is low however anticipating a long-term enhance.

Stablecoin provide ratio (SSR)

The importance of stablecoins goes past being a perfect asset on a crypto trade. You may at all times swap to a stablecoin when the market motion is unstable. However however, stablecoins turn out to be useful as an indicator when analyzing on-chain knowledge.

An indicator known as Stablecoin Provide Ratio (SSR) permits merchants to grasp BTC’s shopping for energy over stablecoins.

Market worth to realized worth (MVRV)

The MVRV (Market Worth to Realized Worth) ratio is an on-chain analysis software described because the ratio of an asset’s market capitalization to realized capitalization.

Evaluating the MVRV of a cryptocurrency reveals the common revenue and lack of the asset in circulation. An MVRV ratio of three.7 or extra reveals a possible market high, and a ratio lower than 1 depicts a attainable market backside.

Community power

A blockchain community’s power will depend on a number of components, together with transaction quantity, provide distribution, hash charge, and extra.

Transaction quantity

On-chain transaction quantity is the overall quantity of crypto property transferred from an exterior pockets. Utilizing a blockchain explorer, you’ll be able to simply view the transaction quantity on the blockchain and make use of it to enhance your buying and selling methods.

Provide distribution

Understanding the provision mannequin, corresponding to most provide, whole provide, and the circulating provide of a coin or token, can enhance buying and selling choices.

Whereas some buyers would possibly take into account a versatile provide distribution whereby cash produced are diminished over time, different buyers would possibly see a hard and fast provide distribution as unfavorable in the long term. This software additionally displays if a coin considerably prioritizes early adopters greater than new buyers. So you’ll be able to higher spot a undertaking value placing cash into.

Energetic addresses

An tackle is energetic when it turns into a direct participant in a profitable transaction — both as a sender or a receiver.

Energetic addresses are the blockchain addresses that turn into energetic after a profitable transaction has occurred over a sure interval. Because of this, energetic addresses could be a good on-chain indicator that reveals the variety of energetic customers on a blockchain.

Evaluating the variety of energetic addresses entails the rely of each sender and receiver addresses over a given interval. For instance, month-to-month energetic addresses characterize all of the individuals that both despatched or obtained cryptocurrency over that specific month.

Hashrate

Hashrate is the overall computational energy utilized in mining and verifying transactions in proof-of-work consensus networks corresponding to Bitcoin.

The hashrate is a vital metric for evaluating a blockchain community’s safety and total well being. It is because the hashrate rises with the rising variety of inputs dedicated to discovering the subsequent block. Because of this, it turns into actually completely different from launching any assault on the community, boosting safety.

In distinction, a lower in hash charge means miner capitulation — a major variety of miners turning off machines for a sure time period. This weakens the safety of the community.

Shopping for and promoting

Shopping for and promoting extends to all types of trades, together with realized earnings and losses, unrealized market positive aspects, market worth, provide in losses and earnings, and extra.

Realized earnings and losses

Realized earnings and losses are floating earnings/losses achieved after cryptocurrency promoting. As quickly as you purchase an asset with a fiat forex, there can be a revenue/loss because of the price actions.

Realized revenue and losses are decided by evaluating the quantity realized and realized earnings. Therefore, if the outcomes come out optimistic, notice earnings; in any other case, if destructive, it’s a loss.

Realized capitalization

It is a variation of market capitalization that values every UTXO primarily based on its earlier historic price change, in contrast to its current worth. Because of this, fairly than the same old market worth of cash, the realized cap displays the realized worth of all of the accessible property in a community.

The thought behind realized capitalization revolves round making a metric that helps reduce the impact of misplaced cash and worth cash in keeping with the current state of an account chain. Normally, when a coin will get misplaced, the market cap doesn’t account for it.

Realized is actually completely different because it revalues every final moved coin to its present worth. So if a coin is spent at a price greater than when it was beforehand moved, it’ll revalue to the next price and have an equal enhance within the realized cap.

Provide in earnings and loss

Provide in earnings and loss evaluates the sum of UTxO’s worth. Revenue quantity focuses on the overall sums of UTxO in revenue by evaluating the price between created and destroyed, whereas loss quantity is the overall sum of UTxO worth within the loss by evaluating the price between created and destroyed.

1. IntoTheBlock

Extra than simply an on-chain analytics platform, IntoTeBlock is a premier knowledge science tech firm that makes use of cutting-edge AI research to offer helpful intelligence for the cryptocurrency trade. IntoTheBlock makes on-chain analysis easy for each the novice and skilled dealer. On high of this, all options can be found at a really cheap price.

Jesus Rodriguez based the Miami-based tech firm in 2018. It’s a group of knowledge scientists, cryptocurrency specialists, and AI lovers who’ve set out on a journey to unravel the mysteries of crypto property and supply buyers with related market intelligence. They’d too many unanswered questions on cryptocurrency markets. Because of this, they created a platform that enables us to make use of machine studying to generate new insights about this fascinating asset class.

Options:

- Synthetic intelligence-powered price predictions

- Over 900 property with completely different metrics like price, market cap, change, and extra

- Subtle analytics within the DeFi area for normal market knowledge and particular DeFi protocols

- Capital markets (indices, shares, ETFs, commodities, spot, and derivatives) buying and selling knowledge

- NFT Analytics

Pricing:

You may be completely happy to know that IntoTheBlock has a free 7-day trial, with no bank card required. You may subscribe to this premier service for as little as $10 month-to-month. Within the true spirit of crypto, you’ll be able to fund your subscription in both fiat or cryptocurrency.

2. Glassnode

Glassnode is an on-chain analysis software that gives crypto market insights through on-chain indicators. Based in 2018, Glassnode focuses on serving to the research journey of crypto merchants with market intelligence and different related on-chain knowledge to enhance customers’ crypto buying and selling choices.

Broadly identified for its in-depth experiences of market indicators for a number of cryptocurrencies, Glassnode has provided a number of purposes that provide new methods of staying up to this point with market fluctuations. The platform’s stay knowledge opens you into a number of charts and dashboards with detailed insights on tackle exercise, balances, progress, provide, hodlers, and so on.

Options:

- Many on-chain market indicators for a number of cryptocurrencies

- Greater than 200 metrics

- Customizable dashboards that let you add your favourite metrics for sure cash

- Greater than 10+ years of knowledge

- Weighing completely different metrics for various cash

- TradingView integration

- Complete sources on well-known blockchains and cryptocurrency

Pricing:

Glassnode presents three-tier packages with a free, superior, {and professional} plan. The superior plan goes for $29/month (annual cost) and $39 on a month-to-month cost. The skilled plan prices $799/month (annual cost).

3. Nansen

Nansen is among the hottest blockchain analytics platforms that mixes on-chain knowledge with many pockets labels. By way of its real-time dashboards and alerts, customers can acquire an improved perception into the crypto market.

Whereas Nansen is finest identified for crypto specialists searching for deep research into on-chain knowledge, new crypto buyers can leverage the software to be taught extra about crypto. Listed here are some key options of Nansen:

Options:

- Some in-demand options embrace Pockets Profiler, ETH tracker, DEX trades, CSV knowledge, and extra.

- Utilizing Nansen analytics, you’ll be able to simply spot patterns and forecast the price actions

- Modifiable good alerts

- Uncover new traits with the platform’s customized experiences

- Actual-time on-chain knowledge for populating blockchains, together with Ethereum, BSC (Binance Good Chain), and so on.

- Thousands and thousands of pockets labels present insights into a number of crypto property

- With detailed dashboards, you’ll be able to simply uncover new traits in NFTs, DeFi, and DAOs

- Uncover instruments for brand spanking new tasks, tokens, and new NFTs

- Spot rising traits supporting a number of blockchains

Pricing

Nansen presents a free plan for customers. It presents three packages, together with Customary, VIP, and Alpha. The Customary plan varies between $100/month and $150/month, relying on the billing interval. The VIP plan prices $1000/month (billed yearly), and Alpha goes $2000 (billed yearly)

4. Dune

Dune is a vital blockchain analytics software for querying Ethereum knowledge utilizing easy SQL queries from premade databases. As an alternative of a complete new script, you’ll be able to question the database to gather just about any info hosted on the blockchain.

Popularly identified for gaining insights into the Ethereum blockchain research, you’ll be able to simply view on-chain knowledge utilizing question codes. In the end, Dune presents all of the wanted instruments to question, extract, and show huge volumes of blockchain knowledge.

Options:

- Breaking down advanced knowledge into easy-to-understand info presents easy knowledge assortment and visualization (charts, graphs, and so on.)

- Entry to many metrics for on-chain knowledge analysis

- Dune extracts blockchain knowledge and arranges it into SQL databases that may be queried.

Pricing

Dune presents a free bundle with customized dashboards, chart sharing, a most of three queries, and extra. The professional tier prices $390/person/month with on the spot question entry, about six question choices, and way more.

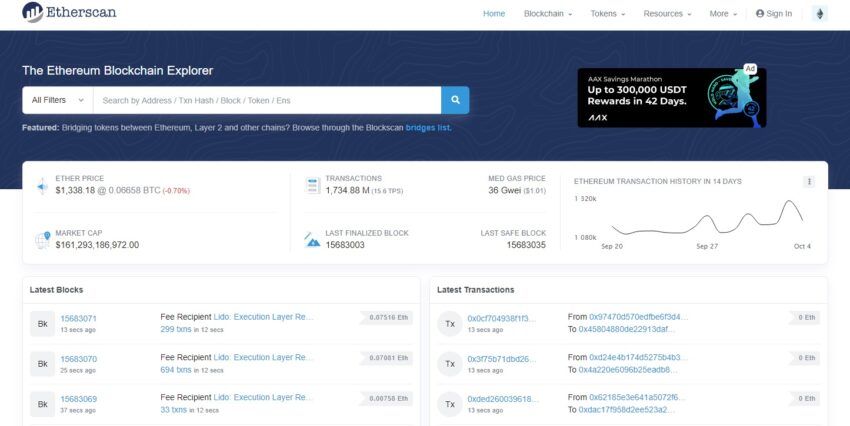

5. Etherscan

Because the identify suggests, Etherscan is a blockchain explorer and analytics software for the Ethereum blockchain. It presents easy accessibility to real-world knowledge and transaction particulars, corresponding to pending and accepted transactions.

Finest identified for accessing and leveraging transaction actions on Ethereum, Etherscan permits customers to identify fraudulent exercise simply. Listed here are some options of Etherscan:

Options:

- Spot early traits, corresponding to airdrops on the Ethereum blockchain

- Complete technical experiences from Ethereum builders

- Observe gasoline charge

- Customized alerts for transactions and any large exercise

- Verify particulars of any public ETH pockets tackle

- Analyze transaction blocks, tokens, and extra

Pricing:

Etherscan has three plans, excluding a free plan. You may select to go for the Customary bundle, which prices $199/month, $299/month for the Superior plan, or $399/month for the Skilled plan.

6. Santiment

It is a detailed market analytics software that gives correct knowledge feeds, low-latency indicators, customized market watches, alerts, chart layouts, and different instruments to enhance your buying and selling journey.

Santiment is broadly identified for sending its customers newsletters, evaluations, and market experiences. Providing varied on-chain analysis instruments like Sandbase, you’ll be able to view and analyze charts of all cash.

Options:

- Leverage on-chain, social, and growth metrics

- Spot rising social traits

- Personalized alerts for buying and selling actions whereby you’ll be able to simply spot any malicious act

- Social crypto traits

- Personalised watchlist for weekly coin updates

- Insights and behavioral experiences from Santiment’s crypto analysts

Pricing

Santiment presents a free plan and paid plans (professional and professional+). The professional bundle presents superior crypto metrics and market insights, costing $44/month (annual subscription). The professional+ presents much more options, and it goes for $225/month (annual cost)

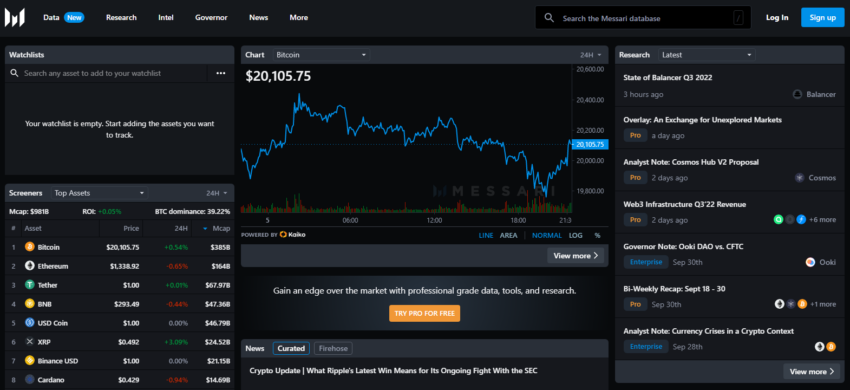

7. Messari

It is a first rate software for exploring the crypto area, extra particularly, offering free charting providers, long-form weekly experiences, downloadable CSV knowledge, and extra. Messari is broadly identified for every day insights protecting the primary sectors in crypto, starting from DeFi, Metaverse, and Web3 to NFTs.

Options:

- Entry to completely different charts, screeners, watchlists, and experiences

- Useful instruments to research charts and evaluations

- Entry to statistical data corresponding to quantity, liquidity, on-chain, staking, provide, and market cap, and so on.

Pricing:

Messari Professional prices $24.99/month if billed on an annual foundation.

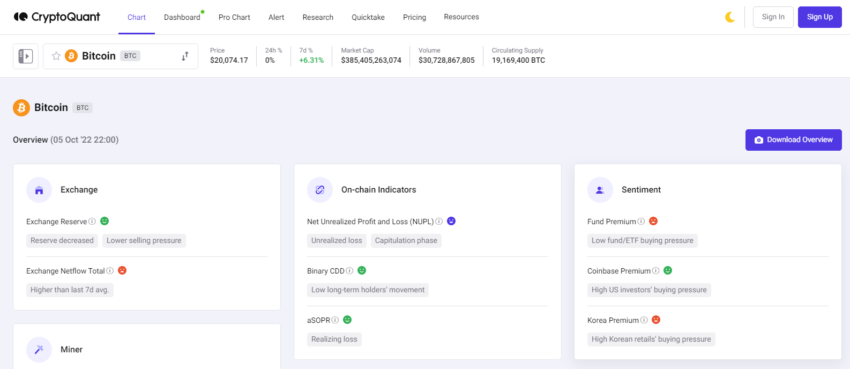

8. CryptoQuant

CryptoQuant offers market knowledge and on-chain knowledge through API or any knowledge analytics software. As well as, the platform presents inclusive knowledge corresponding to on-chain knowledge and quick/long-term indicators for in style crypto property, together with Bitcoin, Ethereum, Stablecoins, and ERC20 tokens.

Options

- Entry to charts overview, trade overflows, professional chart, alerts, and extra

- Choose completely different metrics like Circulate Indicator, Miner Circulate, and extra

- Get notified when there’s any rip-off

Pricing:

CryptoQuant presents a free plan with many metrics. Then it presents three plans, together with Superior, Skilled, and Premium, going for $29/month, $99/month, and $799/month, respectively.

Mastering market traits via on-chain analysis

On-chain knowledge offers quite a few benefits, corresponding to deepening your understanding of market buildings and investor conduct and enhancing your buying and selling methods. This knowledge additionally presents complete insights into the operations of a undertaking or community, aiding in additional knowledgeable decision-making. We advocate incorporating these platforms into your funding strategy. With time, integrating on-chain analysis into your common funding practices is considerably useful.

Ceaselessly requested questions

Disclaimer

Consistent with the Belief Challenge tips, the tutorial content material on this web site is obtainable in good religion and for normal info functions solely. BeInCrypto prioritizes offering high-quality info, taking the time to research and create informative content material for readers. Whereas companions could reward the corporate with commissions for placements in articles, these commissions don’t affect the unbiased, sincere, and useful content material creation course of. Any motion taken by the reader primarily based on this info is strictly at their very own danger. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.